2024-10-5 19:30 |

Bitcoin (BTC) has faced a rough start to the historically bullish month of October, impacted by escalating geopolitical tensions in the Middle East. Despite this, bulls remain hopeful for a turnaround later in the month.

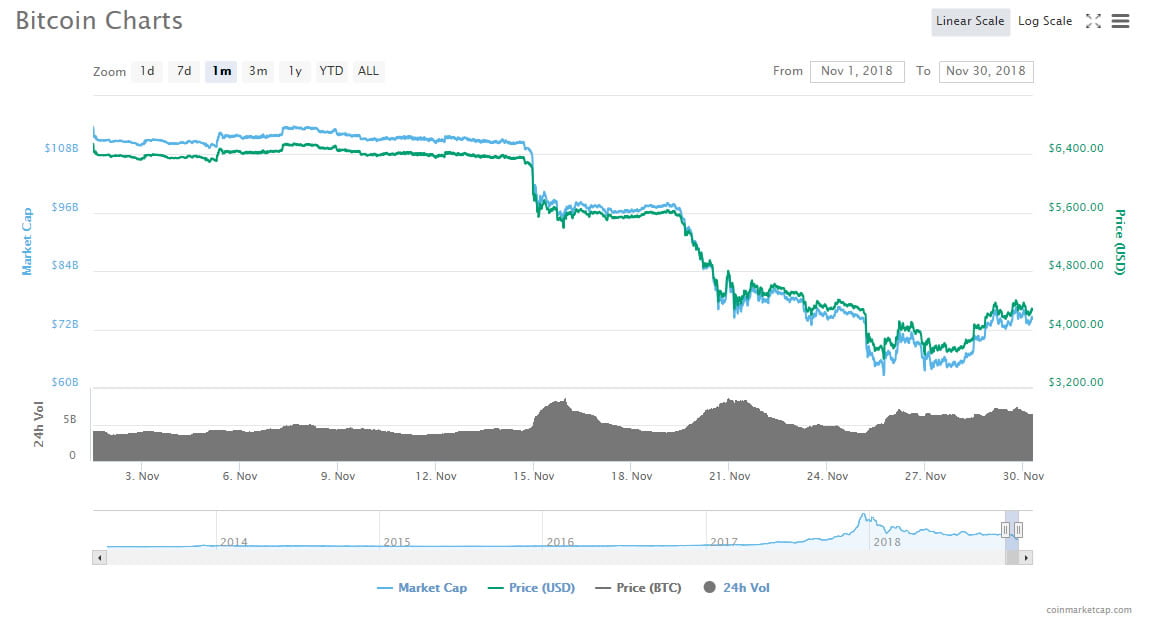

Bitcoin’s “Uptober” Off To A Patchy StartThe leading digital asset by reported market cap had a tumultuous beginning to its most bullish month since 2013. The chart below depicts how October has historically been the most bullish month for Bitcoin, giving a median return of 21.2%.

Yesterday, BTC briefly plunged below the critical $60,000 level before rebounding to $61,179 at press time. During this see-sawing price movement, BTC witnessed liquidations worth over $32 million, while ETH liquidations stood slightly above $18 million.

Over the past seven days, Bitcoin has tumbled by 6.9%, while major altcoins have experienced even greater losses. Ethereum (ETH) is down 11.2%, Solana (SOL) has dropped 10.9%, and BNB has declined by 9.9%.

According to data from CoinGlass, most of BTC’s price appreciation typically occurs in the latter part of October. The chart below illustrates that the initial days of October have historically been less favorable for BTC prices.

Notably, October 1 has been positive for Bitcoin only once since 2013, while October 2 has shown gains five times out of eleven. In contrast, later dates, such as October 28, have delivered positive returns nine times out of eleven, followed by October 20, which has had eight positive days out of eleven.

It’s worth noting that Bitcoin’s most bearish month, September, closed with gains of 7.29% this year, clocking in its best performance since 2013.

Multiple Factors Weighing On Bitcoin Price ActionBitcoin underwent its fourth halving in April 2024, followed by the US Federal Reserve’s (Fed) interest rate cuts in September, two events typically considered bullish for BTC’s price outlook.

However, rising geopolitical escalations have overshadowed these positive developments and the uncertainty surrounding the results of the closely-contested US presidential elections in November 2024.

That said, some crypto analysts are confident about Bitcoin’s bounce back later in the year. For instance, an analyst from Standard Chartered sees BTC’s slump below $60,000 as a tremendous buying opportunity.

Similarly, 10x Research’s Markus Thielen foresees “exceptionally high” chances of a crypto rally in Q4 2024. Some of the factors for this prediction are the declining Bitcoin dominance and the rise in Ethereum gas fees.

In contrast, BitMEX co-founder Arthur Hayes opines that interest rate cuts might lead to a short-term market crash. BTC trades at $61,179 at press time, up 2.2% in the last 24 hours.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|