2019-10-18 22:00 |

Now that Bitcoin has broken down from the triangle formation it was trading in, putting an end to months of consolidation, crypto analysts are sifting through Bitcoin price charts hoping to find clues as to what might happen next.

One crypto analyst may have found some evidence that Bitcoin’s bull run isn’t actually over, and is simply resting an important long-term moving average that following the last bear market, once it was retested, the true bull market began that resulted with Bitcoin reaching $20,000 per BTC.

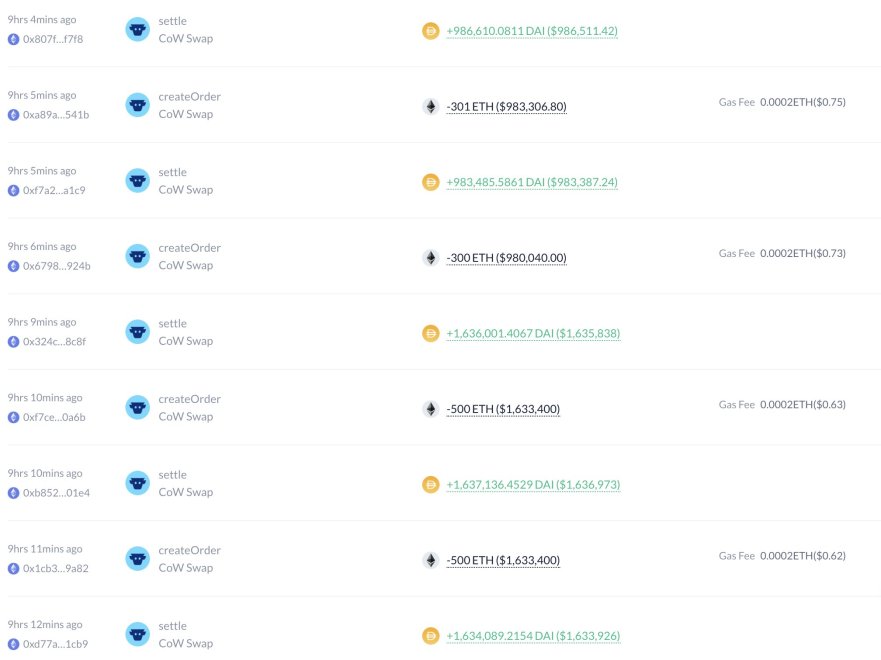

100-Week Moving Average Retest Ignited Bitcoin Bull RunAt the end of 2015 – just as the 2014-2015 bear market came to a close, Bitcoin broke up above the 100-week moving average, later retesting it as support in early 2016, before going full parabolic and setting a new all-time high at $20,000.

When Bitcoin broke down from $6,000 to its bear market low last November, the leading crypto asset by market cap fell below the 100-week moving average for the first time since 2016.

Related Reading | Bye-Bye Bull Run: Bitcoin Price Daily Closes Under Vital Moving Average

In April 2019, Bitcoin once again broke back above the 100-week moving average it had finally fallen below in November. Now, after the triangle breakdown, Bitcoin is once again retesting the 100-week moving average as support, and if history repeats – and if often does – Bitcoin could once again be supported by the moving average, and the next true bull run may begin soon after.

Yes, No, Maybe So? pic.twitter.com/1eR74bfdfg

— Nunya Bizniz (@Pladizow) October 17, 2019

Will History Repeat Itself, Or Will Another Moving Average Fall to Crypto Bears?According to a chart shared by a prominent crypto analyst, it demonstrates how the 100-week moving average acted as resistance turned support in early 2016, ultimately leading to the crypto bubble that put Bitcoin on the map and made it a household name.

A closer look at the weekly chart shows that Bitcoin had two weekly candles bounce off the moving average, giving bulls a glimmer of hope that the bull market isn’t over before it really got started.

Bears, however, can take solace in the fact that other crypto analysts had repeatedly cited other moving averages, such as the 200-day moving average, acting as support throughout the last bull market. Bitcoin has now closed many consecutive candles under the 200-day moving average and was unable to reclaim it as support even after several attempts.

Related Reading | Bitcoin Price: Reclaiming Important Moving Average Could Lead to Retest of Highs

Technical analysts often look for theories and stick with them until they are invalidated. The idea that the 100-week moving average could act as support is currently still valid, however, a break below $7,700 on the weekly and a full candle close below it, the theory can go out the window along with the 200-day moving average propping Bitcoin up enough for a new bull run.

The post Bitcoin Testing Weekly Moving Average That Sparked Last Crypto Bull Market appeared first on NewsBTC.

origin »Bitcoin (BTC) на Currencies.ru

|

|