2024-11-26 20:55 |

After facing rejection just below the $100,000 psychological resistance, BTC consolidated over the weekend before losing support at $98,000 and continuing to dip throughout the Asian trading hours on Monday.

The recent pullback impacted the altcoin market, slowing rallies, though a few altcoins managed to retain some of last week’s gains while some bucked from the broader downturn.

At the time of writing, the total cryptocurrency market capitalisation had dropped over 2.3% in the past 24 hours to $3.4 trillion.

The BTC price swing also drove total crypto liquidations above $500 million, with long positions suffering the most losses.

Why is Bitcoin going down?Several crypto pundits attribute the current price action to increased profit-taking.

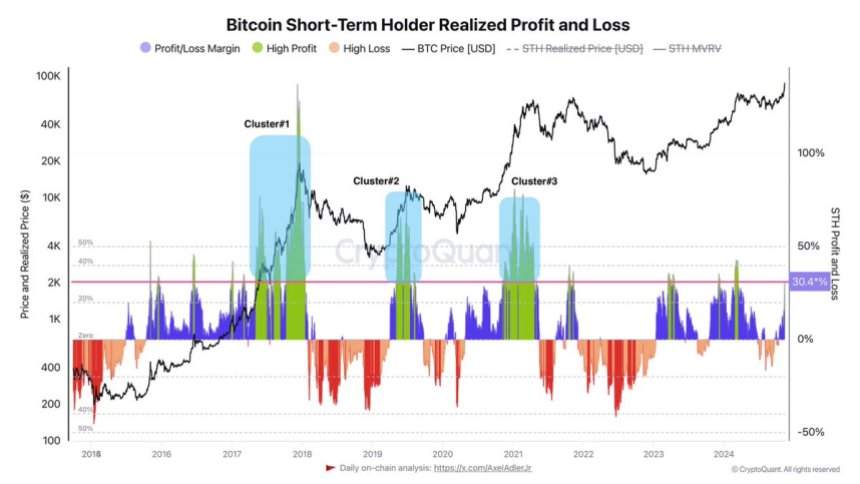

According to Galaxy Digital CEO Mike Novogratz, a lot of selling pressure is coming from short-term holders who entered the market in 2024, at a time when BTC was trading near $56,000.

However, he added that such a trend is expected from these traders and is normal during bull runs, and in contrast, he expects long-term holders to continue accumulating and holding, contributing to healthier supply dynamics over time.

Similarly, CryptoQuant analyst Maartunn recently highlighted that Bitcoin’s Realized Profit, a metric measuring profit-taking activity, had reached an all-time high—an indicator that many traders consider a sign that the market has hit a local top.

Such price action is seen as healthy for sustaining prolonged rallies, a sentiment echoed by several analysts who view periodic profit-taking as essential for resetting market momentum and encouraging long-term growth.

Bitcoin trader and analyst Rekt Capital supports this outlook and views such corrections as normal when BTC is in price discovery.

He observed that the cryptocurrency was forming a short-term range just below the $100,000 mark, with no significant rejection at this level.

As such, he anticipates a breakout above the psychological resistance in the near future.

Pseudonymous analyst Inmortal echoed similar insights, suggesting that Bitcoin could consolidate within the $94,000–$98,000 range before making its next move.

Based on the chart he shared, he expects this range to be a strong foundation for a breakout, with the potential for a brief “trap” scenario below the range to shake out weaker hands, ultimately fueling a rally beyond the $100,000.

On the flip side, Bitcoin commentator Moustache pointed out that the flagship crypto has broken out of a bullish megaphone pattern on the monthly chart, which sets the stage for strong upward momentum in the coming months.

Bitcoin recorded an intraday low of $94,821 at the time of writing and rebounded to trade just above $96,000.

Meanwhile, the Crypto Fear and Greed Index climbed to 82, up from 80 the previous day, reflecting a slight increase in bullish sentiment.

With Bitcoin showing signs that it could trade sideways, altcoins failed to show strength, suggesting that alt season is yet to arrive.

The top-performing altcoins for the day were:

The SandboxThe Sandbox (SAND) topped the day’s gainers, surging by 41% in the past 24 hours.

The altcoin was trading at $0.7613, with a market cap of over $1.84 billion.

Source: CoinMarketCap

A lot of the recent chatter around the metaverse token began after the project announced The Sandbox Alpha Season 4, a 10-week event that offers new experiences and rewards for players and community members.

The event translated to a surge in the project’s on-chain activity and increased buying pressure from retail and whale investors.

Lido DAOLido DAO (LDO), the governing body behind the Ethereum liquid staking platform Lido, was up over 24% to hit a six-month high of $1.76 on Monday.

At press time, the altcoin was trading for $1.69 with a market cap of $1.5 billion.

Source: CoinMarketCap

While there was no apparent reason behind LDO’s price surge, several analysts noted that the token had broken out of the multi-month accumulation zone, which has injected a sense of optimism among the community.

Such breakouts typically attract momentum traders and investors, who anticipate further upward movement, thereby boosting demand and driving prices higher.

UniswapUniswap (UNI) rallied approximately 15% over the past day, reaching $11.86, a level last seen in June, while boasting a market cap of over $7.1 billion when writing.

Source: CoinMarkeCap

UNI continued to extend its rally that ensued after Donald Trump’s victory in the 2024 US elections.

Since then, the altcoin has seen an uptick in demand from whales and retail traders, according to Coinglass data.

Much of the bullish momentum stems from anticipation surrounding the mainnet launch of Unichain, a layer-2 solution powered by Optimism Superchain and developed by Uniswap, expected to go live by late 2024 or early 2025.

The post Bitcoin steady below $100K as SAND, LDO, UNI lead daily gains appeared first on Invezz

origin »Bitcoin (BTC) на Currencies.ru

|

|