2023-8-22 15:18 |

Bitcoin is hovering just above $26,000 on Monday morning, giving up slight gains witnessed over the weekend. The flagship cryptocurrency is down nearly 1% in the past 24 hours and 11% this past week.

Bitcoin price outlookWhile the market dynamics could shift in bulls’ favour with possible injection of fresh volatility – the Grayscale ETF court decision is expected on Tuesday – Glassnode says the sell-off pressure that sent BTC under $25k may not have fully dissipated.

This is what analysts at Glassnode, an on-chain and financial metric provider, say catalysed the BTC price crash:

“Bitcoin bulls were caught off guard with the largest sell-off in 2023 sending $BTC below $25k. A deleveraging in futures markets is the likely catalyst, however a bigger concern may be the 88.3% of Short-Term Holder supply now held in an unrealized loss.”

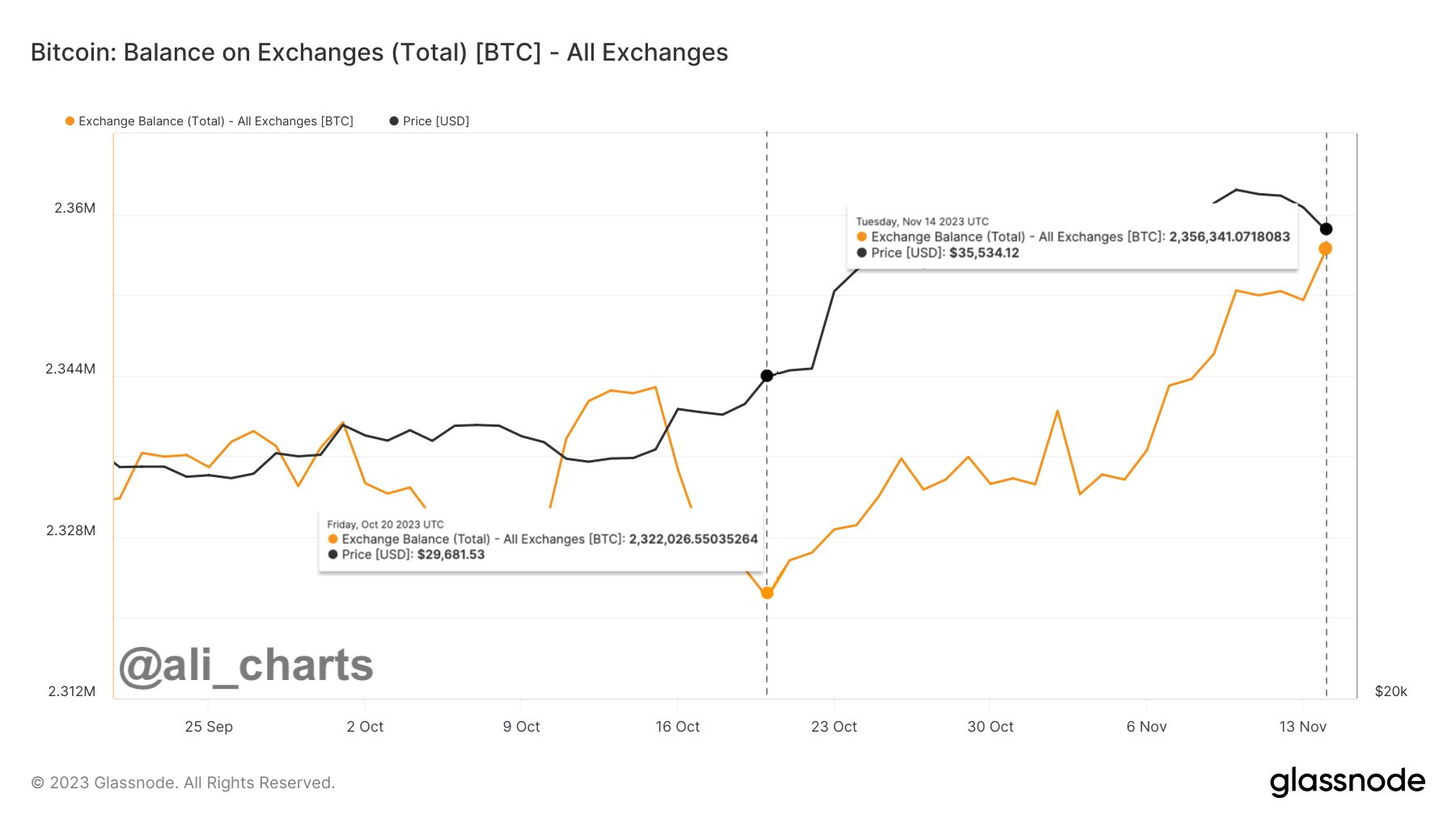

According to the analysts, leverage flush-out across the derivatives market cleared more than $2.5 billion worth of open interest within hours. While the options markets have since seen a sharp repricing in volatility premiums, OI remains remarkably stable. Also notable is that spot markets are largely ‘top heavy’, amid such a high number of short-term holders with unrealized losses.

