2023-1-18 01:00 |

Tanzania is exploring the potential of central bank digital currency with a new initiative from its central bank, the Bank of Tanzania (BoT). The central bank is looking into the possibility of creating a digital version of the Tanzanian shilling, in line with the growing trend among central banks worldwide to examine the use of digital currencies as a way to enhance financial inclusion and improve the efficiency of monetary policy.

Tanzania’s central bank said it’s working toward a “phased, cautious and risk-based” introduction of a digital currency for the East African nation.

The Bank of Tanzania after conducting initial research into the potential benefits and risks associated with CBDCs, has decided to wait for the conclusion of its research before making a final decision. This is in contrast to other countries such as China, which have already begun testing their own digital currencies.

JUST IN : The Bank of Tanzania is considering adopting CBDC – Central Bank Digital Currencies

Will Tanzania become a cashless society in the near future? pic.twitter.com/x7jEOSZv4P

The Bank of Tanzania’s research into CBDCs will focus on issues such as security, privacy, and financial stability. It will also look at how CBDCs could be used to improve access to financial services in rural areas and reduce costs associated with traditional banking systems.

The bank has stated that it wants to ensure that any decision made regarding CBDC adoption is based on sound evidence and analysis. It remains unclear when the bank’s research will be completed or when a final decision will be made.

The Era of CryptocurrencyDigital currencies, also known as cryptocurrencies, are digital assets that use encryption techniques to secure and verify transactions. They are not controlled by a central authority like a government or central bank and are decentralized in nature. Bitcoin is the most well-known digital currency, but there are now thousands of different digital currencies in circulation, each with different use cases and levels of adoption.

Although the BoT’s initiative is still in the early stages of development, it is clear that the central bank is taking digital currencies seriously. The BoT has stated that it is “exploring the possibility of issuing a digital version of the Tanzanian shilling” and that any digital currency created would be fully backed by reserves of the physical currency.

Financial Inclusion is KeyOne of the main reasons for the BoT’s interest in digital currency is the potential to improve financial inclusion in Tanzania. Many people in the country do not have access to traditional banking services, and digital currencies could provide a way for them to participate in the financial system. Additionally, digital currencies can make it easier for people to send and receive money across borders, which could boost trade and investment in the country.

Another reason for the BoT’s interest in digital currency is the potential to improve the efficiency of monetary policy. Digital currencies can be used to conduct transactions more quickly and cheaply than traditional financial systems, which can help central banks respond more effectively to changes in the economy.

Digital Currency RisksHowever, there are also risks associated with digital currencies. One of the main risks is the potential for them to be used for illegal activities, such as money laundering and terrorism financing. Additionally, digital currency systems are vulnerable to hacking and other types of cyber attacks, raising concerns about their security.

To mitigate these risks, the BoT will have to ensure that any digital currency it creates is properly regulated. This will likely involve working with other government agencies, such as the central bank and the financial regulatory body, to develop a comprehensive regulatory framework for digital currencies.

The central bank will also need to work with the private sector to develop secure digital currency systems that are resistant to cyber-attacks.

.

The Cryptocurrency Bandwagon: All Aboard?The Bank of Tanzania (BoT) recently made its first formal communication on cryptocurrency dealings since issuing a cautionary notice two years ago. Bank of Tanzania Governor Florens Luoga stated at a conference of Tanzania financial sector stakeholders in the capital of Dodoma that the bank is conducting research before committing itself to join the cryptocurrency bandwagon.

Luoga also confirmed tentative plans to launch an official Central Bank Digital Currency (CBDC) system and possibly incorporate cryptocurrencies.

Despite this, Luoga said that the public is still allowed to invest in crypto-related investments “at their own risk” as the bank is not yet competent with or able to regulate it.

The BoT’s cautious approach toward cryptocurrency is understandable given its volatile nature and lack of regulation. It is important for any bank to conduct thorough research before making any decisions, as it could have serious implications for both investors and the economy as a whole. The governor’s statement serves as a reminder that while cryptocurrency may be an attractive investment opportunity, it should be done so with caution and an understanding of the risks involved.

A Global ApproachThe world is becoming increasingly interconnected, and this has led to a global approach to many aspects of life. This includes the digital money revolution, which will have an impact on economies around the world. Emerging markets and lower-income countries are particularly vulnerable to changes in the international monetary system, so it is important that they are aware of these changes and that the IMF stands beside them to ensure that their interests are protected.

The introduction of digital forms of money could also bring about significant changes in how people and companies manage their finances. Lower costs associated with obtaining, storing, and spending digital money could make it easier for people and companies to substitute their domestic currency with a more stable currency, especially in countries with high inflation and volatile exchange rates.

This practice is already widespread—foreign currency deposits exceed 50 percent in more than 18 percent of countries worldwide—and it is likely to become even more common as digital money becomes more widely accepted.

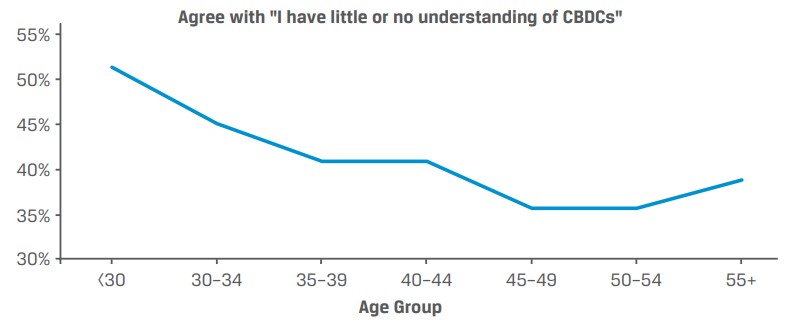

Overall, while CBDCs are gaining traction globally, it is clear that they have not yet been met with enthusiasm from consumers. Issues such as low adoption, lack of support from government bodies, and concerns about security and illegal activities continue to be a concern for central banks as they consider the implementation of CBDCs.

The post Caution Is Key as Tanzania Mulls Central Bank Digital Currency Launch appeared first on BeInCrypto.

Similar to Notcoin - Blum - Airdrops In 2024

Central African CFA Franc (XAF) на Currencies.ru

|

|