2025-3-5 17:34 |

Bitcoin has wiped out recent gains with a 10% dump in the past 24 hours; the same as Ethereum price. This happens as the US began its tariffs program against Canada and Mexico, with the investor reaction to the trade war telling as risk assets plummeted.

What does this risk off sentiment mean for BTC price? What about the outlook for XRP, SOL and Bitcoin Pepe?

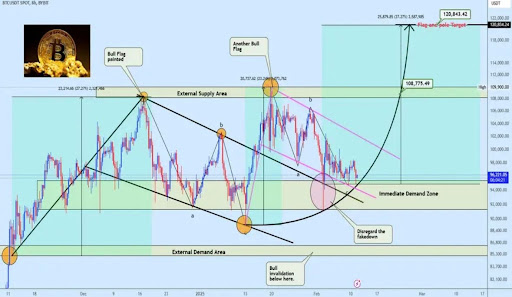

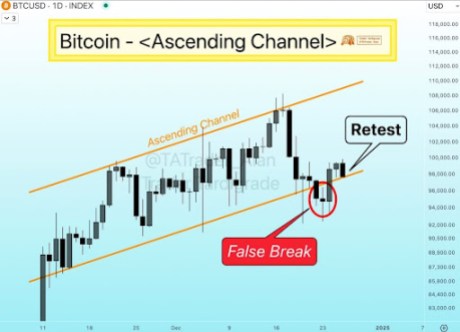

Bitcoin price prediction as BTC reverses gainsBitcoin rose sharply on Sunday after US President Donald Trump revisited the issue of a US crypto stockpile. The announcement saw BTC price print a $10,000 candle to jump from lows of $85k to near $95k.

The flagship digital asset is however back below $84k, having erased the gains amid market reaction to the start of tariffs on Canadian and Mexican imports.

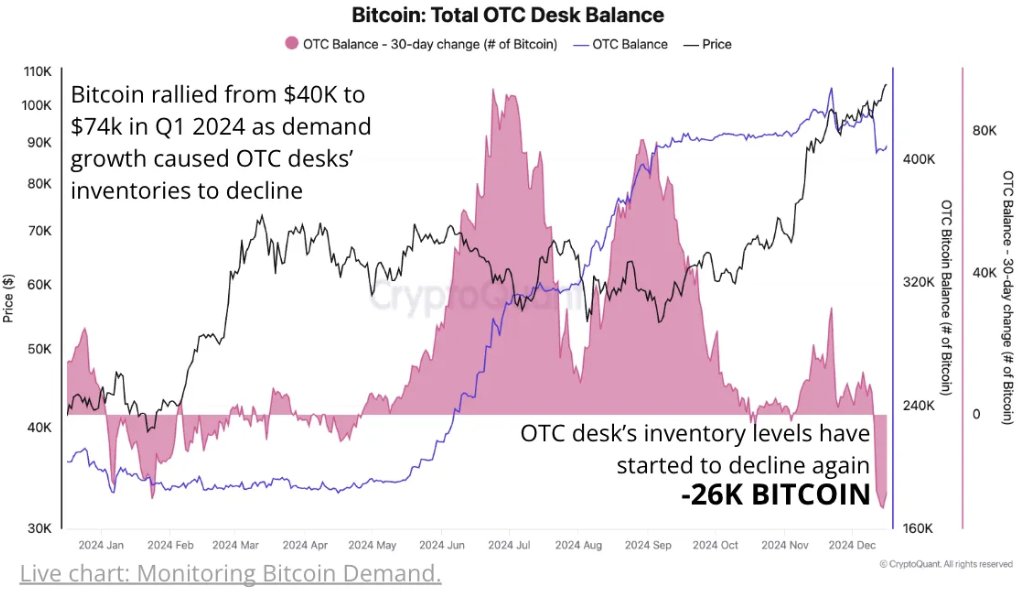

CryptoQuant CEO Ki Young Ju believes the bull cycle remains. However, with no major on-chain activity and key indicators largely neutral, the analyst predicts a slow grind “ until sentiment in the U.S. improves.”

“If the cycle ends here, it’s an outcome no one wanted—not old whales, mining companies, TradFi, or even Trump,” he added.

