2020-2-13 03:21 |

The Bitcoin price might have increased a lot so far in 2020 but with memories of a bitter “crypto winter” still fresh, some still don’t believe that this time might be different. However, the number of Bitcoin deposited at exchanges of late seems to suggest that the market isn’t done pumping just yet.

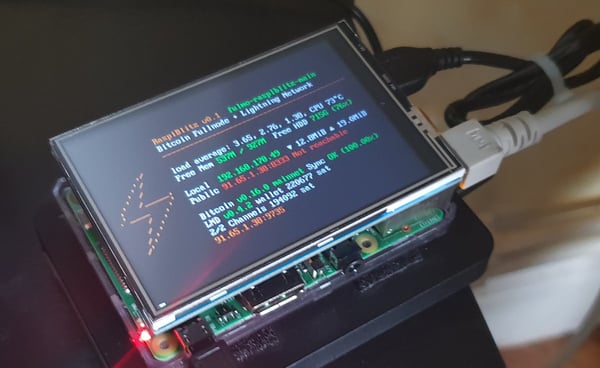

Highlighting the size of deposits relative to other pumps is the cryptocurrency market insight firm Unfolded. The company uses data from researchers at GlassNode to demonstrate that the market usually forms a local top following a surge in deposits to trading venues.

Historically, when #Bitcoin has approached local or global tops, we've seen increased deposits to exchanges as investors look to sell, there's no indication this timehttps://t.co/Y1jSPFlMDB pic.twitter.com/x3MuDGuqaI

— Unfolded (@cryptounfolded) February 12, 2020

The rationale is simple. To create a top, the trend needs to shift from upward to downward. For this to occur, selling pressure must exceed buying pressure.

Since it is widely understood to be best practice to hold cryptocurrencies in non-custodial wallets (not on exchanges themselves), for many holders to be able to sell, they first need to make a deposit at a trading venue.

As highlighted in the above tweet, almost every time there has been a market top in the last three years, there has also been a steep increase in the number of Bitcoin deposited at exchanges. The most striking example, of course, is the ultimate all-time high top of almost $20,000. A frankly vast spike in exchange deposits lines up almost perfectly with the beginning of the crash.

The same holds true during each of the local tops leading up to the all-time high and following it. Trend changes in early summer and autumn of 2017, as well as spring 2018 and summer 2019, all coincide with a clear uptick in the amount of Bitcoin sent to trading venues.

According to GlassNode’s figures, Bitcoin deposited at exchanges has been falling since the rally that took BTC price to just under $14,000 last year. Despite the price rising around 45 percent since the beginning of the year, there has been no increase in deposits during this run-up.

Whilst no indicator can ever be perfect, the data seems to suggest that the market has a little more room to grow before it takes a sustained correction. As seen several times during the 2017 bull market, such corrections aren’t necessarily permanent either.

The post Bitcoin Top Not in Sight, Exchange Deposits Hint Further Upside to Come appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|