2023-10-7 16:00 |

The crypto market has been dominated by the sudden surge in the price of Bitcoin. BTC briefly touched $28,400 before undergoing a rapid reversal. This sharp price movement triggered a cascade of events, including $110 million in Futures’ liquidations as traders grappled with the volatile market conditions. Amidst this, other cryptocurrencies like Kava ($KAVA) and InQubeta ($QUBE) have displayed bullish trends worth exploring in greater detail.

InQubeta is increasingly becoming a compelling choice for crypto investors. Early investors in the ongoing $QUBE presale have nearly doubled their initial investments.

This article explores InQubeta and Kava’s bullish signals while also shedding light on the significance of Bitcoin’s short-lived spike.

InQubeta’s ($QUBE) bullish surgeInQubeta, a platform pioneering a new way for AI startups to raise funds, is growing into a promising crypto project. $QUBE tokens, the native tokens of InQubeta, are at the core of this innovative crowdfunding platform, enabling fractional investments in AI startups.

In InQubeta, each investment opportunity is represented as an NFT and fractionally divided, allowing investors to participate regardless of their budget while enjoying the benefits of being early backers.

InQubeta’s NFT marketplace opens up exciting possibilities for AI startups, enabling them to raise funds and offer reward and equity-based NFTs. Meanwhile, $QUBE token holders can seamlessly invest in the projects they believe in, creating a mutually beneficial ecosystem for both parties.

InQubeta’s unique investment protocol has resulted in a successful and ongoing presale. Having raised over $3.4 million in funding so far, with stage four of the presale currently in progress, $QUBE has established itself as a contender for the top crypto to buy to boost your portfolio. Crypto enthusiasts and investors are showing keen interest in this opportunity, with over 384 million $QUBE tokens sold.

What sets $QUBE apart from other crypto investments is its deflationary nature as an ERC20 token. A 2% buy and sell tax contributes to a burning wallet, and a 5% buy and sell tax goes to a dedicated reward pool. This means that $QUBE holders can earn rewards through token staking, making it an appealing investment for those who see the potential in AI technology startups.

Liquidations Soar after Bitcoin ($BTC) sudden price surgeBitcoin’s price has made a significant leap, putting traders who had bet against it in a challenging predicament. After several weeks of price consolidation, $BTC suddenly surged to $28,442 on October 2, breaking free from its extended stay in the $26,000 range.

