2023-5-6 15:15 |

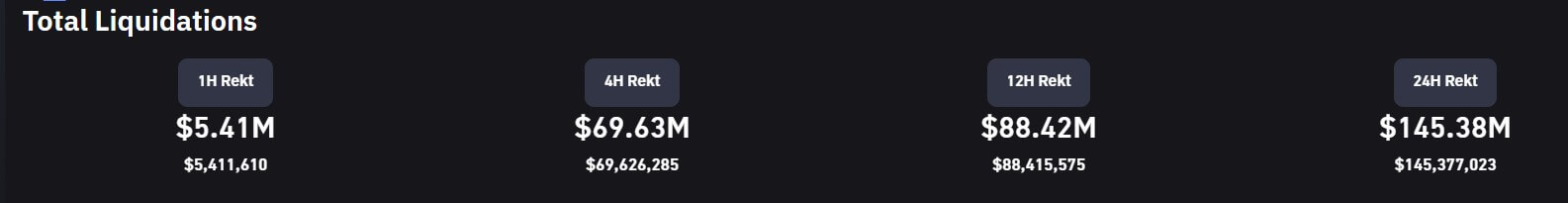

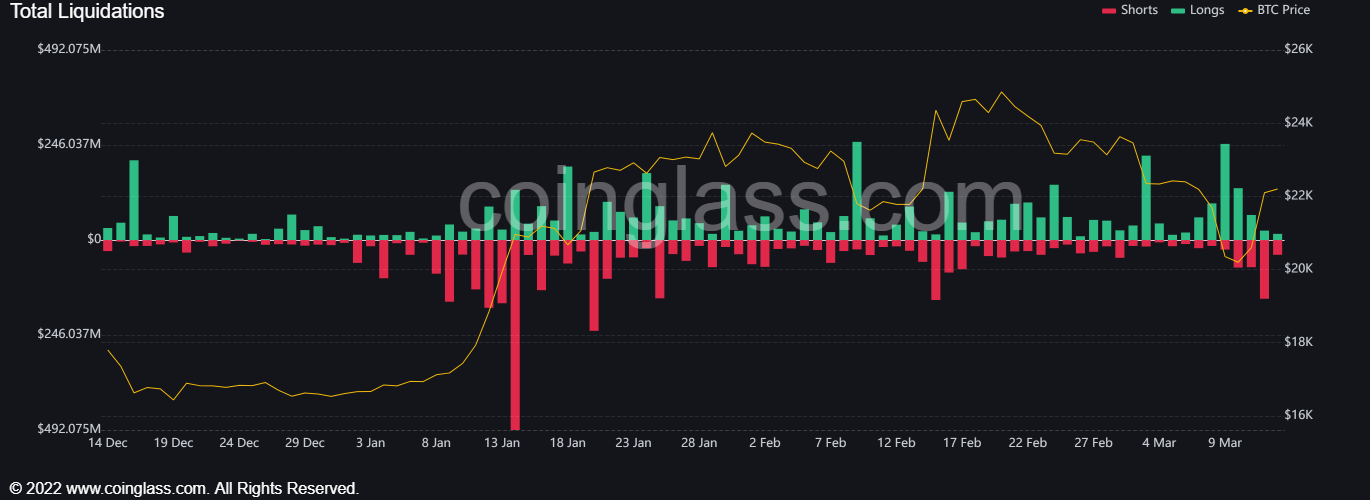

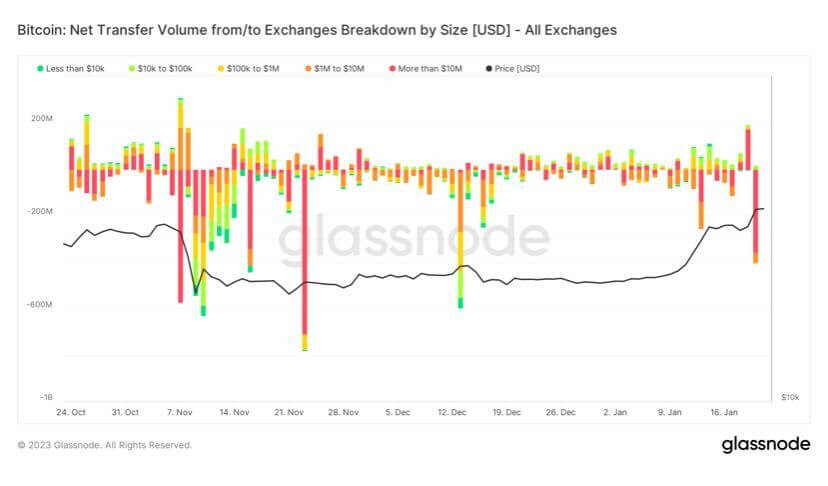

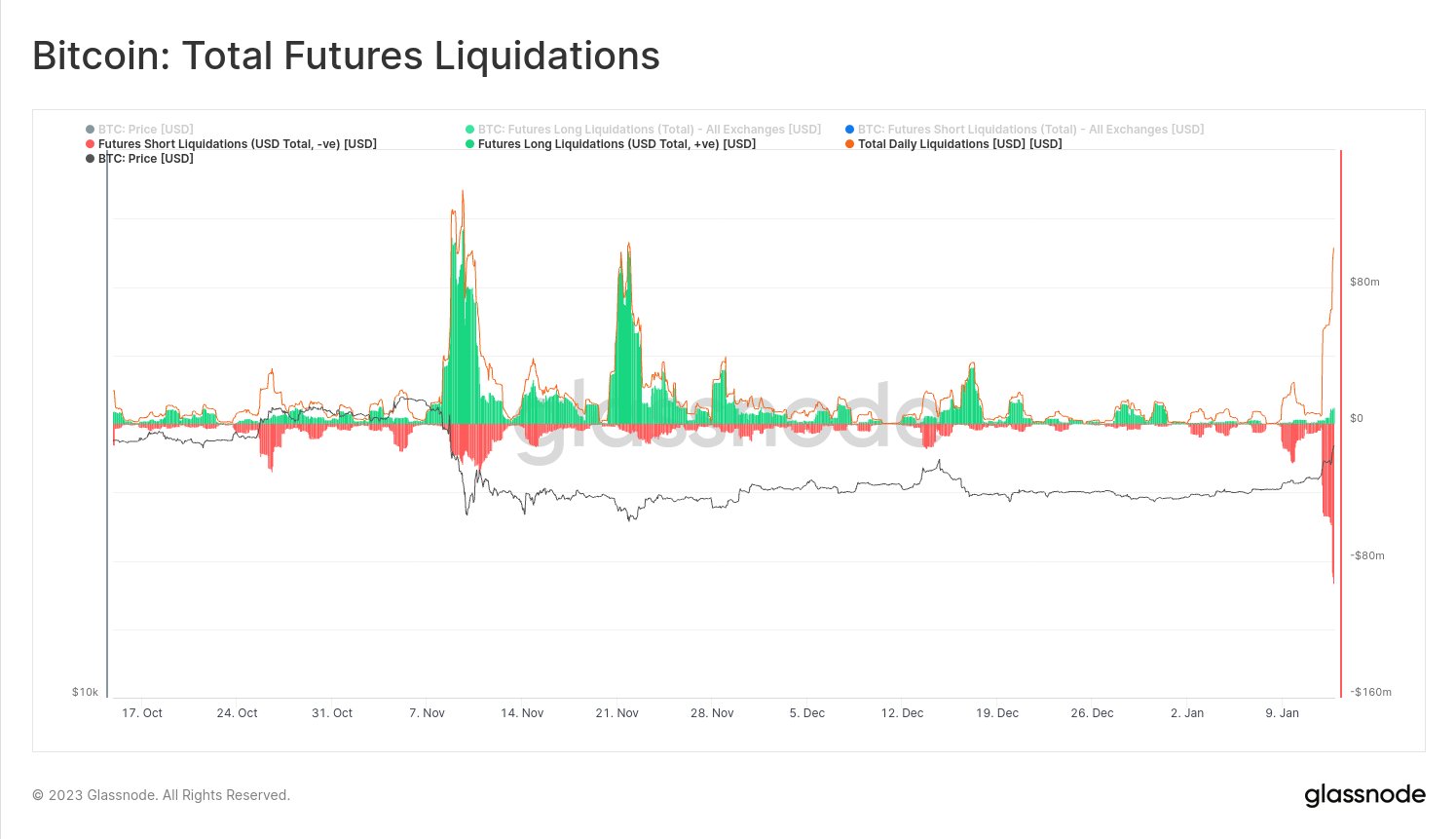

Quick Take Liquidations were one of the main talking points during the 2021 and 2022 cycles — long being liquidated for the better two years. Many reasons liquidations were plenty in 2021 compared to 2022 were due to leverage, whale activity, and market sentiment. As 2021 was a bull market, market sentiment was strong to the upside, and prices continued to increase. Hence, long liquidations on small pullbacks were obliterated. Into 2022, a bear market, and prices continued to go down 75% from their all-time high, investors wanted to go long at any moment; however, they continued to get burnt. Into 2023, it has been a mix of short and long liquidations; shorts did take pole position in 2023 and were on the wrong side. But now you can see liquidations are very similar in size, suggesting a neutral market. Liquidations: (Source: Glassnode) Liquidations: (Source: Glassnode)

The post Caught in the crossfire: how long and short liquidations shape the crypto market’s future appeared first on CryptoSlate.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Market.space (MASP) на Currencies.ru

|

|