2019-6-12 15:18 |

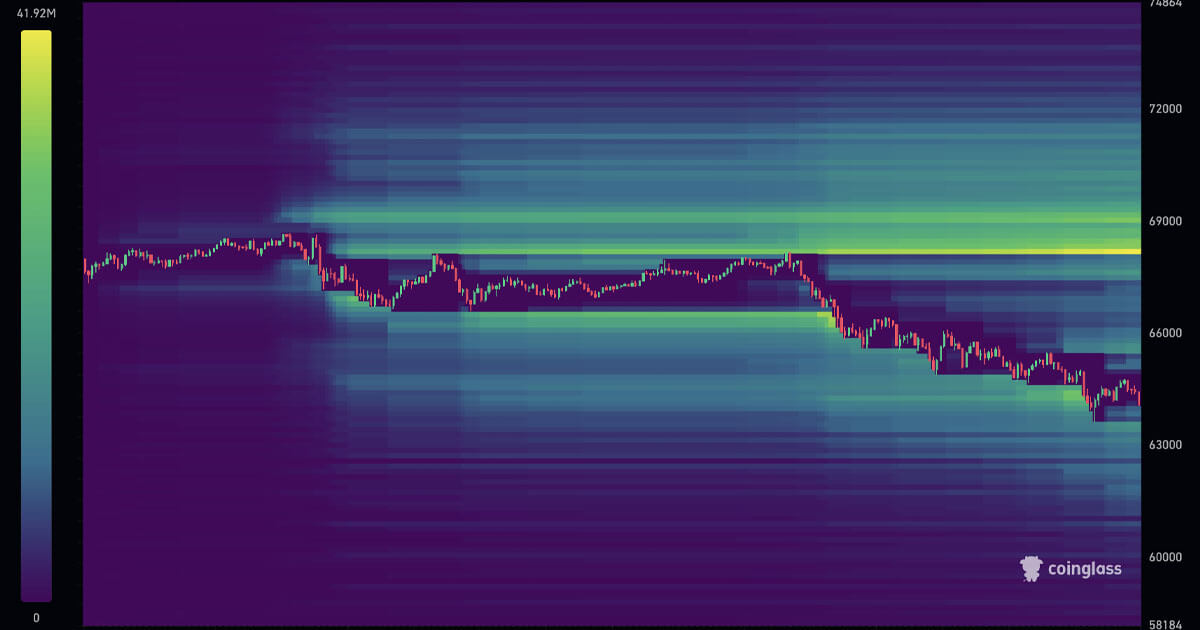

By CCN Markets: A Chinese Bitcoin trader has allegedly committed suicide after he lost investor’s money in a highly leveraged trade position. According to 8btc, Hui Yi lost 2,000 Bitcoins after he entered a short position which was liquidated after it went in the opposite direction.

The trader, who was the co-founder and CEO of cryptocurrency market analysis platform BTE. TOP, died on June 5. At current prices, Yi lost nearly $16 million in one position. Yi had leveraged his position by 100 times and thereby magnifying his losses. Yi’s death was revealed by an ex-partner as speculation was raised that

The post Chinese Bitcoin Trader Commits Suicide after Losing 2,000 BTC on 100x Leverage Bet appeared first on CCN Markets

. origin »Bitcoin (BTC) на Currencies.ru

|

|