2021-7-15 18:45 |

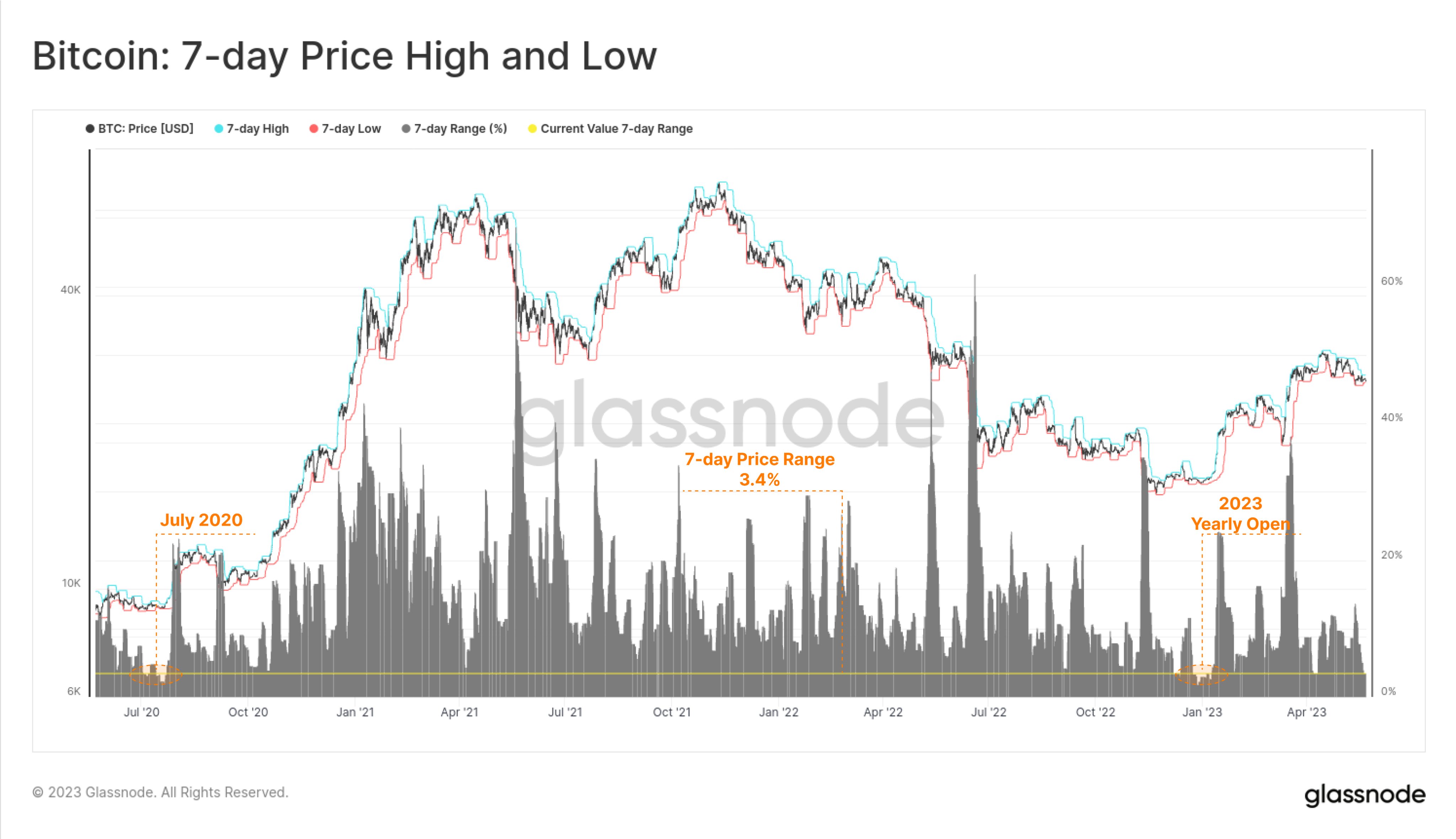

Starting June 21, Bitcoin price has been trapped between $36,000 and $31,000 levels, constituting key resistance and support levels, consecutively. In addition, over the last 48 hours, Bitcoin price recorded a relatively high at around $34,200 and an intraday low of around $32,650, as per data by Coinmarketcap.

BTCUSD Chart By TradingViewZooming out, it is easy to perceive that Bitcoin is exhibiting the same old uneventful pattern of recent weeks, lacking the momentum to start its next rally. This comes at a time when Bitcoin price demonstrates great weakness — last week Bitcoin price slumped following China’s warning regarding stablecoins.

Nevertheless, prices have managed to hold the pattern which has kept them trapped between contracting resistance and support levels, to say the least. However, a potentially bullish sign is that whales are back on track, accumulating Bitcoin after they had retreated in May.

Experts Warn: Losses May ExtendWhile Bitcoin has been successful in preventing extended losses, certain analysts believe that the current market sentiment is an indication that the slump can potentially exacerbate. Elie Le Rest, the cofounder of ExoAlpha, has stated that besides Bitcoin’s “non-directional trend”, its trading volume is also decreasing, which he believes is the reason behind the successive reversals within a particular range.

