2018-11-1 01:39 |

Despite the bear trend in the market today, Coinbase is set to make a profit of about $456 million USD from a revenue of $1.3 billion USD in 2018. The Block Crypto has analyzed the stats of the company for this year and it has affirmed that the company will have its profits increased in 20% despite all the difficulties.

As many exchanges are struggling to remain in business, it looks like Coinbase was a big winner this year, despite “losing” to some other companies like Binance, which was one of the biggest winners of the year.

The company had a slight decrease in profits margins, it was reported, which could have been linked to the fact that some salaries in the company increased over time, as the profit margin was 41.2% in 2017 and will only be 35.3% in 2018 despite being higher than the year before, in which it was only $380 million USD.

As most of the revenues in Coinbase comes from commissions on trades made on the platform, the bear market has significantly altered the prices of the company and the revenues should be down. They are only not because a lot more people started to trade this year.

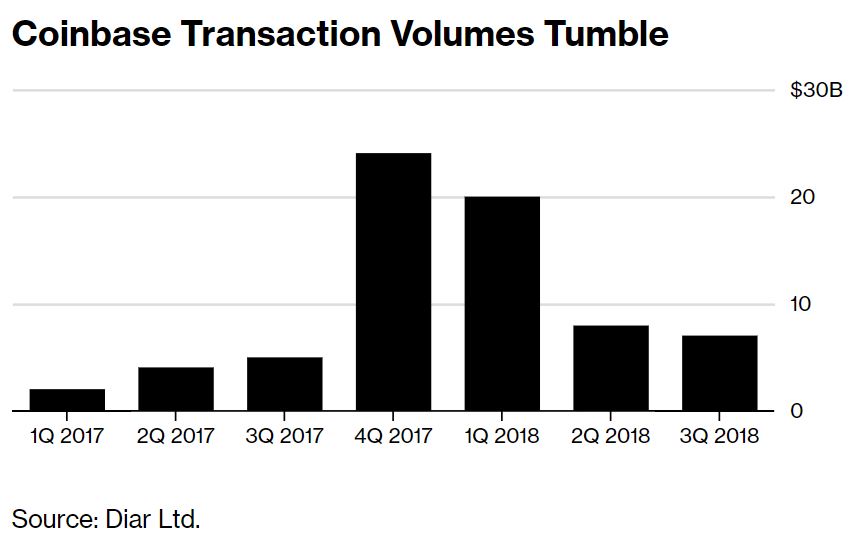

The company had a lot of volumes in the last quarter of 2017 and in the first of 2018, is significantly lower in the other ones. However, it is still higher in 2018 than it was before. For instance, the volumes were very low in the first quarter of 2017 while they will be as much higher as Q3 in Q4 this year.

The Future Is Not Necessarily Very BrightCoinbase’s volumes are steadily dropping, though, which is not a good sign at all. Coinbase had two major spikes in 2017. It grew 575% in Q2 2017 and then 63% and 276% until the end of the year. The first quarter of 2018 saw a decrease of 2% followed by a huge downfall of 61% in volume. Q3 saw its volume lose 44% again and the last quarter sees some “stabilization” with a decrease of 11%.

This means that, despite all the good news, 2019 is full of doubts. If the downtrend continues, the company will be doomed. However, some stabilization will continue to keep it alive, only with far lesser success. The only way would be to get the institutional market that the company seems to want so much right now.

Coinbase has completed its Series E fundraise of $300 million USD led by Tiger Global yesterday and it is currently valued at $8 billion USD, which means that the company is far away from a bankruptcy of failure, just not having a great time (that could be a lot worse, still). The company has also debunked the rumors that it would have an Initial Public Offering (IPO) and go public soon.

The company has plans for 2019, though. It wants to diversify its investments and list some other tokens outside of the United States. This could maybe generate the growth that the company needs so bad right now.

Similar to Notcoin - Blum - Airdrops In 2024

Emerald Crypto (EMD) на Currencies.ru

|

|