2021-8-12 20:21 |

The past few days have nothing short of a debacle on the Senate floor, especially in relation to crypto. Recent legislation titled the “INVEST in America Act” has been tossed back and forth in hopes of reaching a bipartisan vote. The short answer is, it has. However, it did not pass without contention.

Much speculation has ensued due to broad language concerning crypto. Promptly, two competing amendments was drafted to redefine a major point of contention: the meaning of “broker.” However, these amendments were shot down shortly after being introduced.

Breaking It DownThe infrastructure bill was originally introduced to the House on June 4th of this year, titled H.R. 3684 or the “INVEST in America Act.” Numbering over 2,000 pages, the resolution is a bit tricky to read. However, clean analysis will be promote a better understanding of the legislation. Much of the bill focuses on issues unrelated to crypto, but this article will be strictly devoted to the bill’s effect on crypto and the crypto community.

As one may already know, this bill was introduced and passed in Congress about a month after the introduction. 221 House Representatives voted in favor of the legislation with 201 voting against. All of which were the entirety of democratic representation in the House and 2 republicans as well. All 201 nay votes were cast by republicans, and 8 members did not vote. Those who did not vote were all republicans.

Recently, the bill has just been passed on the Senate floor. The next step would land the bill on Biden’s desk once any remaining contentions are resolved.

Related Reading | U.S. Treasury Secretary Yellen Accused Of Corruption Following Move Against DeFi

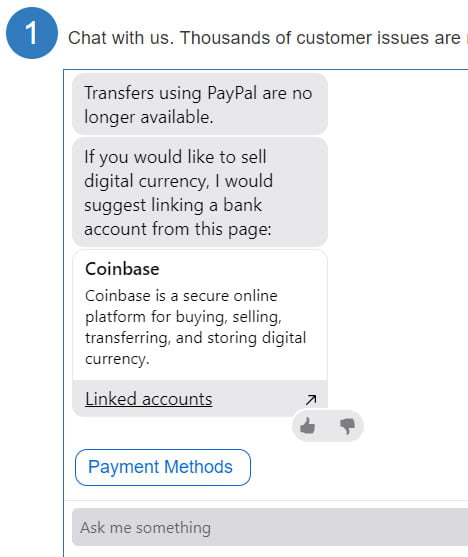

Despite some praising the passing of this bill, many are wary of the effects it could have on crypto. Most of this comes from the bill’s definition of broker, “any person who (for consideration) is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person.” Contentions are further explained by CNBC, “This, according to many within the crypto space, is too broad. A primary concern is that the current definition would target miners, developers, stakers and others who do not have customers and therefore wouldn’t have access to the information needed to comply.”

Another issued posed by the passing of this legislation comes from the lack of knowledge on crypto in the Senate. On the 3rd of this month, the Senate held a hearing titled, “Cryptocurrencies: What Are They Good For.” Most of the hearing entailed Senators attempting to gain a basic understanding of crypto. A majority of Senators who voted for this new legislation were not even present at said hearing. A little over one week after this hearing, the bill passed on the Senate floor.

All of this prompts a few questions: Why pass legislation concerning issues that were not understood or just over a week before passing it? Why include crypto in a bill which mostly concerns road infrastructure? Though this bill does address cryptocurrency, cryptocurrency is not included anywhere in the summary of the bill.

Coming in at over 2,000 pages, almost none of the bill addresses cryptocurrency. Despite this, the definition of “broker” in this bill can radically change the way blockchain transactions are addressed. An amendment to clarify the definition of broker failed and the bill moves on with major contention in the crypto community.

What Does This Mean For Crypto? Bitcoin rises despite recent US infrastructure bill | Source: BTCUSD on TradingView.comWhat does this mean for crypto? The short answer is a lot of uncertainty. The language behind what exactly broker means is far too broad. Essentially, the US government is going after the little guy. Much of the funding for this legislation will come via taxes at the expense of crypto users. AP News elaborates, “currency you can’t hold in your hand would effectively pay for roads, bridges, water systems, internet broadband access and shoring up the electrical grid.”

As mentioned earlier, amendments were made to clarify this language, but it they were quickly shot down after their introduction with very little consideration. At this point, there is not much anyone can do as the bill moves forward. All one can really do in this situation is wait for the bill to be ratified and become law.

Related Reading | Crypto Market Gets “Greedy,” How This Could Impact Bitcoin

Fortunately, crypto such as Bitcoin and Ethereum continue to rise. Speculation suggests that this very well may be due to the most recent update to Ethereum’s blockchain, the “London Hard Fork.” Hopefully this trend will continue on its current route as we near towards the end of the year.

Featured image from iStockPhoto, Charts from TradingView.com origin »Emerald Crypto (EMD) на Currencies.ru

|

|