2023-2-17 11:00 |

While many bitcoin investors look for the asset to behave as a safe haven, bitcoin typically has ultimately acted as the riskiest of all risk allocations.

The below is an excerpt from a recent edition of Bitcoin Magazine PRO, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Short-Term Price Versus Long-Term ThesisHow bitcoin, the asset, will behave in the future versus how it currently trades in the market have proven to be drastically different from our long-term thesis. In this piece, we’re taking a deeper look into those risk-on correlations, and comparing the returns and correlations across bitcoin and other asset classes.

Consistently, tracking and analyzing these correlations can give us a better understanding if and when bitcoin has a real decoupling moment from its current trend. We don’t believe we are in that period today, but expect that decoupling to be more likely over the next five years.

Macro Drives CorrelationsFor starters, we’re looking at the correlations of one-day returns for bitcoin and many other assets. Ultimately we want to know how bitcoin moves relative to other major asset classes. There’s a lot of narratives on what bitcoin is and what it could be, but that’s different from how the market trades it.

Correlations range from negative one to one and indicate how strong of a relationship there is between two variables, or asset returns in our case. Typically, a strong correlation is above 0.75 and a moderate correlation is above 0.5. Higher correlations show that assets are moving in the same direction with the opposite being true for negative or inverse correlations. Correlations of 0 indicate a neutral position or no real relationship. Looking at longer windows of time gives a better indication on the strength of a relationship because this removes short-term, volatile changes.

