2023-8-31 11:30 |

Following the court’s ruling in favor of Grayscale against the US Securities and Exchange Commission (SEC), many have begun to wonder whether or not the SEC will succumb and approve Grayscale’s ETF application. However, this looks more likely as Bloomberg ETF analysts have increased the odds in favor of the asset manager.

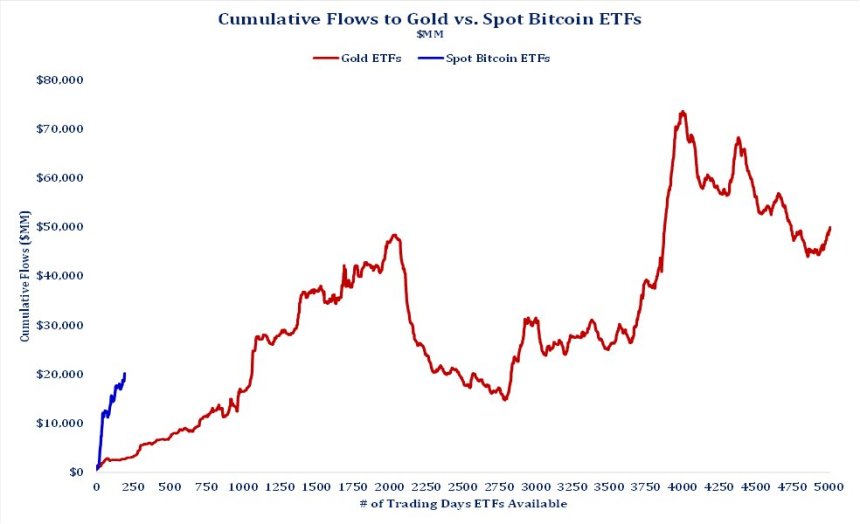

Odds For ETF Approval “75%”Bloomberg Analysts Eric Balchunas and James Seyffart have increased the likelihood of Spot Bitcoin ETFs launching this year to 75%. Balchunas further stated that the odds would rise to 95% by the end of 2024 if these ETFs weren’t approved by then.

This latest prediction comes after both analysts had previously put the odds of ETF approval this year at 65% (pre-Grayscale’s victory). According to them, the increase in the odds is because “the unanimity and decisiveness of [the] ruling was beyond expectations” and leaves the SEC with little or nothing to hang on to.

The court had adopted Grayscale’s primary argument that the prices in the spot and futures market were “99.9” correlated. As such, both Spot and futures ETFs should get the same regulatory treatment, something which the court found that the Commission failed to do when it approved the Teucrium and Valkyrie XBTO’s Bitcoin Futures Fund but disapproved Grayscale’s Spot Bitcoin ETF application.

Key Events To Look Out ForThese Bloomberg analysts believe that the SEC will find it harder to justify denials as it “faces deadlines, negative PR, and Hashdex’s novel approach.”

BlackRock’s application was published in the federal register on July 19, so September 2 marks the Commission’s first 4-deadline of a 240-day window to approve or deny the application. The SEC is also meant to decide on Fidelity, VanEck, Invesco, and WisdomTree applications on that day.

However, many expect the SEC to delay its decision on these applications just like it delayed Cathie Wood’s ARK Invest ETF application.

Despite this, Balchunas doesn’t believe timelines matter much in this situation as he expects the SEC to “give in” at some point and eventually approve these ETF applications.

Alongside the legal loss, the negative PR that the SEC is getting is another event that could eventually lead to the approval of these applications. He suggested that the mainstream media coverage by CNN, ABC, WSJ, and other media outlets could change the narrative with more people becoming open-minded to crypto, making a “denial politically untenable.”

Lastly, Hashdex’s “novel approach” makes it hard for the Commission to deny a Spot ETF application. The Digital Asset Management firm recently filed an application with the SEC to offer a Spot Bitcoin fund.

However, unlike other applicants (including BlackRock) relying on a surveillance sharing agreement with Coinbase, Hashdex will purchase the spot Bitcoin directly from exchanges within the Chicago Mercantile Exchange (CME) market.

origin »Bitcoin price in Telegram @btc_price_every_hour

EthereumFog (ETF) на Currencies.ru

|

|