2024-7-17 19:30 |

Crypto investment products have experienced another week of inflows to build upon inflows witnessed in the prior week. According to data from CoinShares, digital asset investment products recorded $1.44 billion worth of inflows last week, which is a further indication of the return of bullish momentum into the crypto industry. This brings the total inflow to $1.881 billion over a two-week period after three consecutive weeks of outflows. With last week’s numbers, the total value of inflows into crypto investment funds this year now stands at a record $17.8 billion.

Bullish Return Among Institutional Crypto InvestorsThe latest data shows that crypto investment products are starting to reflect the overall change in market sentiment. As noted by CoinShares’ latest weekly report, this change into bullish sentiment has allowed digital investment products to further surpass the $10.6 billion inflow received during the 2021 bull market.

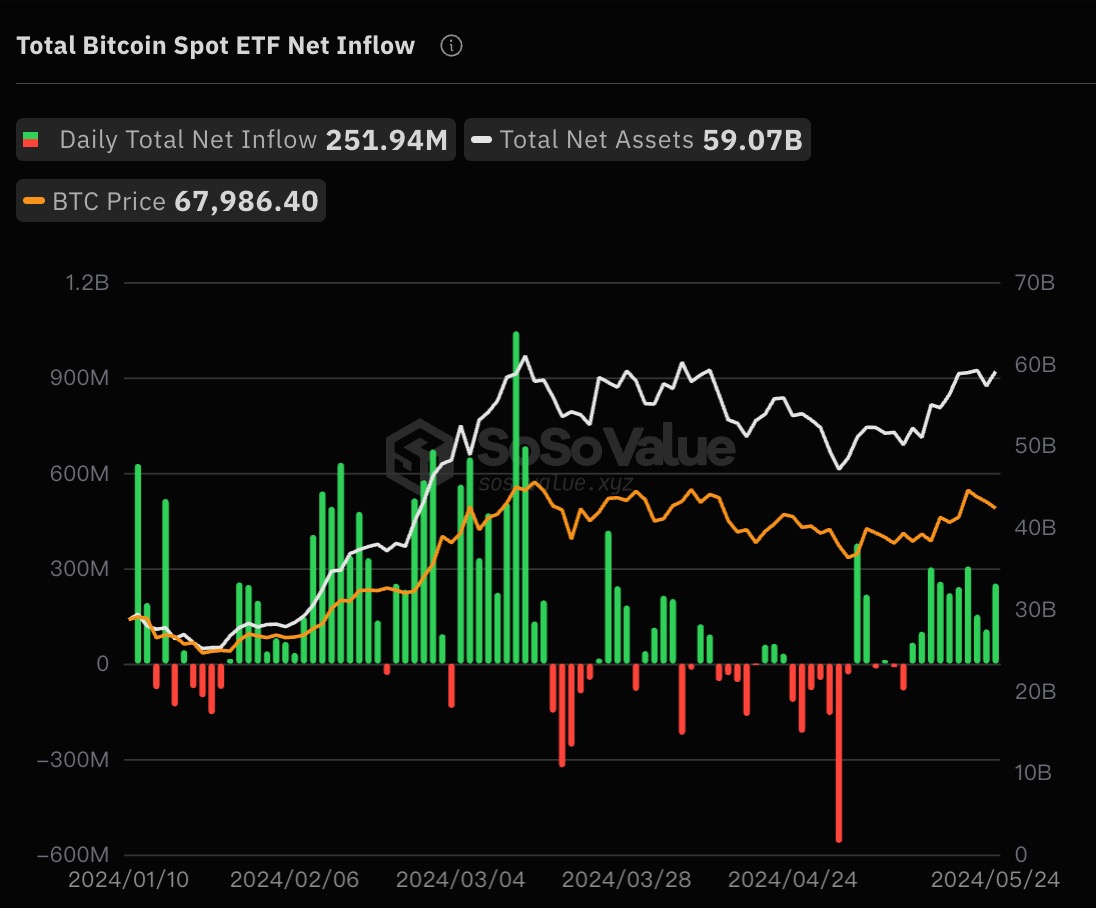

Last week’s inflows amounted to $1.44 billion, which is the 5th largest weekly inflow on record. Unsurprisingly, Bitcoin received the lion’s share of the investments. As the world’s first and largest crypto asset, Bitcoin has always been the centre of attraction among other cryptocurrencies. The cryptocurrency has also been in the spotlight for the past few months since the launch of Spot Bitcoin ETFs. A return of bullish momentum allowed Bitcoin to receive $1.35 billion last week, which is also the fifth-largest weekly inflow on record for Bitcoin. Notably, this inflow came amidst concerns about selling pressure sparked by a selloff of over 45,000 BTC by the German State of Saxony.

On the other hand, short-Bitcoin products witnessed $8.6 million worth of outflows. Short-Bitcoin products are for investors who anticipate a decline in the price of Bitcoin. With this in mind, it can be deduced that the withdrawal of short positions is a manifestation of a diminishing bearish outlook among institutional investors.

Ethereum led the altcoin market with a net inflow of $72 million, allowing it to reverse its total net inflow this year from a negative $15 million at the beginning of the week to $57 million at the end of the week. Solana exchange-traded products followed suit with a $4.4 million net inflow, a 270% reduction from $16.3 million in the prior week. At the time of writing, Solana’s total inflow this year stands at $62 million.

Litecoin, XRP, and Cardano witnessed inflows of $1.2 million, $1.0 million, and $1.2 million, respectively. Multi-asset investment products also recorded $17.2 million in inflows.

ETPs are still one of the best ways for institutional investors to get exposure to cryptocurrencies like Bitcoin and Ethereum. Their use has been on the rise since the beginning of the year, especially in North America. In terms of geographical location, the United States had the most inflows with $1.274 billion, Switzerland with $57.5 million, Hong Kong with $54.6 million, and Canada with $23.2 million, among others.

According to CoinShares, the total assets under management (AuM) are now at $84.713 billion.

Similar to Notcoin - Blum - Airdrops In 2024

Emerald Crypto (EMD) на Currencies.ru

|

|