2024-10-10 19:00 |

The Bitcoin price is still recovering from a major dip to $60,000 in the first three days of October. As the bulls and long-term holders continue to capitalize on the dip, analysis of on-chain data has revealed that the selling pressure has been eased massively as the majority of short-term holders have exited the market. Interestingly, these short-term holders are accountable for the drop to $60,000, as the data shows many of them exiting the market during the initial decline, further exacerbating the price drop.

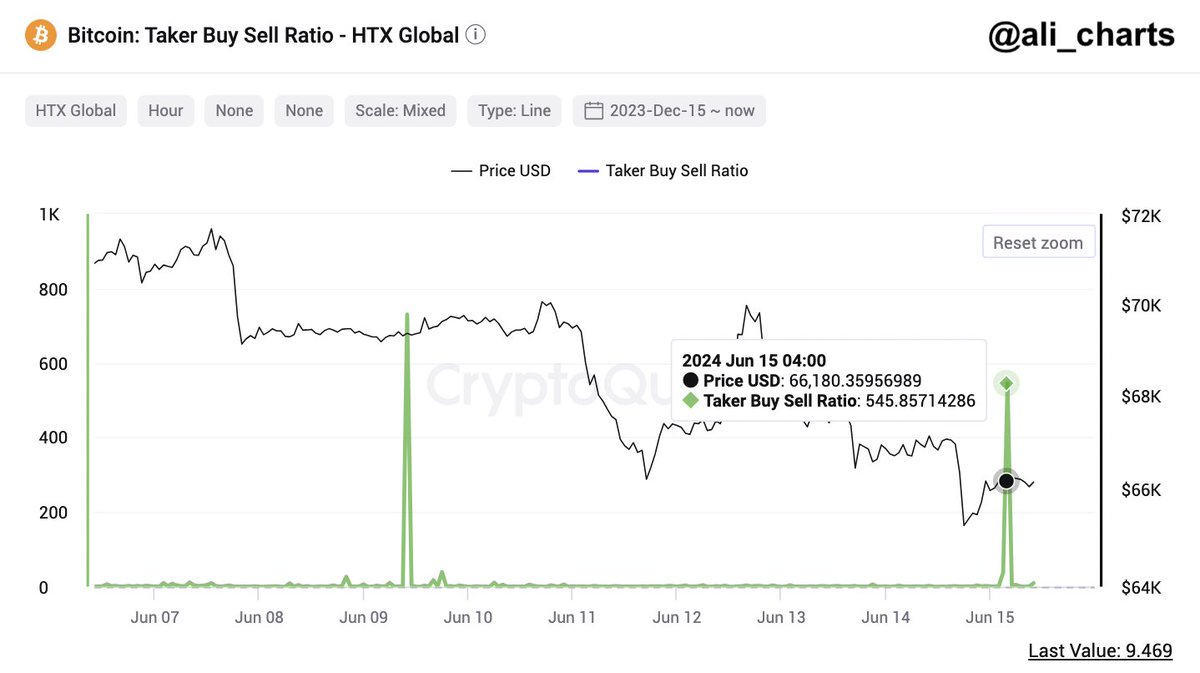

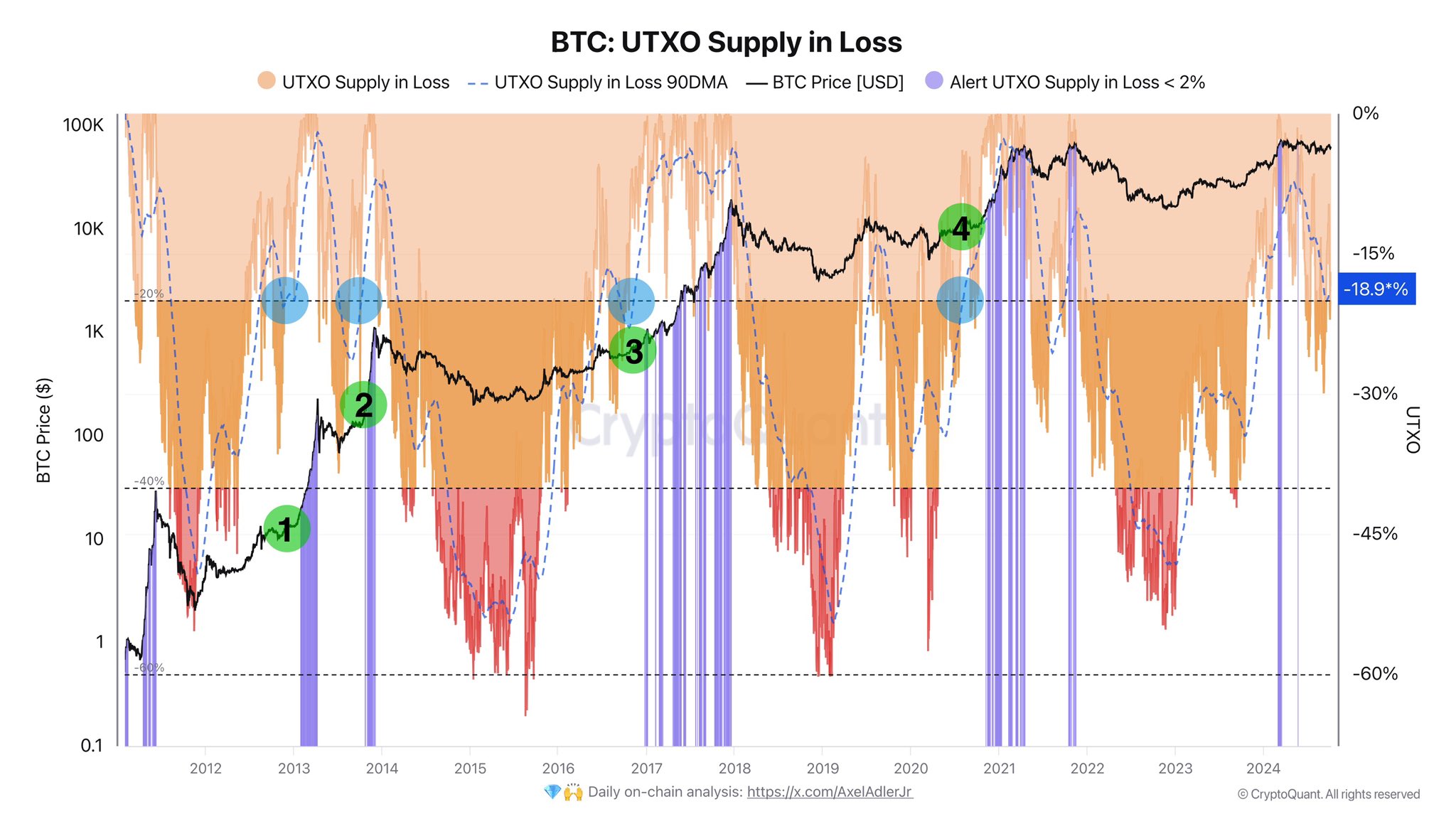

Short-Term Holders Exit The MarketAccording to an analysis of Bitcoin holder cohorts using data from the CryptoQuant platform, the supply of Bitcoin held by short-term holders has declined