2020-8-29 17:51 |

August is coming to an end, and hopefully, it will end Bitcoin’s ranging.

This month started on a good note as July saw the largest digital asset breaking above the key levels, moving from $9,000 to $12,000.

But August remains within $11,000 – $12,000, for the most part, and is now looking to end the month right around where it started it.

Trading under $11,500, bitcoin is managing just over $1.3 billion in ‘real’ trading volume. BTC ranging meanwhile is good for altcoins.

LINK is back on the move and up 5.58% while Cardano, Monero, and EOS are recording greens of over 3%.

Other gainers include NEM (25%), Siacoin (17%), Waves (10.71%), BTT (9.68%), and NEO (7%).

DeFi meanwhile is on their own trajectory of explosive gains.

For starters, YFI has broken above Bitcoin’s ATH to well nearly $25,000. Tendies is trading above $1 with 33% gains and Ampleforth 26.8%.

Against BTC, almost every DeFi token has surged in the past year, last 90 days, and in the past month.

2020 is all about DeFi.

The Macro of itIn the macro world, the stock market is also enjoying an uptrend.

All the market trends this year have been affected by the central bank policies in its attempt to prop up the economy battered by the pandemic. In response, the Federal Reserve dropped the interest rates to virtually zero and started printing money by adopting quantitative easing.

However, in expanding its balance sheet as a percentage of GDP, the Fed is nowhere near the Swiss National Bank and Bank of Japan, though it has surpassed the Bank of England and is making efforts to catch up to European Central bank.

FED Powell afraid of negative interest rates: "if inflation expectations fall below our 2% objective, interest rates would decline in tandem. In turn, we would have less scope to cut interest rates to boost employment [], further diminishing our capacity to stabilize the economy" pic.twitter.com/Lps78ntcPB

— PlanB (@100trillionUSD) August 29, 2020

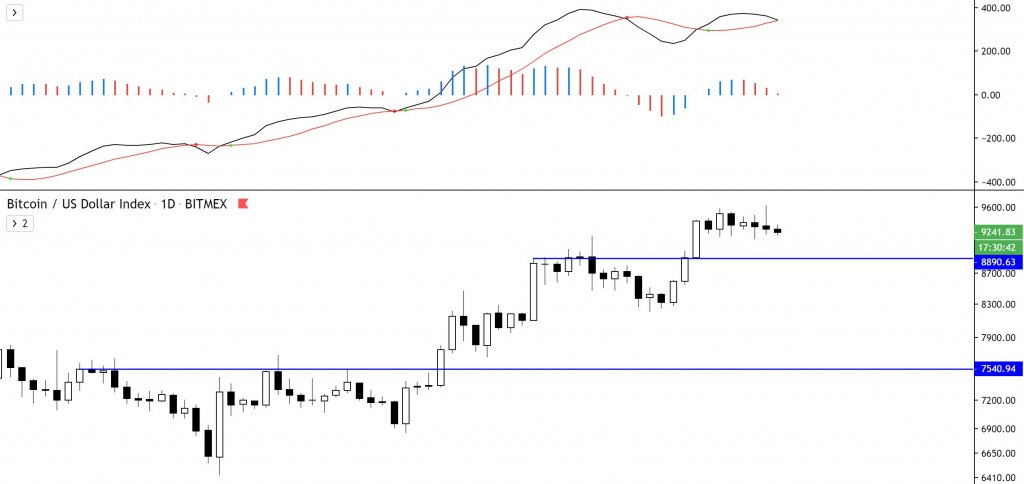

This has US stocks making new highs, with S&P 500 surging over 3,500, up 3.6% from the February high. The equity market still recorded just 7.7% returns YTD.

In comparison to SPY, although bitcoin is still down 42.5% from its ATH, it is up 56.46% in 2020 so far.

Tech dominant Nasdaq had an amazing year, which is up 28.6% but Dow Jones industrial average remains in the red by 0.74% YTD.

Coming onto the precious metals, gold broke the 2011 peak to surpass $2,000, with over 29% returns in 2020. But it was silver that rallied the hardest, 52.7%, and left everything behind.

The US Dollar index meanwhile has been losing its strength since mid-March and is down by 4.65% YTD.

This week, Fed Chairman Jerome Powell also shared that they will let the inflation run above its 2% target and plans to keep interest rates low.

“Crypto discourse has been objectively dominated by the likely bullish nature of this decision for BTC and the rest of the asset class. Traditional equity investors are speculated to continue to want to look elsewhere to invest their capital, and alternative means of currency like Bitcoin, Ethereum, and precious metals should (at least in theory) benefit,” noted Santiment.

Bitcoin (BTC) Live Price 1 BTC/USD =$11,540.5402 change ~ 0.31%Coin Market Cap

$212.98 Billion24 Hour Volume

$3.68 Billion24 Hour VWAP

$11.52 K24 Hour Change

$35.2250 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD");The post Bitcoin Rules the Macro & Poised to Attract More Traditional Equity Investors first appeared on BitcoinExchangeGuide.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|