2021-5-14 15:48 |

Choosing a good crypto exchange is vital for your success as a trader. And we all know it can be hard sometimes. So many technicalities, fees and similar to look out for, you should always choose it carefully.

The older crypto exchange never used to offer derivatives, but with newer derivative specialized competitors like the ones we’ll cover today entering the market, they’ve also embraced them.

Today we’ll look at and compare two crypto exchanges specialized in crypto derivative trading, FTX and Bybit.

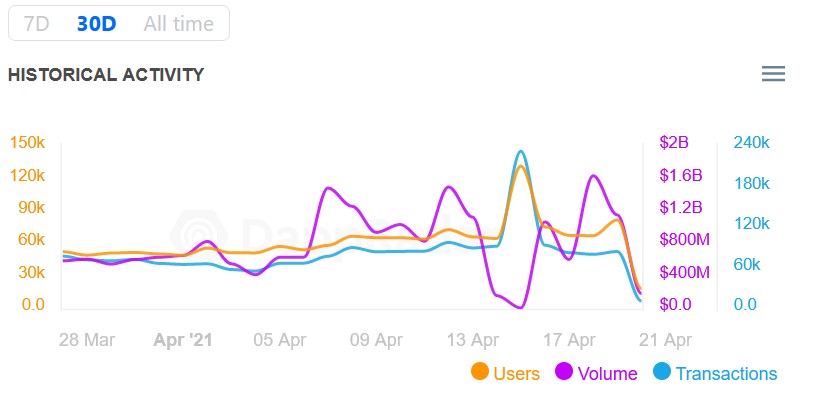

A short introductionBut let’s start with a brief introduction ByBit is a crypto exchange and trading platform that offers only derivative trading. It launched in March of 2018 and has quickly grown since. Ranking in the top five derivative exchanges by trading volume and amassing over 1.2 million users.

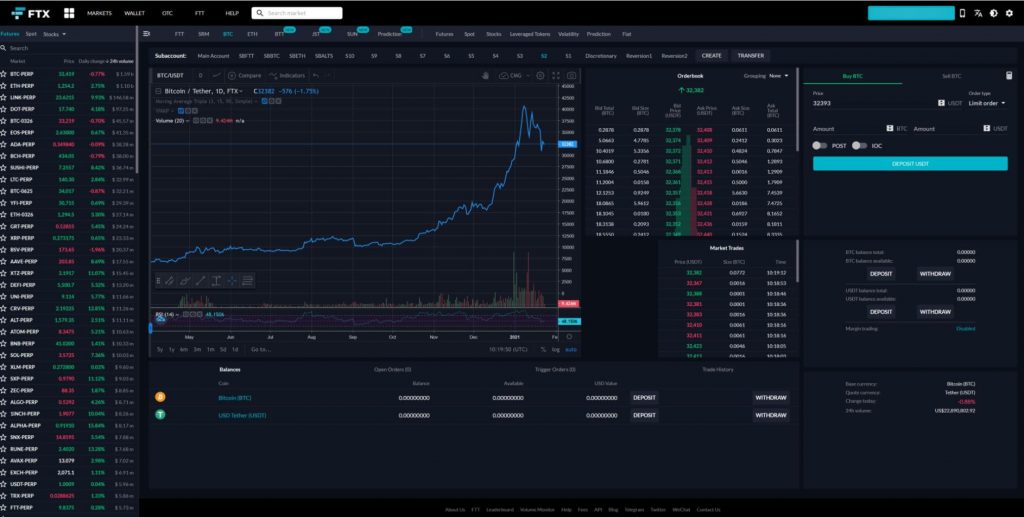

The other platform we’ll look into is FTX, which belongs to Alameda Research Ltd. It was founded in 2018 and has also quickly grown among cryptocurrency traders.

They excel at offering investors cryptocurrency margin trading, future, leverage, and more.

Visit ByBit Now Visit FTX Now

Trading experienceFTX is great even for institutional investors. The platform offers a trading experience among the smooth and most responsive there is. There’ll be no lags in your purchase or sale orders, that’s a guarantee. It also provides more sophisticated features such as deep liquidity, order books, and a very complete tradingview charting system.

Working with artificial intelligence, the liquidation process is also extremely functional. The engine notifies users to close their positions if needed and will automatically do it if the maintenance margin goes under 4.5%.

ByBit on the other hand offers traders an innovative and easy-to-understand trading platform. It is perhaps more suited for beginners than FTX. For all you tech-loving traders out there, here are technical facts: the system takes up 100k TPS and offers an API that refreshes the data every 20ms with near infallibility. In other words, it is like, FTX extremely reliable. It also operates on a top-notch quality AI that prevents unfair automatic liquidation.

And third-party bot and other services can be integrated into the platform.

So neither wins this point, they are both good and are best for you depending on your needs and experience.

OfferingFTX offers the following crypto financial services:

Future. On the platform, you’ll have access to 150 perpetual as well as quarterly futures markets.Leveraged tokens. FTX allows traders to leverage trade 45 ERC-20 coins up to 3X.Options. It offers Bitcoin options contracts that are dealt in USDMOVE. These are FTX exclusive contracts that come as Bitcoin futures with daily, weekly and quarterly maturity dates.The platform allows leverage of 101X on most futures and options. And has a large selection of coins to choose from, 24 on the US version.

Bybit has a different model. It only supports inverse perpetual future contracts on the platform, these are:

BTC/USD, ETH/USD, EOS/USD, XRP/USD, BTC/USDT, ETH/USDT, BCH/USDT, LTC/USDT, XTZ/USDT, LINK/USDT, ADA/USDT, DOT/USDT, and UNO/USDT.

