2019-4-26 17:00 |

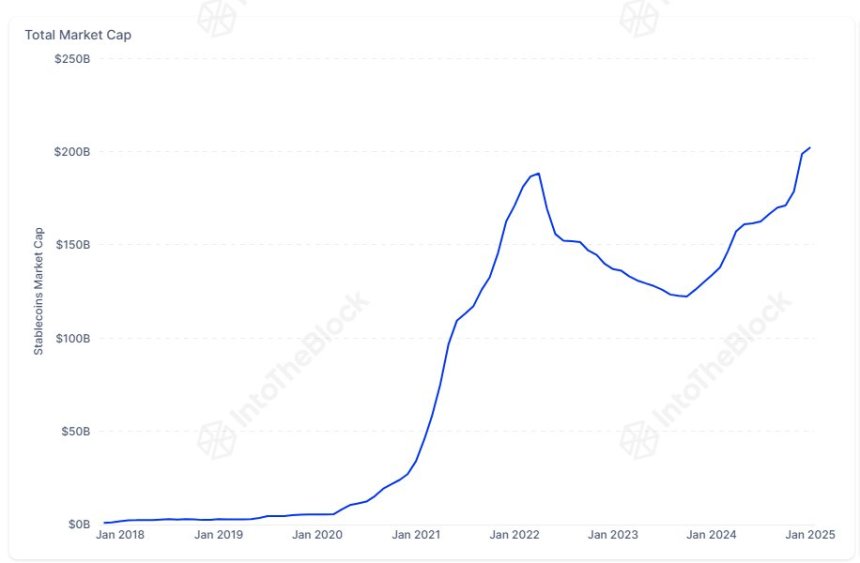

Bitcoin [BTC], the largest cryptocurrency by market cap, fell considerably after news pertaining to Bitfinex, a leading cryptocurrency exchange and Tether [USDT], the largest stablecoin by market cap, broke out. Bitcoin lost around $400 within a few minutes, resulting in a domino effect that pulled down the prices of other cryptocurrencies as well.

A report published by WSJ stated that New York’s Attorney General, Letitia James, accused Bitfinex of covering up a loss of around $850 million with Tether reserves. The report further stated that this incident, which took place in mid-2018, “drained” around $700 million of the stablecoin’s reserve.

This, in turn, resulted in an open investigation being ordered by the court against both the exchange and the stablecoin. The exchange was quick to respond, stating that the filings “were written in bad faith” and “riddled with false assertions,” which included the platform incurring a loss of around $850 million.

The news led to several influencers, including Caitlin Long, the Co-Founder of Wyoming Blockchain Coalition, commenting on the subject. She went on to state that she was “stunned”, but “not surprised” with the news.

However, the blockchain evangelist also stressed that there was a “big double standard”, adding that exchanges had to “clean up” their acts and “cryptographically” prove their solvency. With respect to the issue of double standards, Long highlighted New York AG’s stance on the Merrill Lynch case back. She tweeted,

“Why didn’t the NY AG throw the Martin Act at Merrill Lynch for doing something actually quite similar from 2009-12? Seriously, why the double standard??? […] Lynch commingled customer funds, used them to cover its own obligations, & had it failed its customers would have been exposed to a ‘massive shortfall in the reserve account.”

Source: Twitter

She further stated,

“7/ So…#NewYork did good investigative work here but needs to be called to task on why the double standard, and why the “gotcha” approach? Why not do the same to #WallSt. firms when they play similar shell games???”

This was followed by Long tweeting about cryptocurrency exchanges being more transparent. She stated that exchange platforms should “voluntarily disclose” information pertaining to their solvency, reserves, and audited financial statements. Long further stated that if this was not done on their own terms, then regulators, investors, and litigation would “force it on unfavorable terms”.

To this, Jesse Powell, the Co-Founder, and CEO of Kraken, said,

In the case of USDT it’s the fiat at payment processors and banks that’s in question. Someone could have looked at the CryptoCapital or bank balance and reconciled but a number in an account doesn’t mean cash in the vault. Would need to audit the whole chain to for deliverability

— Jesse Powell (@jespow) April 26, 2019

The post Bitfinex vs NY State Attorney General: Blockchain evangelist calls out New York for double standards appeared first on AMBCrypto.

origin »BottleCaps (CAP) на Currencies.ru

|

|