2023-10-31 12:32 |

As October drew to a close, Bitcoin continued to demonstrate its strength by trading sideways, showing resilience after a brief pause the previous week.

Notably, over the past two weeks, the cryptocurrency market has experienced a surge in returns, living up to the “Uptober” moniker. For the better part of Monday, Bitcoin maintained stability above $34,000, hovering around $34,693 after registering a 0.36 % increase in the past 24 hours.

In the broader cryptocurrency market, other digital assets also exhibited relative stability. At press time, Ethereum (ETH) was holding firm at $1,808, while Dogecoin (DOGE) stood at $0.69, and Cardano (ADA) at $0.30, having made gains of less than 1% over the past 24 hours. Interestingly, Solana (SOL), emerged as the sole top performer among the top 20 coins, surging by around 7% in the same period.

However, amid this stability, the spotlight has remained firmly on Bitcoin, with analysts eagerly anticipating what the upcoming months will bring, particularly in terms of price potential.

Alex Thorn, the Head of Firmwide Research at Galaxy Digital, shared valuable insights into Bitcoin’s supply metrics through a tweet that shed light on the behavior of long-term holders.

“Examining the Bitcoin supply by the price at which each coin last moved showed relatively sparse cost basis between the current price ($34,591) and the $38,400-39,100 range,” wrote Thorn.

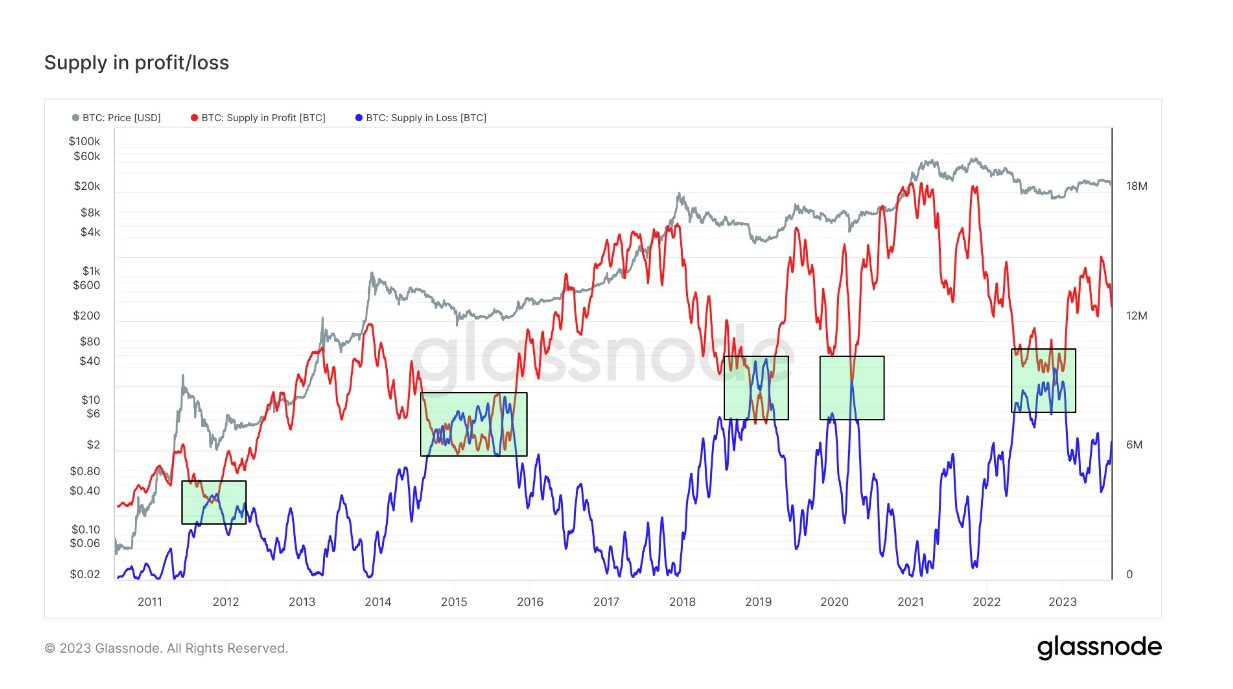

Importantly, this analysis revealed that a significant portion of Bitcoin’s supply was currently in a profitable position.