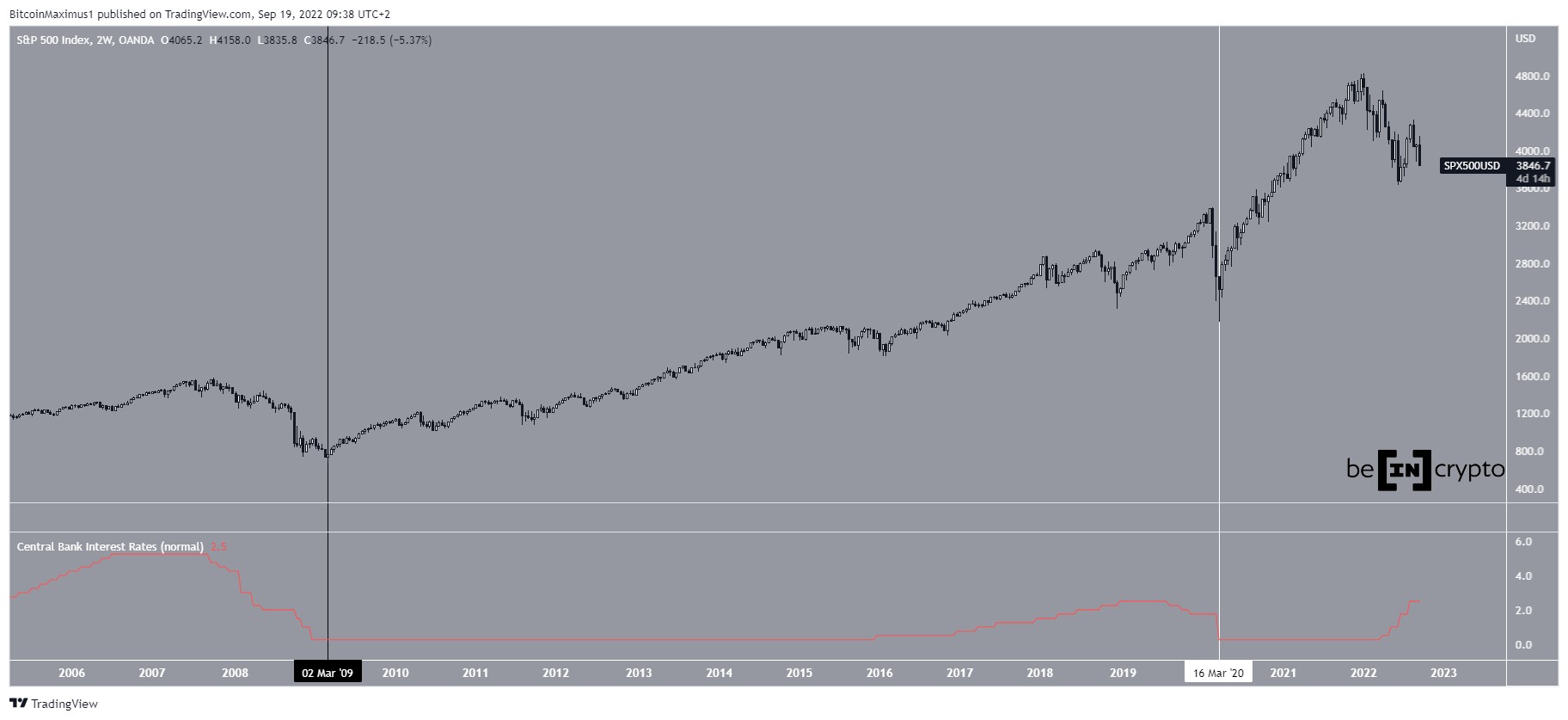

What’s been the most watched correlation with bitcoin over the last two years is its correlation with “risk-on” assets. Comparing bitcoin to traditional asset classes and indexes over the last year or 252 trading days, bitcoin is most correlated with many benchmarks of risk: S&P 500 Index, Russel 2000 (small cap stocks), QQQ ETF, HYG High Yield Corporate Bond ETF and the FANG Index (high-growth tech). In fact, many of these indexes have a strong correlation to each other and goes to show just how strongly correlated all assets are in this current macroeconomic regime.

The table below compare bitcoin to some key asset-class benchmarks across high beta, equities, oil and bonds.

Note, you can find any of these indexes/assets on Google Finance with the tickers above. For 60/40, we’re using BIGPX Blackrock 60/40 Target Allocation Fund, GSG is the S&P GSCI Commodity ETF, and BSV is the Vanguard Short-Term Bond Index Fund ETF.Another important note is that spot bitcoin trades in a 24/7 market while these other assets and indexes do not. Correlations are likely understated here as bitcoin has proven to lead broader risk-on or liquidity market moves in the past because bitcoin can be traded at any time. As bitcoin’s CME futures market has grown, using this futures data produces a less volatile view of correlation changes over time as it trades within the same time limitations as traditional assets.

Looking at the rolling 3-month correlations of bitcoin CME futures versus a few of the risk-on indexes mentioned above, they all track nearly the same.

Bitcoin CME futures correlated with risk-on assets.Although bitcoin has had its own, industry-wide capitulation and deleveraging event that rival many historical bottoming events we’ve seen in the past, these relationships to traditional risk haven’t changed much.

Bitcoin has ultimately acted as the riskiest of all risk allocations and as a liquidity sponge, performing well at any hints of expanding liquidity coming back into the market. It reverses with the slightest sign of rising equities volatility in this current market regime.

We do expect this dynamic to substantially change over time as the understanding and adoption of Bitcoin accelerates. This adoption is what we view as the asymmetric upside to how bitcoin trades today versus how it will trade 5-10 years from now. Until then, bitcoin’s risk-on correlations remain the dominant market force in the short-term and are key to understanding its potential trajectory over the next few months.

Read the full article here.

Like this content? Subscribe now to receive PRO articles directly in your inbox.

Relevant Articles:A Rising Tide Lifts All Boats: Bitcoin, Risk Assets Jump With Increased Global LiquidityThe Everything Bubble: Markets At A CrossroadsJust How Big Is The Everything Bubble?Not Your Average Recession: Unwinding The Largest Financial Bubble In HistoryBrewing Emerging Market Debt CrisesEvaluating Bitcoin’s Risk-On TendenciesThe Unfolding Sovereign Debt & Currency CrisisSimilar to Notcoin - TapSwap on Solana Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|