The biggest leverage available on ByBit is 100x on BTC/USD and BTC/USDT contracts. Although the rest of the contracts have a maximum leverage of 50X.

The winner here is FTX.

Trading feesFTX has a complicated fee structure so let’s break it down. It is tiered in 6 levels, from tier 1 to 6, and is based on the trading volume of the last 30 days.

The first tier will be used for trading volumes under $2 million, has a maker fee of 0.02% and a taker fee of 0.07%. While the last, sixth tier will be used for volume over 50 million and will take no maker fee and a taker fee of 0.04%.

On top of that when a trader uses a leverage of 50-99X the trading fee will increase by 0.02%. And leverage of 100X or higher will increase the trading fee by 0,03%. BTC-Perp and ETH-Perp are the only two contracts to which this fee structure does not apply.

It is also important to point out that traders holding FTX native tokens called FTT will be offered discounts based on how much they’re holding.

Bybit’s fee structure is easier to understand. The platform offers a flat fee of 0.025% for makers and 0.075% for takers.

So Bybit wins this round.

Deposits & withdrawalsFTX charges no deposit fees or withdrawal fees for any asset other than ETH, ERC-20, and FIAT. The FIAT withdrawal fee is $75 if you’re withdrawing under $10 thousand, otherwise, it is fee-free. Withdrawals are usually very quick and are processed in a matter of minutes, although sometimes for larger funds they may take up to 6 hours. Deposits on the other hand may sometimes take up to 24 hours.

Bybit also charges no deposit fee and a small $10 withdrawal fee. Withdrawals are processed manually in 1-2 hours, and deposits can sometimes take up to 3 days but are usually done a lot sooner.

All things considered, Bybit comes out on top.

Security and TrustworthinessFTX requires quite strict security measures to prevent breaches in the user’s account, such as:

The user has to set a strong passwordFTX requires two-factor authentication for login, withdrawal requests, and changing passwordThe platform will block your withdrawals for a while after a 2FA removal or a password changeExperts working at FTX consistently check for suspicious activity on the platformFTX also uses SSL encryption to increase users’ protection on the website data, whitelisting IP addresses, and wallet addresses. They have also had hacks or similar issues, so we can rest assured that the security measures do in fact work.

Bybit is also known for offering traders a secure environment. It uses SSL to increase the security of website data, two-factor authentication just like FTX, and a cold wallet system.

Visit ByBit Now Visit FTX Now

Insurance fundsBybit gives traders the opportunity to buy mutual insurance that hedges all their potential losses. And the premium you’ll pay will be credited to the Mutual Insurance Fund. The fee you’ll pay will be calculated by taking the insurance amount and multiplying it by 0.05%.

Traders on FTX are provided with an insurance fund to protect them from big losses due to market volatility. This will protect traders that use the leverage of 50X-100x that pay for the fund by paying higher fees as we mentioned earlier. If you are liquidated in the event of a big drop in the price of Bitcoin, for example, the fund will reimburse you if you have been unfairly liquidated.

FTX provides traders with a better insurance policy, but it is close.

KYCBybit does not require KYC, which is quite unusual. On FTX KYC is not mandatory. But without verification, you will not be able to deposit more than $1000 and you’ll only be able to deposit crypto. Which of course is not ideal, so in reality, it is more or less mandatory.

If you are looking for a real crypto experience then a platform without KYC, like Bybit is your best option.

Customer support and educationBybit provides traders with 24/7 customer support in multiple languages, live on their chat portal. Contact them on the live chat on their platform, send an email to [email protected], or message them on Telegram @BybitTradinChat. The platform also offers a lot of free educational resources.

FTX offers a wide array of options for customer support. You can find them on E-Mail, Telegram, Facebook, Twitter, WeChat, and Weibo. They also run knowledge-packed social media pages, Telegram communities, and like Bybit a lot of free educational resources.

Bybit comes out on top, due to the live chat functionality.

Available in the US?Bybit is not available in the US, mostly due to a lack of regulation. And neither is FTX. Although residents in the US can trade on FTX.US.

So which platform is better?If we are looking at the criteria we mentioned above as a score tally then Bybit comes out on top and is your best option. But of course, it’s not that simple. Choosing a crypto trading platform is a hard thing to do, and ultimately the choice is all yours. Traders take different choices based on their needs, preferences, and feelings. An article like this can give you an insight into how the platforms work and how they compare with each other, but a lot will still be up to your subjective taste and experience.

But remember whatever you do, choose wisely. Using the right crypto exchange is of vital importance. And when you do choose please make sure you know what you are doing, you trade responsibility and never invest more than what you are willing to lose.

Visit ByBit Now Visit FTX Now

Check out our other crypto exchange comparisons:

Bitmex vs BinanceBitmex vs BybiteToro vs BinanceBinance vs. KuCoin Crypto Exchange DuelBinance vs Bitpanda – Fees, Features, Security ComparedBinance vs Binance US: What are the differences between the exchanges?Coinbase vs Binance | Detailed Overview and ComparisonBittrex vs. Binance Exchange ComparisonCoinmama vs Binance – Fees, Features, Security ComparedCoinbase Pro vs Binance: Which Crypto Exchange Is Better?PrimeXBT vs ByBiteToro vs eToroXThe post Bybit vs FTX: Fees, Leverage, Security & Features Compared appeared first on CaptainAltcoin.

Similar to Notcoin - Blum - Airdrops In 2024

MANY (MANY) на Currencies.ru

|

|