2019-7-30 17:00 |

During weekends, the cryptocurrency market is relatively quiet, with no significant price fluctuations or news. However, when there are sudden shocks or news that affect BTC, then prices tend to wildly fluctuate across different exchanges because of low liquidity.

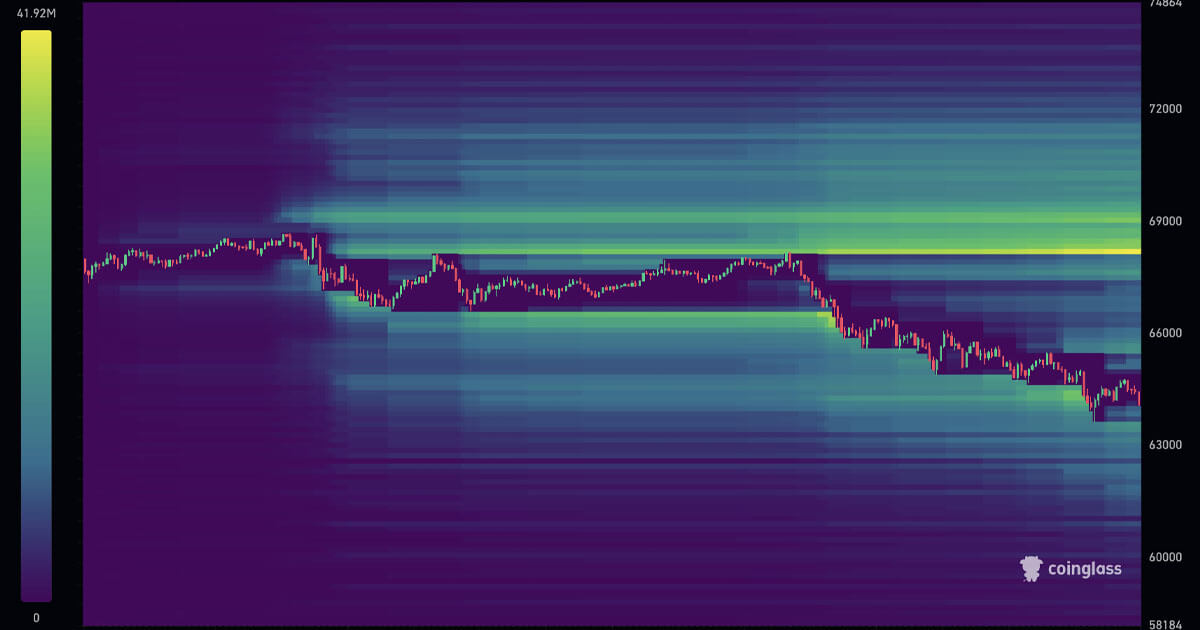

BitMex, a cryptocurrency platform that supports leverage trading, saw some of its users holding long positions liquidate more than $50 million over the weekend. Consequently, the price of Bitcoin sank, reaching to lows of $9,252.

Interestingly, within a short period, the price pumped back to exchange hands at roughly $9,643. Unfortunately, even with the gains after the dump, Bitcoin (BTC) is yet to reach its weeks high of $10,651 according data from mainstream coin trackers.

BTC Dumped Because Of High LeverageWith the cryptocurrency platform enabling trading with a leverage of as high as x20, the resulting liquidation cascaded as long positions were closed within minutes.

Crypto experts such as Max Keiser, noted that the Bitcoin’s price crash was not a mere coincidence. In a tweet, Keiser stated:

“Bitcoin down as BitMex unwinds highly leveraged positions. When I interviewed Hayes (CEO of BitMex), he said the average leverage (on a scale of 0-100) was 20. Extrapolating that number, adding recent outflow data, and get a temporary inferred BTC price of $8,800 – $9,300.”

The House Always Win

Concerned observers took to social media platforms to air their views on what transpired. Some were cautious, saying that irrespective of trade position, the “house always wins.” Another even went to lengths of comparing leverage trading to a poker where the casino almost always wins the game.

A Redditor, ethfiend2064, lamented:

“So, is this the next level of the short seller cartel’s strategy? They figured out a new way so they can not only make money from the longs by flash crashing the market but make even more from the shorts that immediately rush in by pushing the market back up again immediately? Wow. Just imagine how long they could keep doing this if they’re the only ones making money in the market.”

Some seemingly questioned their loyalty to Bitcoin, “a decade in [and] still BTC is manipulated as a penny stock?” Fortunately, some Bitcoin supporters saw the loss as deserving to those who have been gambling and seeking to make quick cash. The liquidation should be a lesson for them to “stop gambling and start hodling.”

The BitMex–Bitcoin RelationshipUnfortunately, this is not the first time that the events at BitMex has affected Bitcoin prices. For example, on August 22, the price of Bitcoin surged by $300, coinciding with BitMex’s scheduled maintenance that took place between 0100 UTC to 0200 UTC on the same day.

With the maintenance taking longer than anticipated, a client said, given the fluctuating BTC prices, one said the service was to their disadvantage.

Ascend Apex, one of the affected traders, tweeted:

“Completely wrong, you guys let all those orders that had SL get liquidated. You stated there was a DDoS attack which admitted that people could not log in to cancel orders yet you resumed trading and let everyone get liquidated. You completely robbed your customers.”

In May, long liquidations amounting to $225 million saw Bitcoin dump to a low of $6,380. The sell-off saw the coin’s market cap drop by $10 billion. Then again, towards the end of June, $500 million worth of BTC shorts were liquidated in less than 24 hours. Unexpectedly, the resulting pump saw prices rally to as high $14,000 before correcting in subsequent days.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|