2022-6-8 02:30 |

Inflows into cryptocurrency funds have largely returned over the past month, with investors betting that Bitcoin has already bottomed out.

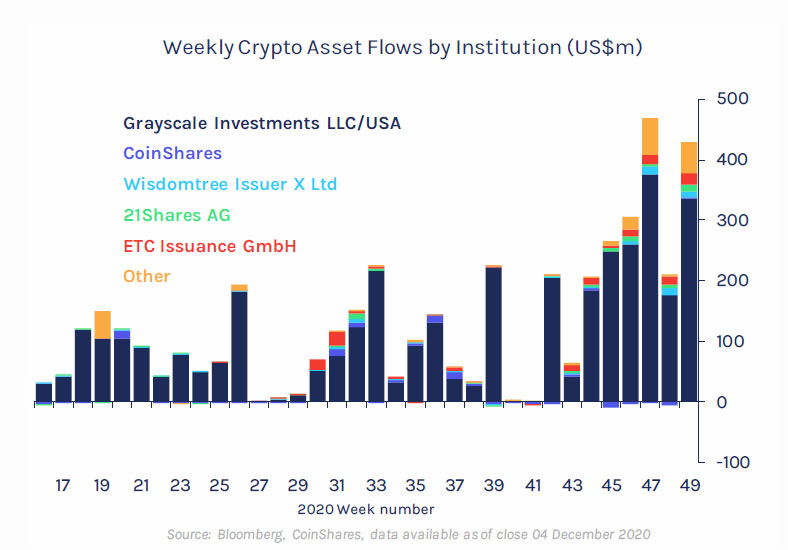

Over the course of May, weekly inflows into crypto funds averaged $66.5 million, in contrast to $49.6 million in average weekly outflows in April, according to CryptoCompare data.

“It’s largely institutional, and to a degree retail investors, recognizing that the pain is already endured, and we’re closer to the bottom than we are to the top,” said Ben McMillan, chief investment officer at IDX Digital Assets. “If you’re getting into crypto at these levels, a little near-term volatility could be worth a long-term payoff,” he added. “A lot of institutional investors are starting to look at crypto as a source of longer-term growth potential.”

Safe exposureAlthough cryptocurrencies themselves have yet to experience a turnaround, investors have flocked to the perceived safety of crypto-based exchange-traded products (ETP). While these assets provide comfortable exposure to crypto, they offer investors greater security and liquidity.

According to Kraken Intelligence, assets under management (AUM) of multiple bitcoin-futures ETFs have climbed over the past week. These include the Global X Blockchain & Bitcoin Strategy ETF and VanEck Bitcoin Strategy ETF which have risen over 3%. After seeing outflows of over $127 million in April, ProShares Bitcoin Strategy ETFs have since grown 6%.

The upward trend appears to be continuing into June, as global bitcoin ETP holdings have jumped to an all-time high of 205,008 bitcoin within the first two days of the month, according to crypto research firm Arcane Research found. “This is a promising sign for what’s to come,” said Arcane analyst Vetle Lunde.

Bitcoin-bound boostNotably, however, it has only been BTC-based funds that have received the recent inflows. According to the latest CoinShares report, such products saw $126 million in inflows over the past week. Year-to-date inflows into Bitcoin-based investment products now amount to over half a billion dollars.

Meanwhile, outflows have continued for funds based on Ethereum and other altcoins. Last week was the ninth consecutive week Ethereum-based funds experienced outflows, bringing year-to-date outflows to $357 million. Additionally, flows into other altcoins-based products remained essentially stagnant last week, as investors flocked to the relative safety of Bitcoin, according to the report.

The post Bitcoin-Based Funds See Inflows Returning appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

World Trade Funds (XWT) на Currencies.ru

|

|