2025-12-28 09:00 |

Bitcoin’s 2025 Q4 performance has been marked by heavy market corrections, pushing prices as low as $80,000. As the premier cryptocurrency struggled to resume its bullish trajectory, recent on-chain data has emerged suggesting little potential for a major price move.

Fading Retail Participation Underscores Bitcoin Market FragilityIn an X post on December 27, renowned market analyst Burak Kesmeci explains that retail participation in the Bitcoin market continues to weaken, with on-chain data showing a renewed slowdown in small transaction activity. Notably, demand from investors executing transactions in the $0–$10,000 range has turned negative again on a 30-day change basis, signaling a lack of fresh retail inflows since mid-December.

The $0–$10,000 transaction cohort is widely used as a proxy for retail behavior, and a sustained negative reading typically reflects declining enthusiasm among smaller investors rather than active distribution by large holders. According to Kesmeci, retail demand began deteriorating around December 14, reversing what had been a brief stabilization period.

At the same time, total retail transfer volume has fallen back toward the $375 million to $400 million range. This contraction suggests that while retail investors are stepping away from the market, they are not rushing for the exits. Instead, activity points to apathy rather than fear, with participants choosing to remain on the sidelines amid uncertain price action. Therefore, while there are no new market inflows, there is also no need for investor panic.

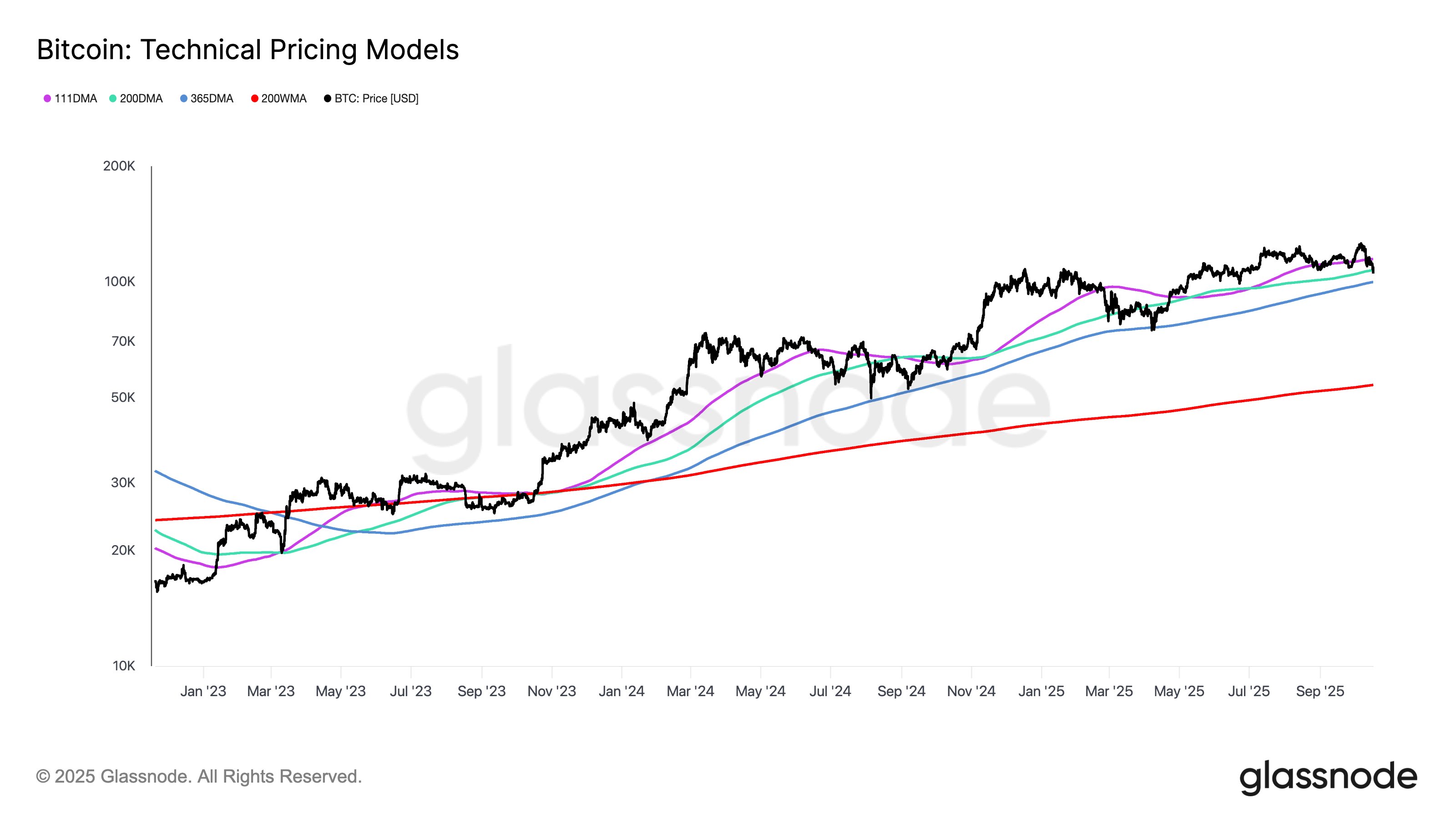

Bitcoin Set For ConsolidationAccording to Kesmeci, the decline in Bitcoin retail investor demand suggests continuation of the broader consolidation phase currently gripping Bitcoin. Since mid-December, the premier cryptocurrency has consistently moved between $85,000 to $90,000, facing strong opposition to further movement at both extremes.

The absence of new retail buyers reduces upside momentum, as historically strong rallies have required sustained participation from smaller investors to complement institutional or whale-driven flows. However, the lack of panic selling also indicates that downside pressure remains muted for now.

Bitcoin is likely to remain within its present consolidation range, barring the introduction of a market catalyst. Many optimists expect the new year to begin on a positive note, citing expected rate cuts and a potentially bullish capital rotation from a soaring commodities market.

On the other hand, some analysts push for market caution, referencing capitulation indicators that suggest the corrections that began in October may extend throughout Q1 2026. At press time, Bitcoin trades at $87,401, reflecting a minor 0.3% gain in the past day.

origin »ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|