2023-7-1 18:31 |

Chancer’s presale has crossed the $436K threshold to highlight the overall positive crypto market sentiment. The recently launched presale event for the blockchain-based predictive market platform has seen the sale of more than 43.6 million $CHANCER tokens in just a few days.

While blockchain technology has demonstrated its ability to upend a variety of industries, gambling is one that is in dire need of change. Despite being widely used, centralized betting platforms have numerous drawbacks that render them subpar making Chancer founders to take advantage of this gap.

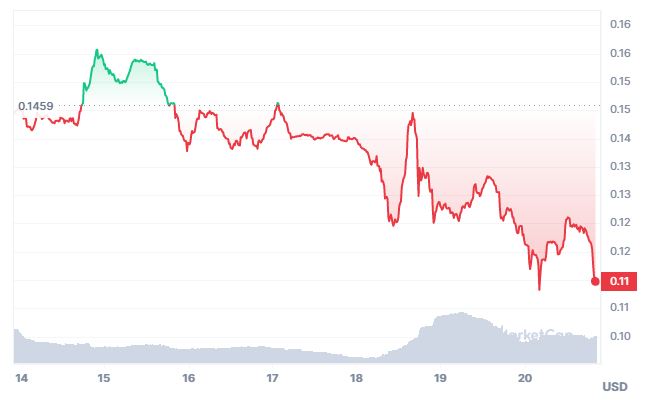

Crypto market – Spot Bitcoin ETF filingsBitcoin (BTC) registered a positive upward rally last week as major asset managers like Fidelity and BlackRock filed to launch a spot BTC exchange traded Fund (ETF). There was also a push from Bitcoin whales who on-chain data suggests they played a crucial role in helping the cryptocurrency breach the $30k price level in the recent rally.

Bitcoin price had surged above $31K before dropping back to around $30K today after the US Securities and Exchanges Commission (SEC) told Cboe Global Markets, Inc. that recent the Spot Bitcoin ETF filings from Fidelity, BlackRock (NYSE: BLK), and others aren’t clear and comprehensive.

BTC institutional activity acceleratesAs institutional activity accelerates, US investors have poured money into bitcoin (BTC), fueling the recent rally of the largest cryptocurrency by market capitalization.

According to a report from cryptocurrency analytics company K33 Research, the main driver of BTC’s recent Bull Run has been the concentration of its price increases and trading volume during US market hours.

Bitcoin has increased 85% so far this year, outpacing the majority of the cryptocurrency market. A number of major financial institutions, including BlackRock, Fidelity, and Citadel, have increased their involvement with BTC, which has prompting investor optimism and the price movement.

BTC activity in the US has outperformed Asian and European trading sessions. The activity increased by 30% cumulatively during US market hours since bottoming out at around $16,000 after asset management behemoth BlackRock submitted an application for a spot BTC exchange-traded fund on June 14.

According to K33, Bitcoin’s 30-day correlation with US equities like the S&P 500 and Nasdaq indices turned negative last week for the first time since January 2021.

Chancer presale riding on Bitcoin’s surgeThe current institutional interest in Bitcoin is far from the opportunistic FOMO (fear of missing out) we have seen in the past mostly only push prices up in the short term. The institutions move slowly and deliberately and invest for the long term meaning it is a possible pointer to a long term Bitcoin price run which may spur a bullish trend across the broader crypto market.

The Chancer presale seems to be riding on the recent Bitcoin price in addition to the growing betting industry that is projected to hit $167.50 billion by the year 2030. The first presale stage is almost halfway sold out in a matter of days showing that investors are confident about the new betting platform which is the first decentralized predictive market making platform.

The post Chancer presale hits $436K as investors bet on positive crypto market sentiment appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|