2020-12-6 20:00 |

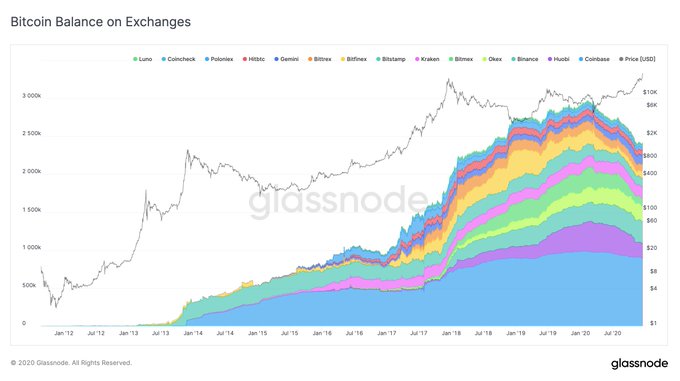

Crypto adoption on Wall Street is booming. Well, Bitcoin adoption anyway.

These past few months have marked a resurgence in the number of Wall Street investors and prominent firms taking a close look at the leading cryptocurrency and related blockchain technologies.

Paul Tudor Jones, a billionaire investor known for outperforming the markets in the 1970s and in the Great Recession, kicked it off prior to the halving this year. He revealed in a research note that he thinks Bitcoin will be the “fastest horse in the race” in a world where inflation is rampant.

This was corroborated by a number of other prominent Wall Street veterans, including those within and outside of the crypto space. This list includes Stanley Druckenmiller, Rick Rieder, Mike Novogratz, and Raoul Pal.

Though, thus far, altcoins have yet to gain traction amongst institutional players, aside from a role as a technology to use.

Top executives in the space expect this to change in the months ahead.

Ethereum to gain Wall Street traction, says Grayscale MDGrayscale Investments’ Michael Sonnenhein says that Ethereum is likely to gain traction amongst more institutional players as an “asset class.” He recently told Bloomberg on the matter:

“Over the course of 2020 we are seeing a new group of investors who are Ethereum first and in some cases Ethereum only. There’s a growing conviction around Ethereum as an asset class.”

Grayscale's Sonnenhein on Ethereum in a Bloomberg interview:

“Over the course of 2020 we are seeing a new group of investors who are Ethereum first and in some cases Ethereum only. There’s a growing conviction around Ethereum as an asset class.”

— Joseph Young (@iamjosephyoung) December 5, 2020

He added in that same interview that he thinks that Ethereum has reached a point where its staying value, so to speak, is now similar to that of Bitcoin.

This is largely in part due to the rise of decentralized finance (DeFi), which has found a home on Ethereum as opposed to other smart contract-focused blockchains.

Ethereum hosts a vast majority of the top DeFi applications by total locked value and by the value of their native cryptocurrencies.

As DeFi Pulse shows, Ethereum hosts MakerDAO, Wrapped Bitcoin, Compound, Aave, Uniswap, and the other top 20 or so DeFi apps.

Many expect this to continue as there remain positive trends in the DeFi space and due to simple network effects.

Paul Tudor Jones talks ETHIn a testament to Wall Street’s growing commitment to non-Bitcoin crypto assets, Paul Tudor Jones recently mentioned Ethereum in a recent interview with Yahoo Finance.

Paul Tudor Jones mentions Ethereum, saying how we may end up with precious crypto and industrial crypto.

He’s going through the rabbit hole.

pic.twitter.com/pN78q1Kodf

— DT (@dgntec) December 3, 2020

He said that there may be a world in which there is a precious cryptocurrency such as Bitcoin and an industrial one, referencing something like Ethereum. Tudor Jones did not expand on his thoughts beyond that, though many see this as validation that prominent Wall Street investors will soon look into Ethereum as both a technology and as an investment.

The post CEO of $10 billion fund expects Ethereum to gain Wall Street traction this year appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Save and Gain (SANDG) на Currencies.ru

|

|