2022-8-25 20:30 |

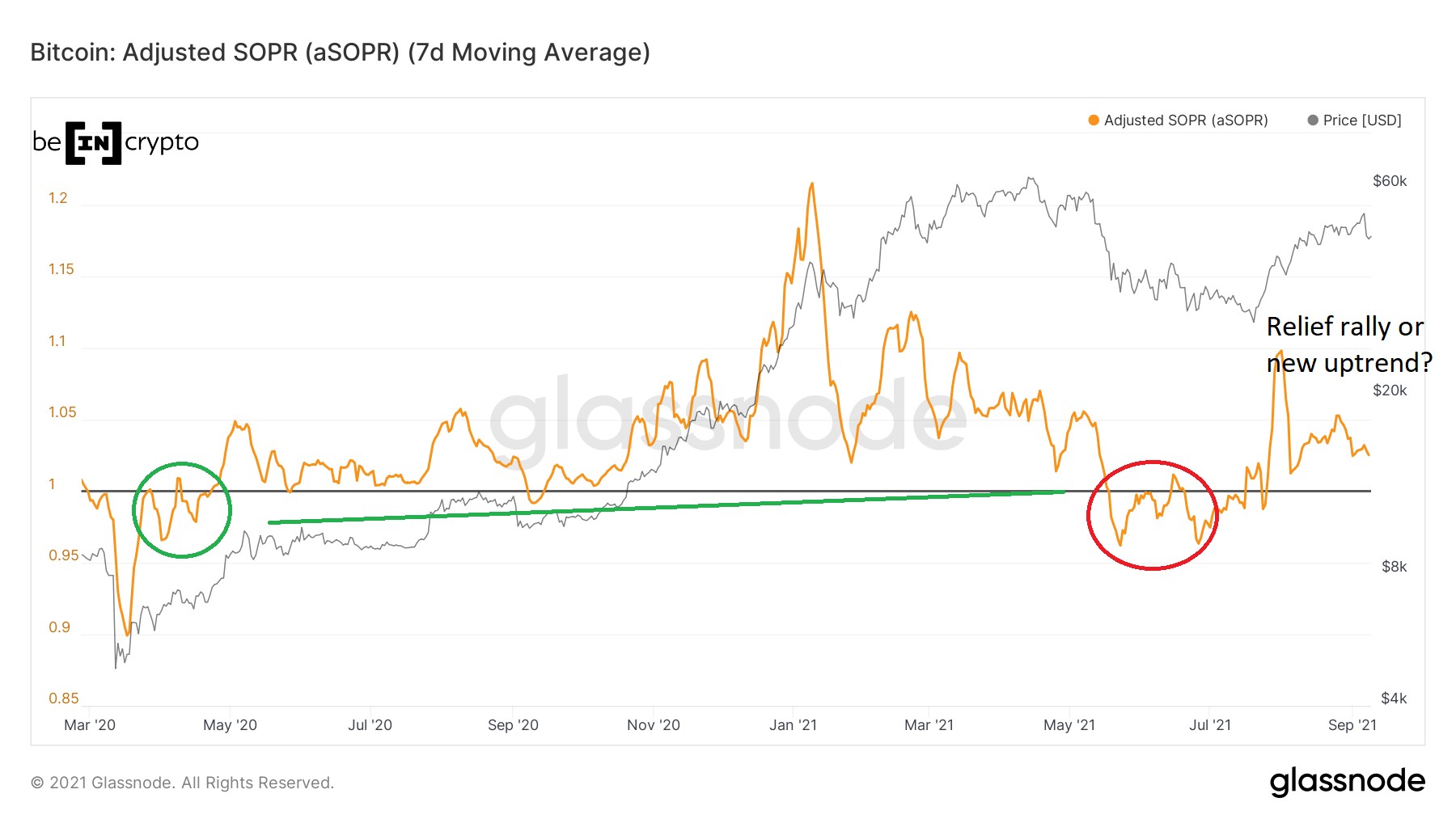

In today’s on-chain analysis, BeInCrypto looks at the SOPR ratio and its derivatives. The goal is to determine whether Bitcoin (BTC) market participants are likely to return to profit in the coming weeks.

Spent Output Profit Ratio (SOPR) is an on-chain indicator that we calculate by dividing the realized value (in USD) by the value at the creation of a spent output (in USD). In other words, it is the selling price/purchase price.

Hence, it is known that if the ratio is above 1, the owner of the sold asset records a profit. On the other hand, if it is below 1, it takes a loss. The greater the deviation from 1, the greater the profit/loss.

For greater accuracy of long-term measurements, the so-called adjusted SOPR (aSOPR) is also used. This indicator ignores data on outputs with a lifespan of less than 1 hour.

SOPR approaches neutral levelsIn an on-chain analysis from almost 2 months ago, BeInCrypto noted that in June the SOPR indicator reached historic capitulation levels set by the rising support line (blue). This happened as a consequence of a sell-off in the cryptocurrency market, in which Bitcoin hit a low of $17,622. Moreover, the indicator suggested that the bull market ended 13 months earlier during the May 2021 declines (red area).

Currently, the SOPR (7D MA) twice tried to regain neutral territory near 1 (green arrows). Unfortunately, it was rejected, dropped, and is currently at 0.98.

Despite this, the index has been clearly rising since the June lows and can be expected to try again soon to regain the 1 level and enter the positive territory for the first time since April 2022. If this happens, investors could return to profit territory, which would improve the extremely negative sentiment of the crypto sector.

aSOPR chart by Glassnode The ratio between LTH and STHAnother derivative of SOPR is the so-called SOPR ratio. It shows the ratio of the indicator’s value for long-term holders (LTH) versus short-term holders (STH). Historically, this indicator has been very closely correlated with the BTC price, being a good marker of macro lows and highs.

On-chain analyst @OnChainCollege tweeted an update of the SOPR indicator (7D MA), marking on it two lines of long-term support (orange). Currently, the chart has reached the first line, signaling a potential bottom. However, a drop to the second line is still possible, which could be triggered by a sharp collapse in the BTC price.

Historically, both previous bear markets of 2015 and 2018 ended with a return to the area of the second, lower support line. The analyst comments on this possibility:

“No one knows where the exact #Bitcoin bottom will be but I like to make decisions for the long term based on historical and probabilistic thinking…”

Source: TwitterFor BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

The post BTC On-Chain Analysis: SOPR Struggles to Return to Positive Territory appeared first on BeInCrypto.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|