2018-7-3 20:05 |

“No, Don’t Ban Cryptocurrencies. EU Monetary Regulators Advised”

There is a recovery in the crypto markets and coins as Cardano, IOTA and NEO are leading the way. Others as Ethereum Classic are striding yes but are yet to hit recent resistance lines and trigger solid buys. Overly though, we remain bullish and as long as our technical analysis trade conditions are met, we should prepare to buy on dips whenever proper signals print.

Let’s have a look at these charts:

Cardano (ADA) Technical Analysis Click here to see the full size Cardano ADA Daily Chart July 3Without a shadow of doubt, Cardano’s Co-Founder, Charles Hoskinson who also doubles up as a head of Ethereum Classic development is technically gifted. It’s because of his expertise that he got an invite to Google where he and the Director of Engineering at IOHK had a chance to introduce to Google employees the technical nitty gritties of Cardano, their general ambition and the future of blockchain where Cardano’s peer reviewed smart contract and dApp platform is king. Charles believes that the advent of crypto would melt the walls between “different tokens representing value” and allows for fluidity and inter-changeability for measures of wealth.

When Cardano met with Google they were asked how Cardano can overcome Ethereum’s first-mover advantage…Hoskinson explained why he believes Ethereum doesn’t have much of a head start. https://t.co/1HukOglqz1

— Adameski (@theeHodler) July 2, 2018

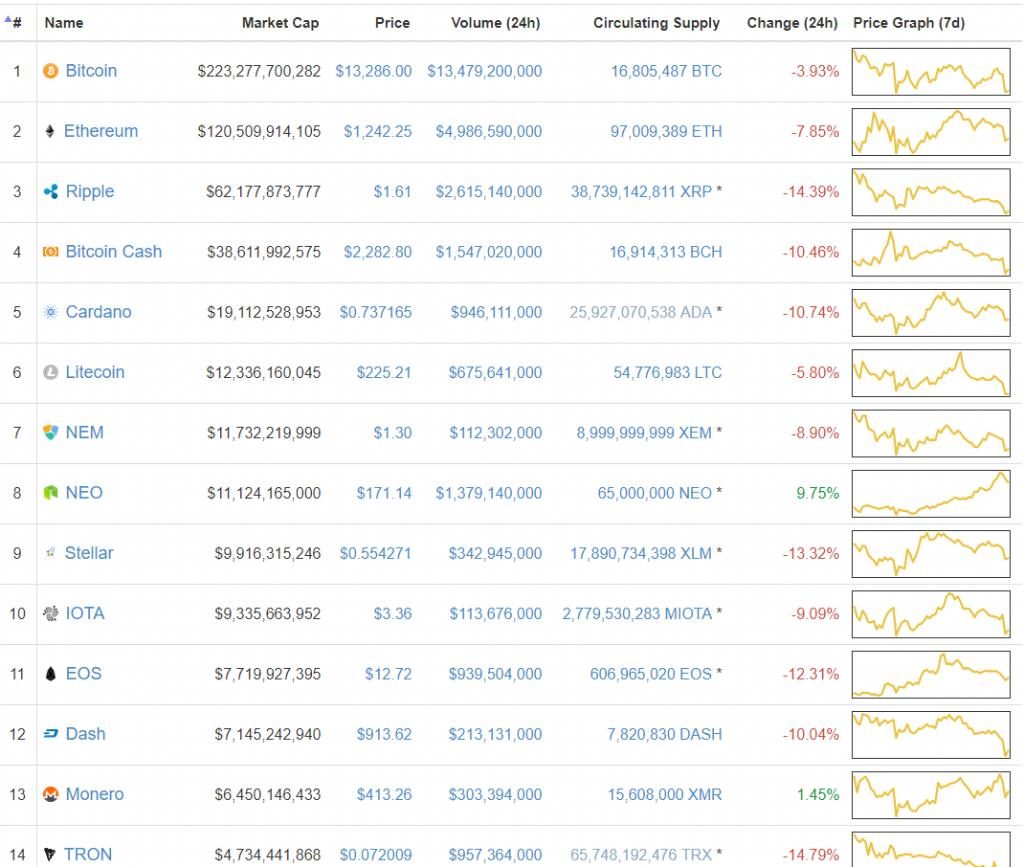

Back to price action and it’s a straight buy for ADA. Note that ADA did bounce off strongly from 12 cents according to our previous trade plan and is now up 12 percent and perched strongly at position eight in the liquidity list. As it stands, my recommendation is to buy at current prices and with safe stops at 12 cents. Ideal targets stands at 20 cents and 40 cents.

