2023-11-17 20:05 |

In an announcement shared with crypto.news on Nov. 15, Bitfinex Securities Ltd, the first global digital asset platform licensed and registered in the AIFC, has shared the news of its new tokenized bond, which has since gone live. origin »

Bitcoin price in Telegram @btc_price_every_hour

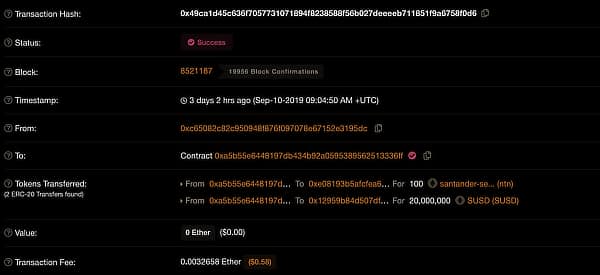

The Tokenized Bitcoin (imBTC) на Currencies.ru

|

|