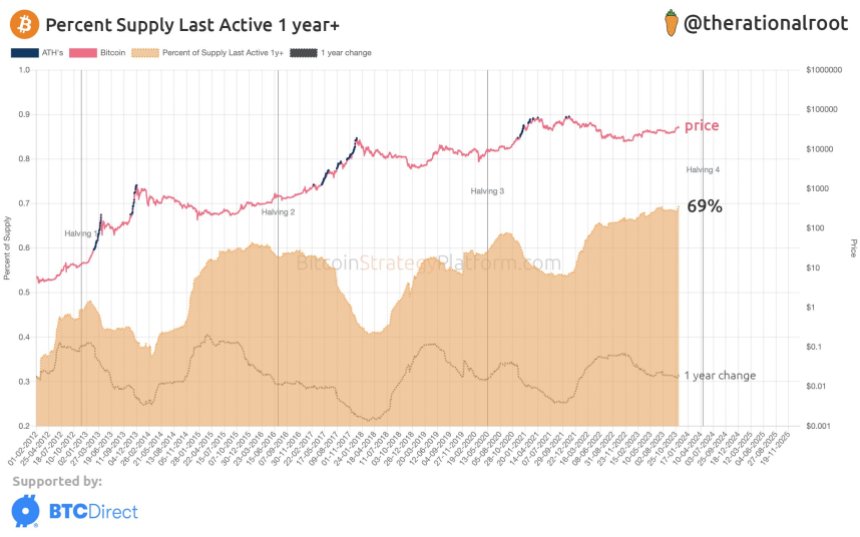

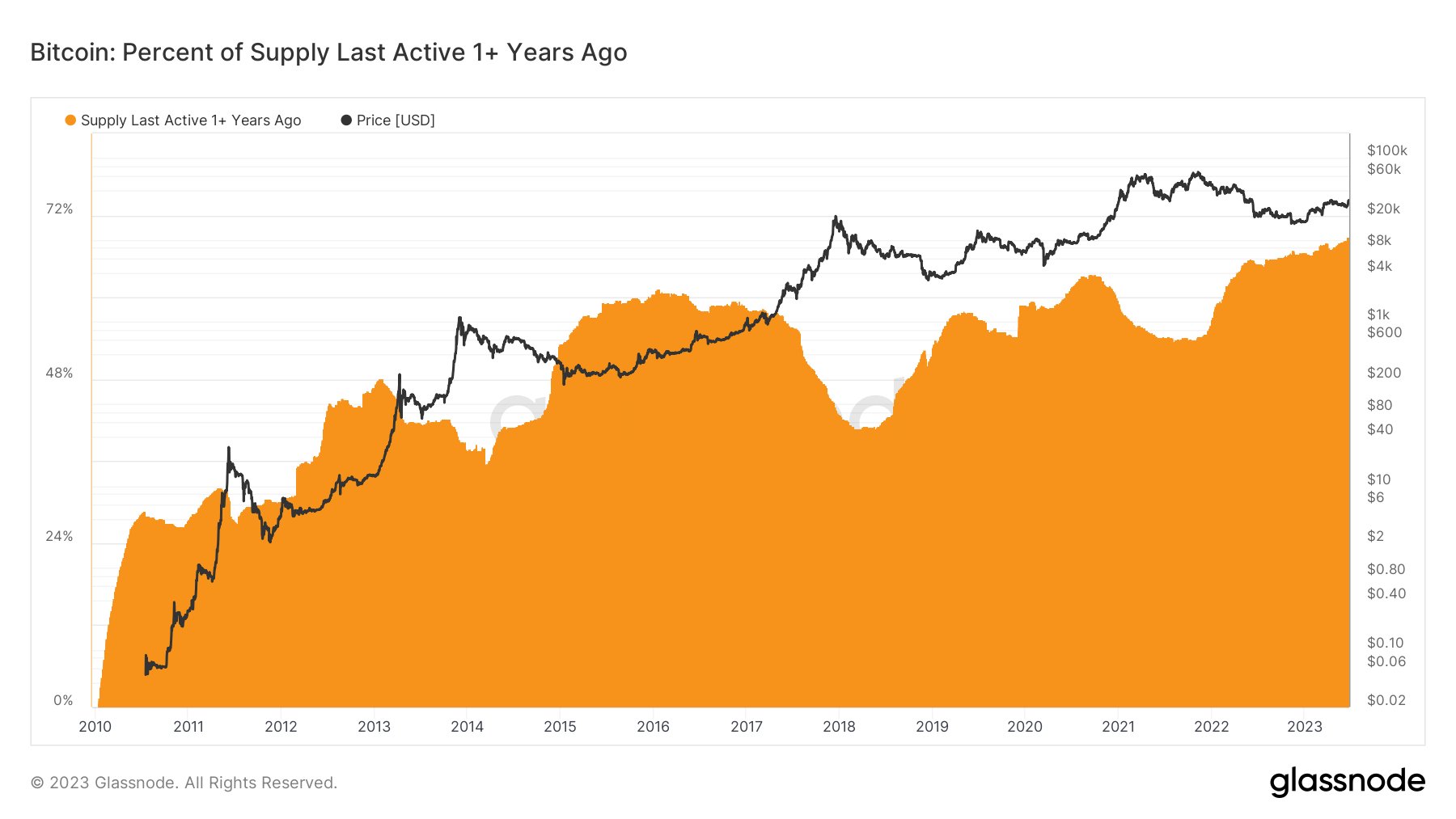

Remarkably, according to the pundit, approximately 83% of the Bitcoin supply has remained dormant since prices were lower than the current levels. This data pointed to a patient and optimistic group of long-term holders who were evidently waiting for even higher prices before considering selling.

He further emphasized that these holders could be waiting to take profit in the $39,000 range, $47,000 range, and $56,000 range, potentially indicating future resistance levels.

“While we cannot predict near-term price, we do see bullish narratives and network and market fundamentals that are supportive for bitcoin bulls,” he added.

Additionally, Thorn discussed the potential for a “Bitcoin gamma squeeze” scenario. A Bitcoin gamma squeeze occurs when Bitcoin’s price undergoes abrupt and substantial shifts due to options dealers urgently adjusting their positions to manage risk.

According to him, If BTCUSD continued to rise to levels around $35,750 to $36,000, options dealers would need to purchase approximately $20 million worth of spot Bitcoin for every 1% increase in price. This could lead to explosive price movements as options dealers attempted to maintain a neutral delta position.

origin »Bitcoin (BTC) на Currencies.ru

|

|