Ethereum Classic (ETC) Technical Analysis Click here to see the full size Ethereum Classic ETC Daily Chart July 3If there is a stamp approval for cryptocurrencies, then it has to be that of regulatory approval. Approval tags with it approval and that by extension drives adoption ushering in institutional investment. Thailand is towing in with the rest of major economies and they have legitimized Ethereum Classic as a form of payment for entities seeking to raise funds through ICOs. The Thailand SEC also laid down regulation to guide ICOs and requirements for companies.

The Securities and Exchange Commission of Thailand will allow seven cryptocurrencies, used for initial coin offerings (ICOs), to be traded as trading pairs. They are bitcoin, ethereum, bitcoin cash, ethereum classic, litecoin, ripple, and stellar. pic.twitter.com/8aabAY0FB6

— KryptoMorphic Wealth Club (@KryptoMorphic) June 16, 2018

At the charts and we are still stuck in a consolidation though with a bullish skew. Here we have two candlesticks-June 12 and 23 that could potential determine trend. However, that subject to break out and should prices edge past $18, we shall trend according to June 12 support candlestick which had strong volumes. In that case, stops would be at $16 but we shall suggest buying on pull backs.

DASH Technical Analysis Click here to see the full size DASH Daily Chart July 3There are a lot of user case applications that cements the need of cryptocurrency legalization. DASH and KuvaCash for example are changing lives in Zimbabwe and that’s not it, the expediency and efficiency that DASH and other cross border payment systems present is unrivaled.

Fact is findings presented to the EU’s Economic and Monetary Affairs Committee findings warns them not the “attempt” to ban cryptocurrencies and the reasons are straight forward. First, cryptos are beneficial and secondly, banning won’t do a thing to crypto proliferation.

Back to the charts and DASH is up eight percent and inching closer to $270, a major resistance line and buy trigger. Now, while we have these nice bull candlesticks springing off $200, we need up-thrusts above $270 before we begin buying. That would entail a bullish break out and in that case DASH bulls can begin buying on dips in lower time frames. If all things pans out as planned and DASH appreciate, then reasonable targets stands at $530 or April highs.

NEO Technical Analysis Click here to see the full size NEO Daily Chart July 3The influence of the state cannot be overstated. China for example has their own stands when it comes to matter cryptocurrency. They are particularly opposed to ICOs but they entertain local regulators to issue licenses to cryptocurrency business according to the latest report.

Now, in light with what has been happening, NEO, one of the most mature smart economy and ICO issuing blockchain platform in China is set to directly benefit from any China shift of stance. Besides, NEO is maturing technologically and is actually the first blockchain to issue off-chain scaling solution, Trinity State Channel Protocol. This will considerably increase the throughput of NEO blockchain.

@TrinityProtocol $TNC

The start of many great things #Nodes https://t.co/vGV28rprSX#blockchain #node #scalingsolution #statechannel #offchain #dev #developer #crypto #tech #python #neo #tnc $neo $eth $zil $ont $eos $btc

— Nick M (@NickTrinityTNC) June 27, 2018

Technically, NEO is still trending inside a bearish break out after June 12 break below. These higher highs are normal and happens often following such break out. In real sense, I don’t recommend taking longs until after we see NEO trading above $40. For now, we still retain a bearish outlook until our entry conditions are met.

IOTA (IOT) Technical Analysis Click here to see the full size IOTA Daily Chart July 3As a pioneer and a project that is gaining ground in the IoT sub-sector, IOTA is strategically position itself as a funnel for tech companies. Many auto makers and banks are leveraging on Tangle and blockless IOTA as they strive to make breakthroughs in their business. Volkswagen, Bosch and DNB ASA are some of the world renowned companies utilizing this infinitely scalable technology meaning IOTA is technically a long term buy-hold digital asset.

Back to price action and IOTA is on an uptrend. It’s up 10 percent in the last day and since we are net buyers, those seeking to load can do so whenever there is a correction on lower time frames. Ideal targets is at $2 with stops at $1.

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.

origin »Bitcoin price in Telegram @btc_price_every_hour

Cardano (ADA) на Currencies.ru

|

|