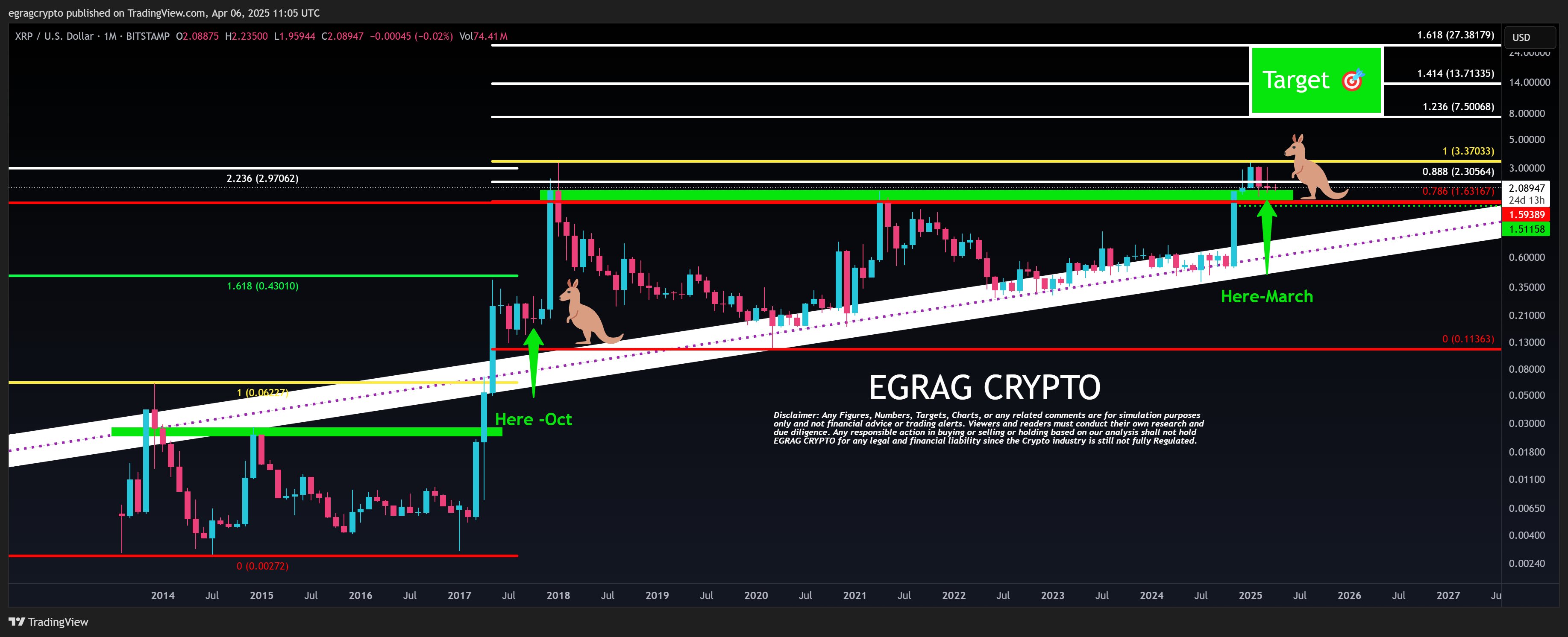

XRP, SOL, ADA price outlookBTC’s notable dive in the past 24 hours also sees top altcoins in the doldrums.

Ethereum’s ETH was down 12% to $2,068, hitting its lowest level in over a year. Meanwhile, Ripple’s XRP and Cardano’s ADA were down 15% and 19% respectively.

Notably, these tokens pumped hardest after Trump’s announcement that they’ll be part of the targeted US crypto reserve.

It’s interesting what industry players have said about Trump’s inclusion of the alts as part of the strategic reserve. To most of them, only Bitcoin fits the bill of a strategic reserve asset.

The tariffs and the initial hype about the strategic reserve fading quickly is what has contributed to XRP, Solana and Cardano prices tanking. Nonetheless, analysts say the stockpile expectations and other factors could provide fresh upside legs for these top altcoins.

Is this a buy opportunity for Bitcoin Pepe?While XRP, ADA and SOL have pared gains, it doesn’t mean prices cannot skyrocket in the coming weeks and months.

Market conditions and other factors are still in play for the rest of the ecosystem and investors may use the dip as a buying opportunity. This same outlook applies to new projects set to the market in the second quarter and beyond.

Bitcoin Pepe (BPEP), currently in presale, stands out as one of the new tokens to attract huge attention.

A 1 million BPEP giveaway is fueling further interest.

BPEP price outlookBitcoin Pepe wants to bring the first meme Bitcoin layer 2 to the market. It is looking to tap into Solana’s speed to bring the new PEP-20 token standard to the meme ecosystem. With regulatory approach to the sector opening up further innovation, Bitcoin Pepe could be Bitcoin’s most disruptive L2.

Traction for BTC and SOL amid a confluence of other factors could see BPEP price explode. A project that relies on the security of Bitcoin’s blockchain and speed of Solana has the market buzzing.

So far, Bitcoin Pepe has raised nearly $3.7 million in its presale.

Meanwhile, the price of BPEP has increased to $0.0255 and will rise through stage 30. This means the current price might be a huge bargain today, particularly with bullish predictions for Bitcoin and Solana.

Find out more about what Bitcoin Pepe is here.

The post BTC, XRP, SOL price forecast: What does it mean for Bitcoin Pepe? appeared first on CoinJournal.

origin »ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|