2022-9-24 19:00 |

In today’s on-chain analysis, BeInCrypto looks at the indicators of BTC supply in profit and loss in the hands of short- and long-term holders. It turns out that the majority of circulating coins are seeing a loss today, and the indicators are in the bottom areas of historical bear markets.

Losses and gains of BTC coins can be divided according to the length of time investors hold them. In on-chain analysis, the threshold between short-term and long-term holders is assumed to be 155 days. If the coins have not moved during this time, the statistical probability of their movement (sale) strongly decreases. They become coins in the hands of long-term holders (LTHs).

If, on the other hand, the coins move (are bought or sold) in less than 155 days, they are statistically more likely to move further. Therefore, they are considered coins in the hands of short-term holders (STHs).

Bags of long-term holders and Nov 2021 ATHAccording to data from Glassnode, currently, the total supply in the hands of long-term holders has reached the new all-time high (ATH) of 13.62 million BTC. The previous ATH of this indicator was set in Nov 2021, at a time when Bitcoin was hitting its ATH of $69,000.

Source: TwitterIt is worth noting that the fact that long-term holders held their coins at the BTC price, which later turned out to be the peak, is highly unusual. In all previous market cycles – including the $64,850 top in April 2021 – the path to the BTC price peak has always been associated with a decline in supply in the hands of LTHs.

A decline in LTH supply is naturally correlated with an increase in supply in the hands of STHs. During a bull market, long-term holders who bought BTC at a lower price in the past sell their coins to short-term buyers. In contrast, during a bear market, STHs capitulate and mostly resell their coins at a loss to LTHs. Bitcoin’s supply returns to the hands of long-term holders again.

However, the ATH of the Bitcoin price in November 2021 had a different course. Long-term holders – convinced that BTC will soon reach higher prices – chose not to sell their coins. At the same time, there were no new STHs on the market who were willing to buy. Bitcoin began a downswing that continues to this day, and most LTHs were left with their bags. They had to come to terms with the fact that their unrealized gains were falling and, over time, turning into unrealized loss.

LTHs historical loss levelsIn the chart below, we can see how the supply with losses in the hands of long-term holders is increasing dramatically. Currently, the chart has reached an area of 5 million BTC (red circle). This is the level that served as a benchmark for the absolute bottom of the BTC price in 2019 and 2020 (green).

Source: TwitterThere is another area, around 5.5 million BTC, which served as resistance in 2015. At that time, although the price of BTC did not fall below the bottom reached a few months earlier, supply at a loss in the hands of LTHs steadily increased.

This happened because many short-term holders who bought during the downtrend became long-term holders after 155 days. Many months of accumulation left their coins at a loss, and they became LTHs during that time.

If this scenario were to repeat itself now, the BTC price does not need to fall below the June low of $17,600. A long enough accumulation will make the losses of long-term holders reach the next resistance area (red). On the other hand, given the increased supply of BTC in circulation due to the systematic mining of new coins, it is not impossible that the indicator will soon reach a new ATH.

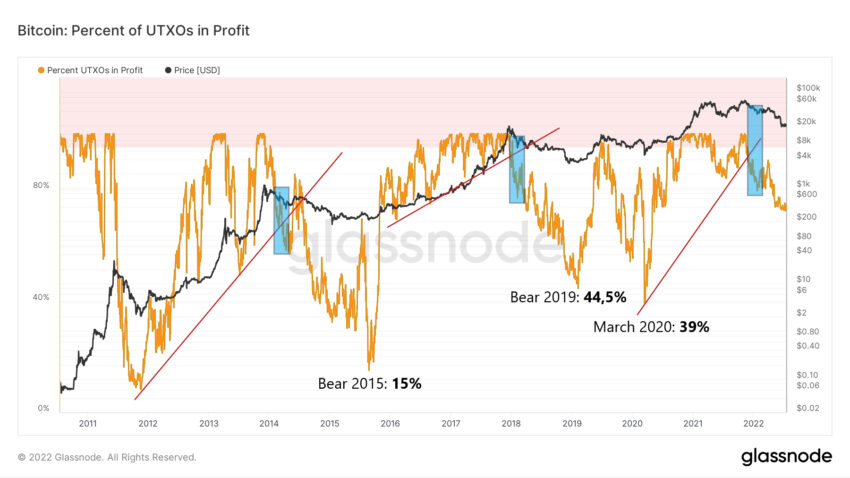

Circulating supply and coins in the hands of STHsFor a complete picture of losses in the Bitcoin market, two more indicators are worth mentioning. The first is the percentage of total supply in profit. It currently sits at 48.71% and is in the green area of historical lows.

A chart of this indicator was published on Twitter by @OnChainCollege, which stated that “more than 9.8 million coins are currently underwater.” It’s easy to count that at this stage of the bear market, 51.29% of all BTC in circulation is recording a loss.

It is worth adding that at previous bottoms in the BTC price, the percentage of supply in profit was even smaller. At the beginning of 2019, it was 39%, and in March 2020 it was 43%. This means that there is still considerable room for potential declines.

Source: TwitterIn confluence with this data is the chart of supply in the hands of short-term holders. Currently, this indicator is also in the red area of historical lows. However, here too we see that it is today well above the lows reached in 2015 and in the correction of the 2021 summer.

The conclusion is that short- and long-term holders may still experience more losses. Interestingly, this is not necessarily related to the lower price of Bitcoin itself, but only a manifestation of a potential long-term accumulation period.

Source: TwitterSource: TwitterFor Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

The post BTC On-Chain Analysis: Losses of Long-Term Holders Reach Historical Peak appeared first on BeInCrypto.

Similar to Notcoin - Blum - Airdrops In 2024

ETH AI Limit Loss (ELL) на Currencies.ru

|

|