substantially since the beginning of the month. Although this contributed to a Bitcoin price decline during this timeframe, it is not necessarily bad for the crypto moving forward. This notable decline is visible in purple bars in the chat below, with every period of price downturns highlighted by an increase in short-term holder selloffs.

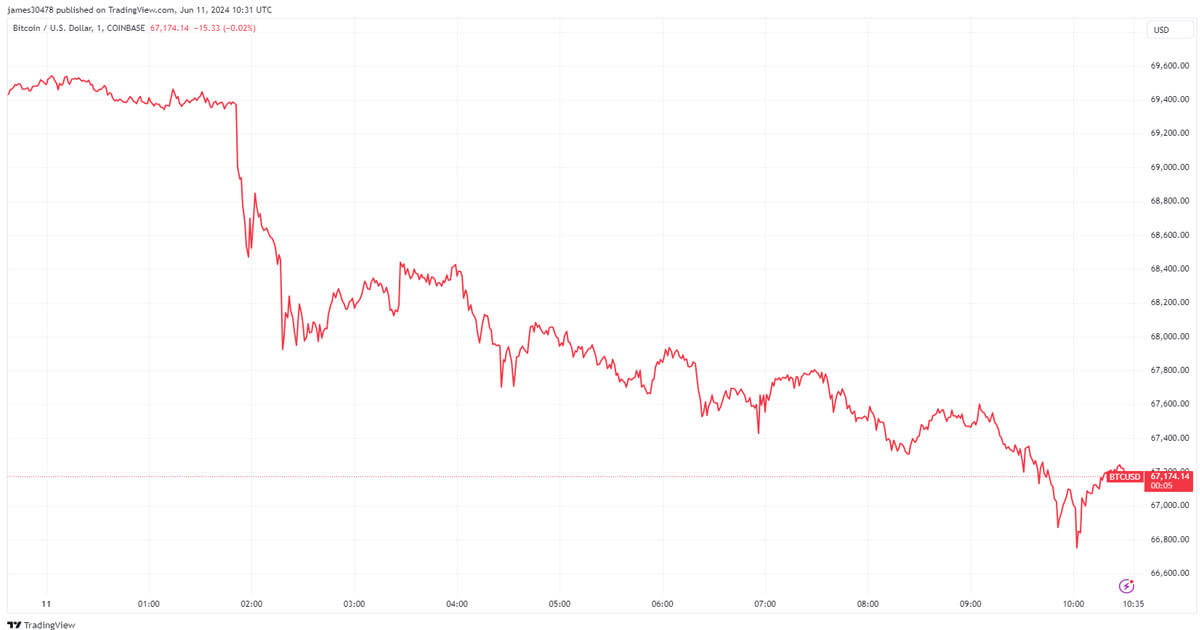

The Bitcoin price, which ended September around $65,000, kicked off October with a price dip amidst broader market tensions. This, in turn, led to a 7.5% Bitcoin price dip until it bottomed at $60,100. Notably, the chart highlights that this most recent decline to the $60,000 level coincided with the emergence of more purple bars, revealing that the selloff by short-term holders played a significant role in the price decline.