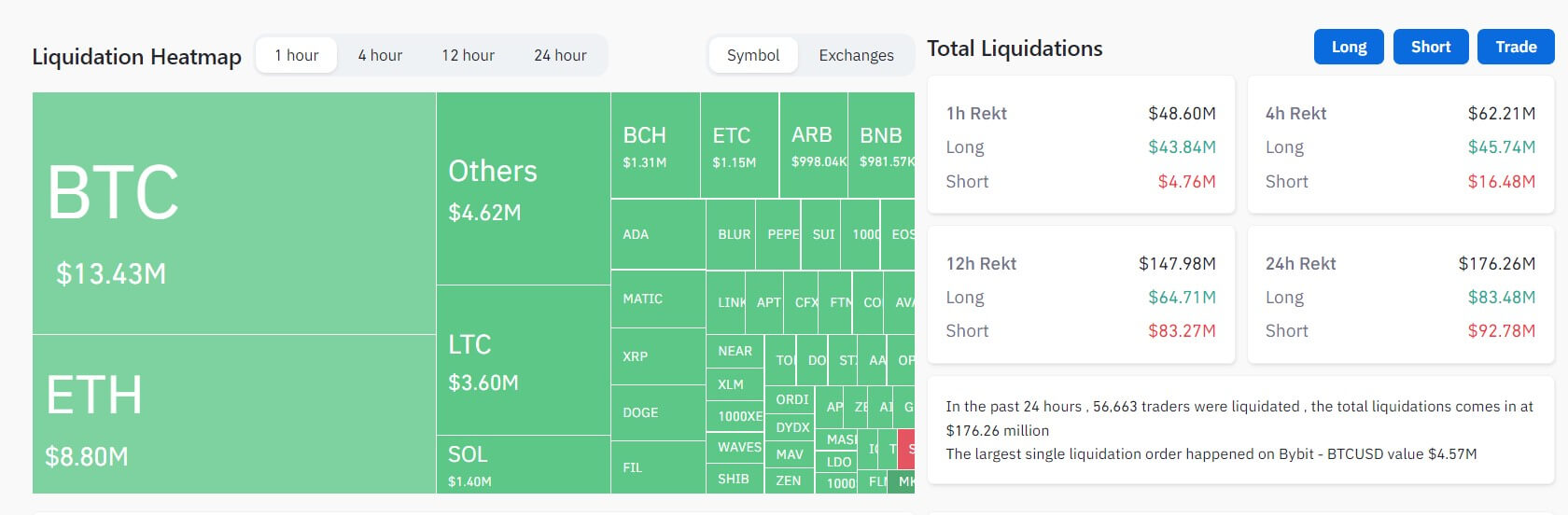

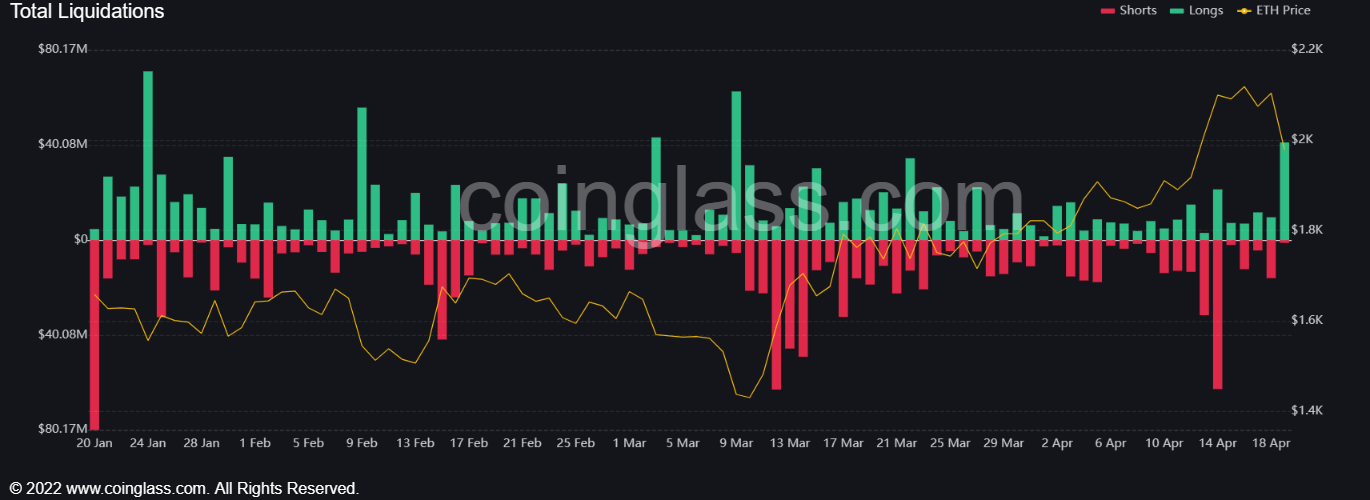

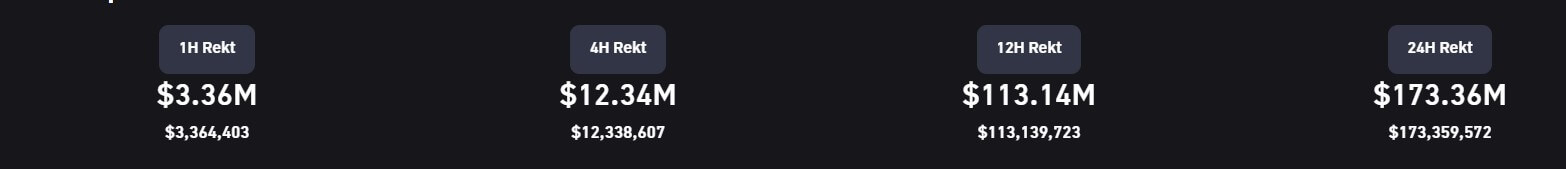

This rapid ascent of Bitcoin has resulted in losses for traders who have taken short positions. This intensifies the ongoing battle between bullish and bearish market forces. According to data provided by Coinglass, a well-known monitor of derivative contracts, Bitcoin’s liquidations exceeded $110 million in value.

Kava showing a promising growthKava primarily aims to merge the swiftness and scalability attributes of the Cosmos SDK with substantial developer backing akin to Ethereum’s ecosystem. KAVA strives to provide developers with the tools and support they need to create cutting-edge blockchain technologies, a mission embodied in its Kava Rise program.

KAVA has been on an encouraging upward trajectory, demonstrating significant promise in recent times. This situation presents an enticing opportunity for potential investors, as this rapid growth suggests that Kava has the potential to establish itself as a reliable asset if this positive trend persists.

ConclusionWhile the $BTC ride and subsequent futures liquidations captured headlines, $QUBE and $KAVA continue to forge innovative paths in the crypto industry.

InQubeta revolutionizes the world of AI startup fundraising with its deflationary token structure.

Investors who want to participate in AI tech startups by accelerating the growth and success of this exciting field can purchase the $QUBE token here InQubeta presale using $ETH, $BTC, or $USDT. They can also keep up to date with their social media activities by joining InQubeta’s communities

The post Bitcoin’s brief $28.4k high causes $110m in liquidations; Kava and InQubeta turn bullish appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|