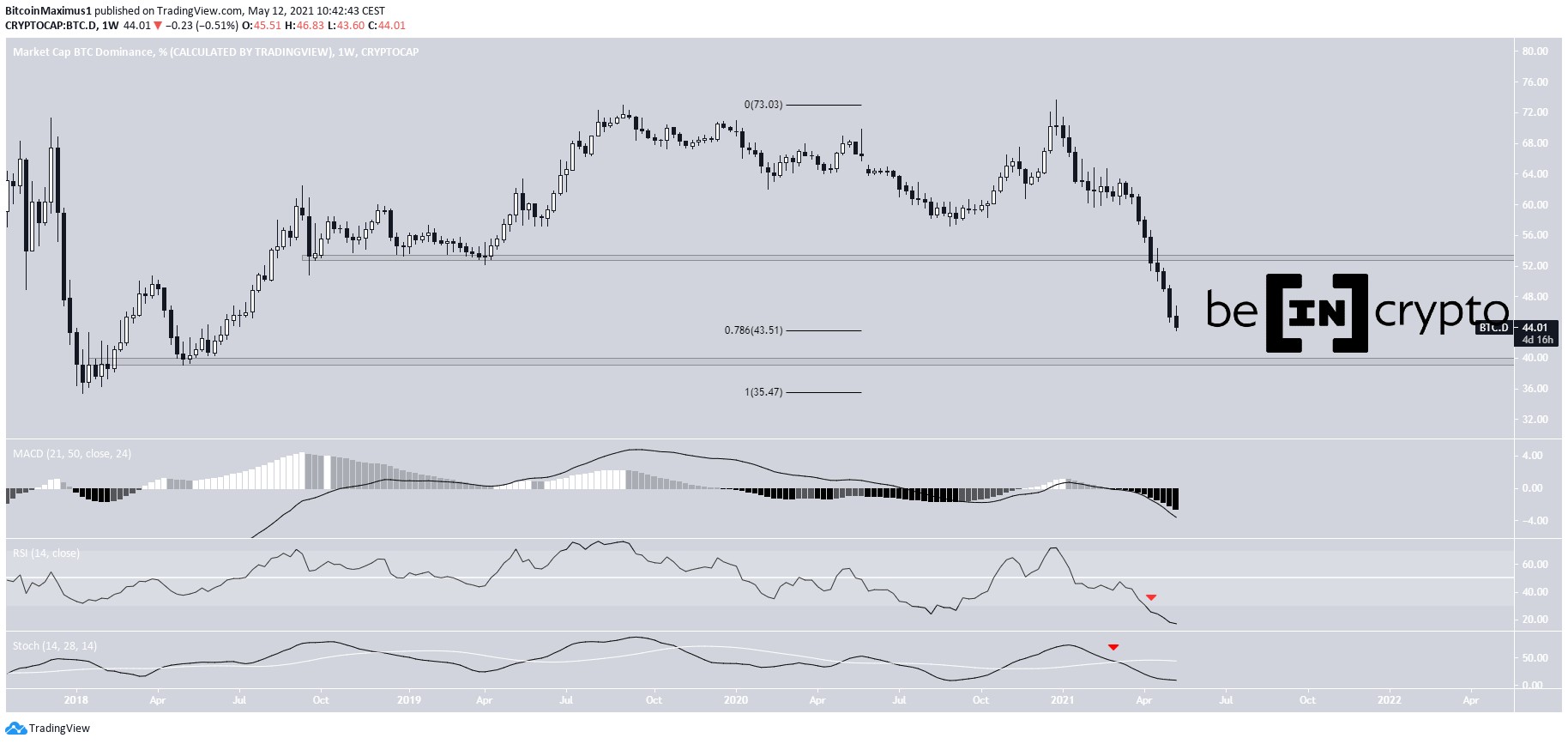

Indeed, Bitcoin’s trading value is decreasing since more and more investors start to view the coin as more of a store of value. As covered by ZyCrypto earlier, Ethereum managed to exceed Bitcoin in terms of active addresses on June 27, which is yet another indication that Bitcoin is not used as a payment system these days, as it used to.

Nevertheless, Le Rest further reasons why Bitcoin may extend losses, saying that Bitcoin is also going through periods of low liquidity. “Inside this range, we are witnessing pumps and dumps with prices slowly grinding higher before being quickly slammed down, typical of low liquidity markets,” he asserted.

All in all, the total crypto market cap is in an insecure position. JPMorgan had previously rationalized that institutions are not buying the Bitcoin slump and stated that Bitcoin will plunge to $23,000 before starting its next rally.

“More than a month after the May 19 crypto crash, bitcoin funds continue to bleed, even as inflows into physical gold ETFs stopped. This suggests that institutional investors, who tend to invest via regulated vehicles such as publicly listed bitcoin funds or CME bitcoin futures, still exhibit little appetite to buy the bitcoin dip,” the note from JPMorgan said.

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|