2024-10-26 10:00 |

The current trajectory of Bitcoin (BTC) prices could push it to the $100,000 mark within the next 90 days, regardless of the results of the U.S. presidential election.

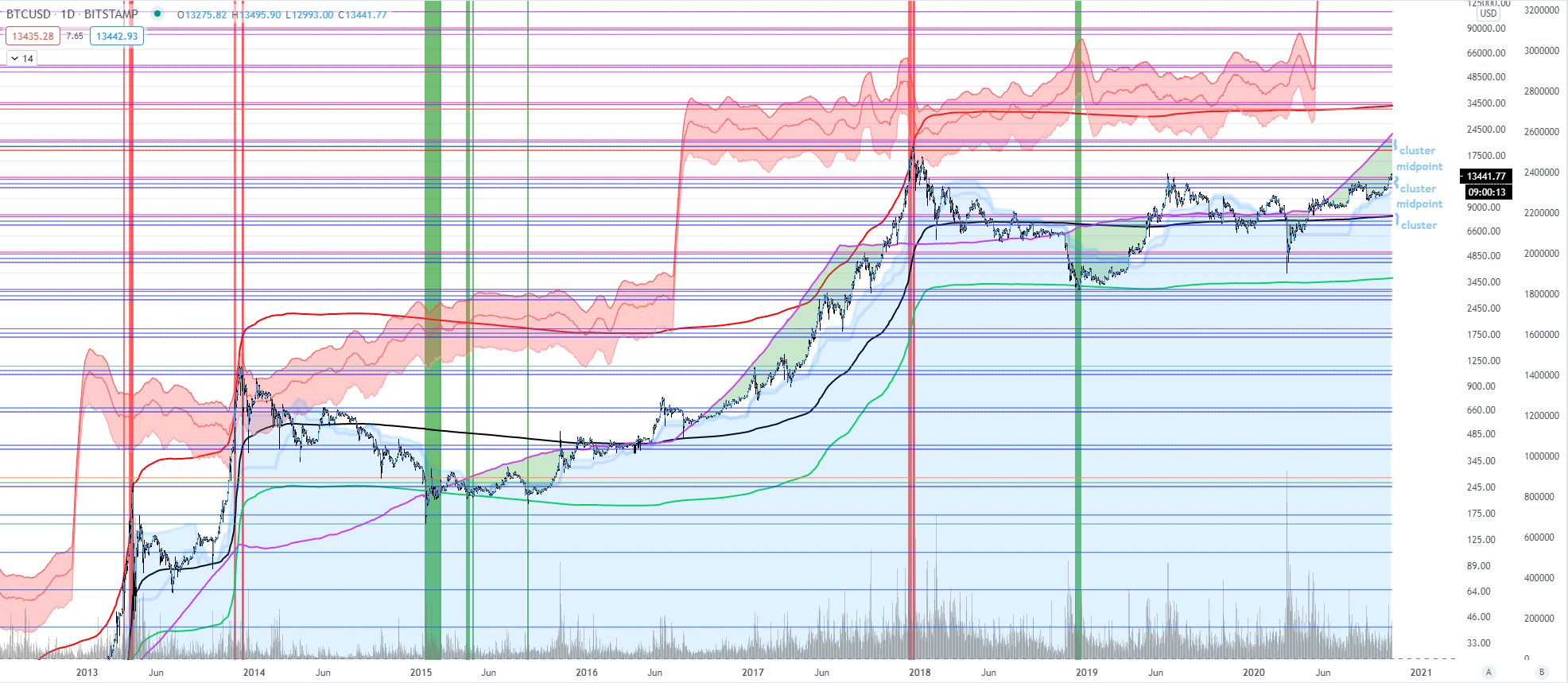

Bitcoin At $100,000 By February 2025?Crypto analyst Timothy Peterson suggests that BTC’s current price movement is not substantially different from previous trends, raising questions about the “diminishing marginal returns” theory.

From an investor’s perspective, Bitcoin’s diminishing marginal returns theory implies that each halving cycle leads to smaller successive price gains, as the digital asset’s total market cap matures and its supply shocks have a reduced impact on driving up demand.

This suggests that while BTC may continue to grow, the extraordinary returns seen in early cycles could decrease over time. However, Peterson’s assessment appears to dismiss this theory.

To recall, BTC made its all-time high (ATH) of $73,737 in March 2024. Since then, the leading cryptocurrency has been consolidating for almost eight months in a wide price range, reaching as low as $54,000. At the time of writing, BTC trades at $67,998, about 10% lower than its ATH.

Peterson argues that BTC’s movement just above the red trendline would put the digital asset at $100,000 within 90 days. The analyst added that such a move will be “completely within reason.” He added:

A conservative scenario puts bitcoin at $100k around February. I think this happens regardless of the US election outcome.

Furthermore, the analyst suggested that according to other data-driven metrics he’s monitoring, BTC is not overpriced at its current market valuation, and the probability of a drop below $60,000 is increasingly unlikely.

Focus On BTC Year-End Price PredictionsWhile Peterson envisions BTC nearing $100,000 within three months, other analysts and industry insiders have varying expectations.

For instance, options market traders expect BTC to break through its previous ATH by November end, no matter who becomes the next US president.

Similarly, in a recent client memo, Bitwise CIO Matt Hougan outlined several factors that could force BTC to “melt-up” to $80,000 in Q4 2024.

These factors include the potential victory of Republican candidate Donald Trump, additional interest rate cuts by the U.S. Federal Reserve (Fed), and an extended period free of major negative developments in the crypto sector.

Besides the aforementioned factors, the optimism toward a year-end BTC rally is also fueled by rising retail demand for the premier digital asset.

Recent analysis by CryptoQuant highlighted that Bitcoin transactions worth less than $10,000 are on an uptrend, indicating renewed retail demand as the market gradually pivots from risk-off to risk-on mode. BTC trades at $67,998 on the daily chart at press time, up 1.1% in the past 24 hours.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|