An analysis Glassnode shared in their weekly on-chain report published on Monday, the platform’s market experts noted:

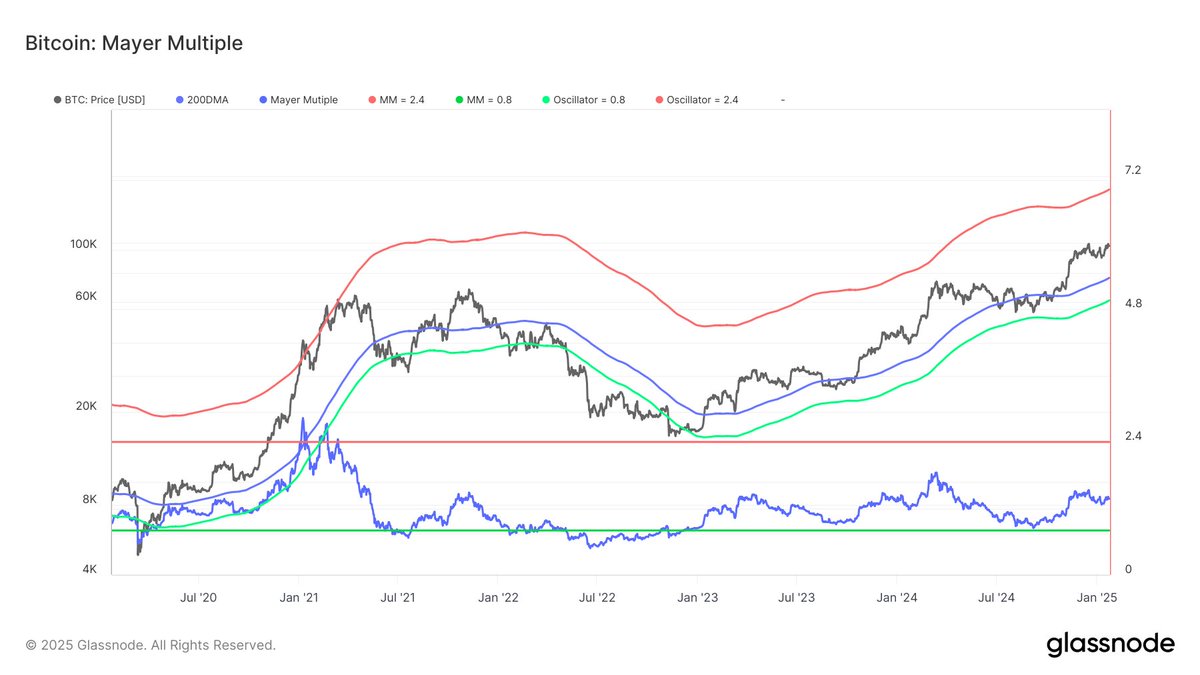

“The sell-off also pushed prices below the Short-Term Holder cost basis, an on-chain price model which has historically provided support during robust up-trends. With the Realized Price and Long-Term Holder cost basis trading some distance below ($20.3k), this puts the market in a somewhat precarious position from a psychological standpoint.”

This outlook ties in with what we highlighted last week.

As one analyst noted, Bitcoin’s dip resulted in a double top pattern, which analysts say could open up BTC to another decline. Giving up $25k would bring the $20k support zone into focus. On the flipside, Bitcoin Archive has shared a chart showing that the daily RSI for BTC has hit the most oversold level since 2020 during the Covid-19 crash.

#Bitcoin Daily RSI is now the most oversold since the Covid Crash in March 2020. pic.twitter.com/OULTwMFl2A

— Bitcoin Archive (@BTC_Archive) August 21, 2023 Crypto and stocks – the week aheadThe outlook could combine with broader market sentiment to provide new downward impetus. Possible trigger is what lies ahead this week for stocks.

Specifically, investor attention could invariably shift to the Federal Reserve’s Jackson Hole symposium this Friday. Fed Chair Jerome Powell’s speech will be a key focus area, given the outlook for interest rates and inflation among other macro factors.

The post Bitcoin on-chain data suggests BTC not out of the woods just yet appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|