![Bitcoin’s [BTC] movement above 200-day moving average more advantageous for bullish movement, says Fundstrat’s Thomas Lee](http://ambcrypto.sfo2.digitaloceanspaces.com/2019/04/tl.jpg)

2019-4-3 21:30 |

Thomas Lee, the Co-founder of Fundstrat Global, tweeted an analysis of Bitcoin that explains how Bitcoin moving above the 200-day moving average was more advantageous for BTC in terms of bullish movement, than Bitcoin moving below the 200-day moving average.

Lee tweeted,

“Definitely a positive development that #Bitcoin is now above its 200D mov. avg.

–Many consider P>200D as sign of $BTC in positive trend

–BTC acts significantly better P>200D, a win-ratio of 80% vs 36% when P<200D

source: data scientists @fundstrat_ken @AlexKernA”

Source: Twitter | Thomas Lee

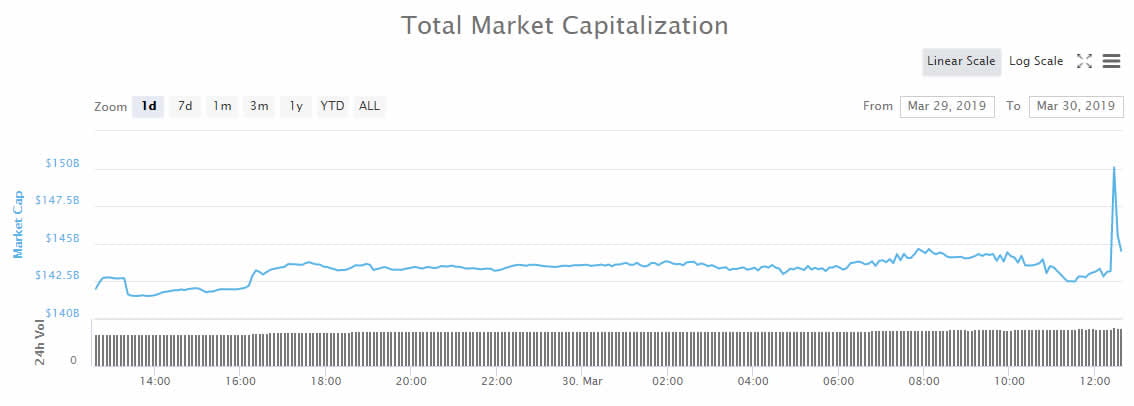

As seen in the chart, Bitcoin moving above the 200-day moving average has a higher win ratio, as compared to that of Bitcoin moving below the 200-day moving average. This means that if Bitcoin moved above the 200-day moving average, the bulls would have a higher probability of continuing the trend upwards. There have been a total of 1765 instances in the past when Bitcoin has moved above the 200-day moving average, which is 66% of the total instances.

However, Bitcoin has moved below the 200-day moving average 923 times, which is 34% of the total. The win rate for this move is 36%, which is considerably less when compared to the other scenario.

Additionally, Lee also mentioned the performance of BTC in a 10-day time frame. Lee stated,

“Reminder that BTC generally generates all of its performance within 10D of any year.

–ex the top 10 days, BTC is down 25% annually since 2013”

2/ Reminder that BTC generally generates all of its performance within 10D of any year.

–ex the top 10 days, BTC is down 25% annually since 2013 pic.twitter.com/zoEocEEZvu

— Thomas Lee (@fundstrat) April 2, 2019

Additionally, Lee compared the performance of BTC to equities like the S&P 500 in his tweet. He tweeted,

“For equities, ex-top 10 days, the S&P 500 only cedes 300bp per annum.

–the obvious conclusion is top 10 days way more influential for BTC than equities

–HODL the other 355 days?”

Source: Twitter | Thomas Lee

@oNealN47de, a Twitter user, commented,

“So doesn’t this imply you stay invested long term to capture those significant gains? Chances you will miss out if trying to trade. Agree?”

The post Bitcoin’s [BTC] movement above 200-day moving average more advantageous for bullish movement, says Fundstrat’s Thomas Lee appeared first on AMBCrypto.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Moving Cloud Coin (MCC) на Currencies.ru

|

|