2020-10-7 14:19 |

Bitcoin continues consolidating without providing a clear path for where it is headed next. As the range in which BTC trading gets narrower over time, the odds for an explosive price movement are increasing exponentially.

BTC whales are sellingFear, uncertainty, and doubt have struck the cryptocurrency market once again. On October 1st, the CFTC charged one of the largest crypto derivatives exchanges in the industry, BitMEX, for violating multiple regulations, including operating an unregulated trading platform. And the following day, President Donald Trump announced that he and the First Lady tested positive for COVID-19.

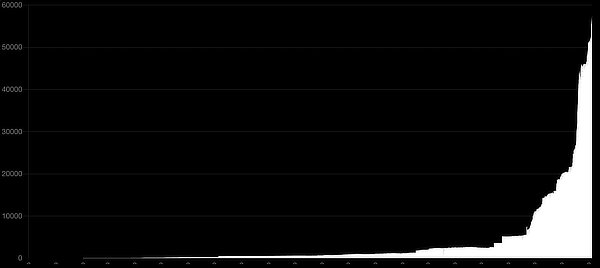

The subsequent negative news caused a state of commotion among investors who appear to have rushed to exchanges to sell their cryptocurrencies in expectation of a severe market reaction. On-chain data shows that addresses with millions of dollars in Bitcoin have been offloading their holdings. The so-called “BTC whales” appear to be exiting the market since late September, but the selling pressure has intensified recently.

Since the beginning of the month, the number of addresses holding 100 to 1,000 BTC dropped by nearly 0.30%. Roughly 40 whales left the network or redistributed their tokens in the past six days, which is quite significant, considering they hold between $1 million and $10 million worth of Bitcoin.

As sell orders continue to pile up behind Bitcoin, different technical indicators have turned bearish, suggesting that a downswing is underway.

Technical analysis: Support becomes weaker over timeThe downward price action seen at the beginning of October was significant enough to allow the parabolic stop and reverse points, or “SAR,” to move above BTC’s price on the daily chart. This behaviour can be considered a negative sign since it indicates that the trend changed from bullish to bearish.

Historically, the stop and reversal system has been highly effective in determining the pioneer cryptocurrency’s course. The last two times the parabolic SAR flipped from bullish to bearish within the 1-day chart, Bitcoin’s price dropped by 13% and 16%, respectively.

Due to the recent flip over of the SAR index, a lot of importance can be placed on the 100-day moving average. This support level is the only barrier preventing BTC from dropping towards the 200-day moving average, currently hovering at $9,500. Therefore, if the selling spree by large investors continues, the bellwether cryptocurrency would likely be bound for a wild downward ride.

Chart by https://www.tradingview.com/x/uVtc6mjV/Given the unpredictability of the cryptocurrency market, the bullish outlook cannot be disregarded. The pessimistic scenario will be invalidated if Bitcoin manages to turn the 50-day moving average into support. Under such circumstances, BTC could aim at the infamous $12,000 mark.

Key price levels to watchBased on the mounting selling pressure coming from BTC whales, the odds are currently favouring the bears. However, the pessimistic outlook will be confirmed the moment Bitcoin closes below the 100-day moving average. Until then, its future price action remains uncertain.

On the flip side, investors must pay close attention to the 50-day moving average. Turning this hurdle into support will negate all probabilities of a steeper correction and lead to an upswing towards $12,000.

The post Bitcoin price on the cusp of a major movement appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|