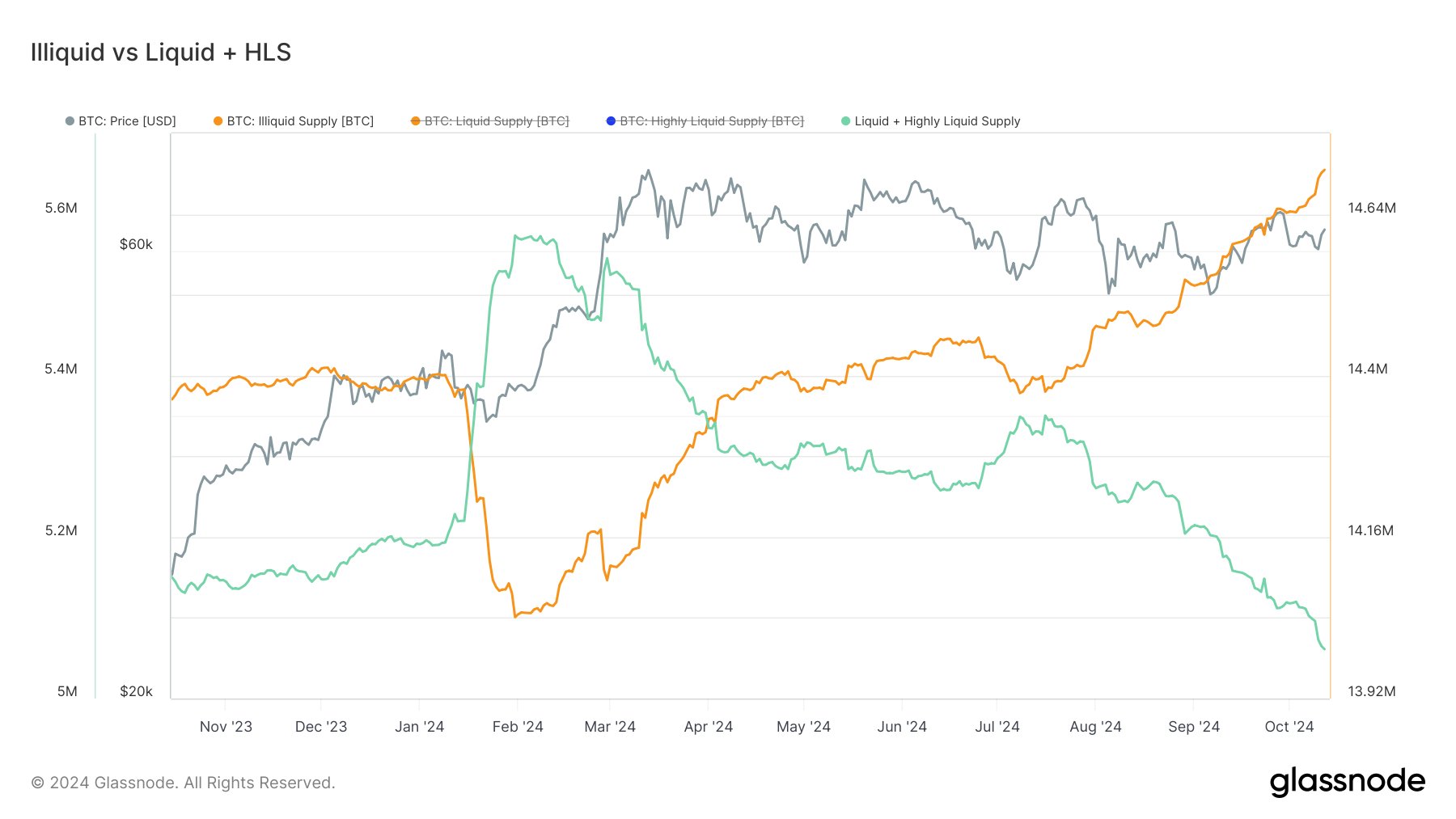

What Does This Mean For Bitcoin?Moving forward, the selloff from short-term holders and the price decline has given rise to more accumulation by long-term holders. This, in turn, gives rise to the creation of a price floor around $60,000 in the coming weeks and months. It also marks the shift of more bitcoins to stronger hands who would rather hold than sell.

Notably, the exit of many short-term holders has given rise to a better average cost for the cohort. According to on-chain metrics revealed by a verified CryptoQuant analyst, the average cost of one to three-month holders is now around $61,633, and the average cost of three to six-month holders is around $64,459.

At the time of writing, Bitcoin is trading at $62,130, which positions it right in the middle of these two key holder cohorts. According to analyst Burak Kesmeci, a decisive close above the $64,500 level would significantly strengthen the bullish momentum, giving both short and long-term holders more confidence to continue holding. On the other hand, if Bitcoin falls below $61,600, it could trigger a wave of additional selling pressure from more short-term holders, potentially leading to further price declines to revisit $60,000 again.

Similar to Notcoin - Blum - Airdrops In 2024

Streamr DATAcoin (DATA) на Currencies.ru

|

|