2024-4-25 18:00 |

Quick Take

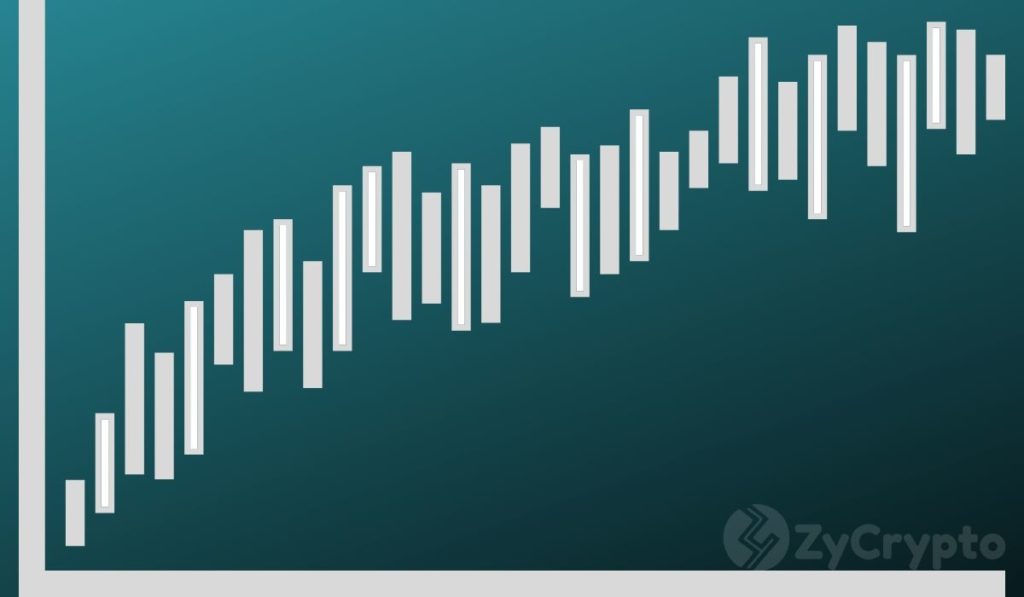

Data from Trading Economics shows the United States economy grew at an annualized rate of 1.6% in the first quarter of 2024, falling short of the forecasted 2.5% and slowing down from the previous quarter’s 3.4% growth. Despite the slower pace, the economy continues to expand in an already overheated environment, with inflation persisting above the target level.

US GDP Growth Rate: (Source: Trading Economics)US bond yields rose in response to the economic data, with the 2-year Treasury yield surpassing 5%. The front end of the yield curve, particularly the 3-month and 6-month yields, are now hovering around 5.4%. With the current federal funds rate at 5.25% to 5.5%, the market is not anticipating rate cuts for at least six months.

US03MY and US06MY: (Source: TradingView)The CME FedWatch tool tracks futures markets and suggests that investors expect no rate cuts until July, followed by a single cut in September and a pause for the remainder of the year. This outlook marks a significant shift from the beginning of the year when markets were pricing in around six rate cuts.

CME Fed Watch Tool: (Source: CME)As a result of the economic news, Bitcoin (BTC) is trading at approximately $63,300, while US equity markets have declined by more than 1%.

The post Bitcoin stabilizes near $63,000 as U.S. economic growth decelerates. appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

United Bitcoin (UBTC) на Currencies.ru

|

|