2024-10-18 18:05 |

Bitcoin’s price has surged in recent weeks, reaching $68,000 and nearing its all-time high. This rally has been accompanied by a rise in Bitcoin’s dominance, the percentage of the total cryptocurrency market capitalization it represents. However, experts are divided on whether this bullish trend will continue uninterrupted.

Bitcoin Dominance on the RiseBitcoin’s dominance has climbed from 57.69% at the start of October to over 58.8% currently. Crypto analyst Ash Crypto, posting on X, noted that if Bitcoin’s price reaches $80,000-$90,000 in the next 30 days, its dominance could hit 61%.

Source: X

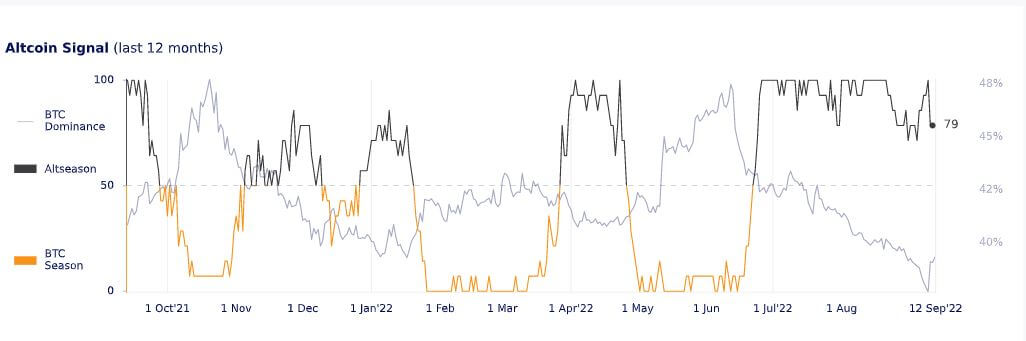

Historically, altcoins have tended to underperform when Bitcoin rallies strongly, leading Ash Crypto to advise altcoin investors to hold their assets for the next six months, anticipating a new “alt season” once Bitcoin breaks its all-time high.

Key Resistance Levels AheadVeteran analyst Peter Brandt cautions that Bitcoin needs to break through the $72,000 resistance level for higher price targets to be validated. Brandt points out that Bitcoin has faced resistance around $70,000 several times in the past seven months, each time followed by a significant correction. He wrote on X, “The Bitcoin price is in the window. Will Bitcoin escape through the window or have the window slammed on its head?”

Source: X

Analyst Rekt Capital echoes this sentiment, warning of a potential price crash if Bitcoin fails to close this week above $68,000, as has happened with similar attempts to break the current range.

Source: X

Mixed Signals and Potential PullbackWhile some analysts remain optimistic about Bitcoin’s prospects, others point to potential warning signs. Santiment, a crypto intelligence platform, cautions that the widespread calls for a $70,000 Bitcoin price are a contrarian indicator, suggesting a pullback might be imminent. Raoul Pal, a global macro investor, also warns against excessive optimism until Bitcoin convincingly breaks $70,000.

An analysis from Cryptonews highlights the crucial resistance level at $69,000, with support at $66,110. Meanwhile, another analysis points to Bitcoin’s recent surge to $67,803, breaking above a descending falling wedge pattern. However, it cautions that this breakout needs confirmation with a daily candle close above the resistance.

Factors Influencing Bitcoin’s PriceSeveral factors beyond technical analysis are also impacting Bitcoin’s price. Italy’s proposed 42% Bitcoin capital gains tax, Donald Trump’s campaign raising $7.5 million in cryptocurrency donations, and the launch of a Bitcoin and gold ETF are all potentially influencing investor sentiment and market dynamics.

Meanwhile, the Bitcoin ETFs are experiencing strong inflows, suggesting renewed interest in Bitcoin as an asset class.

In fact, total net inflows into spot Bitcoin ETFs have surpassed $20 billion since their launch earlier this year. It took gold ETFs 5 years to reach this figure. That makes the Bitcoin ETFs the most successful debut of any ETF in history.

Source: X

Bitcoin’s recent price surge and growing dominance have sparked both optimism and caution among analysts. While some predict further gains and the potential for a new altcoin season, others warn of potential pullbacks and the need for Bitcoin to overcome key resistance levels. Investors should carefully consider these diverse perspectives and conduct thorough research before making any investment decisions.

origin »Bitcoin (BTC) на Currencies.ru

|

|