2019-6-22 02:33 |

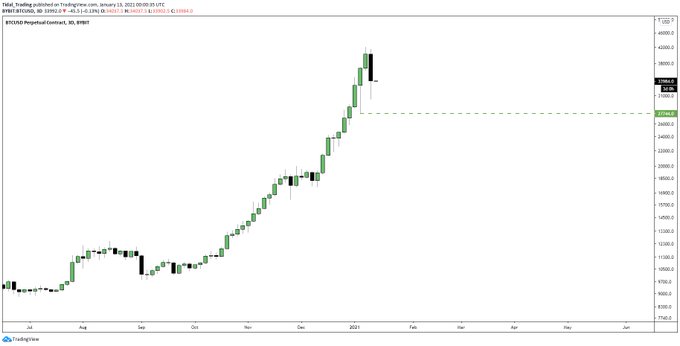

Bitcoin prices (BTC) pushed past the $10,000 boundary on Coinbase Pro today, the cryptocurrency’s highest valuation for more than a year and a significant psychological milestone for retail investors as institutions prepare to enter the market.

BTC stayed steady between the $9,000-$9,100 mark in the earlier part of the week. Prices only began moving more rapidly on Thursday morning and hit $9,600 by yesterday’s close: the trend continued, albeit at a slower pace, throughout the Asian and European trading days. Bitcoin spiked above $10,000 on Coinbase Pro (GDAX) at around 11:32pm UTC.

This is Bitcoin’s highest valuation for 2019; its apotheosis since the boom in early April. BTC was last above $10,000 back in early March 2018, and although it came within a whisker of hitting the Big Ten in the run-up to last year’s Consensus event in New York, it eventually fell short.

Today’s price marks a significant turnaround from Bitcoin’s low point in the middle of crypto winter; it represents a 212% ROI for buyers who entered the market when the digital asset traded around the $3,200 mark in mid-December.

The rally has been the catalyst for a significant inflow of new capital. “It’s clear that during the 54-week bear market, money didn’t leave the asset behind; it just sat on the sidelines waiting to get back in,” said George McDonaugh, CEO of KR1.

Paul Gordon, Director of Coinscrum, explained to Crypto Briefing that the recent recovery mirrored previous Bitcoin rallies. “This rally could push higher if mirroring similar moves in the past,” he said. “$11,800 being the equivalent target that we saw during early 2013’s correction from the then-$250 high, when the price bounced to around $175 from a $50 post-crash low.”

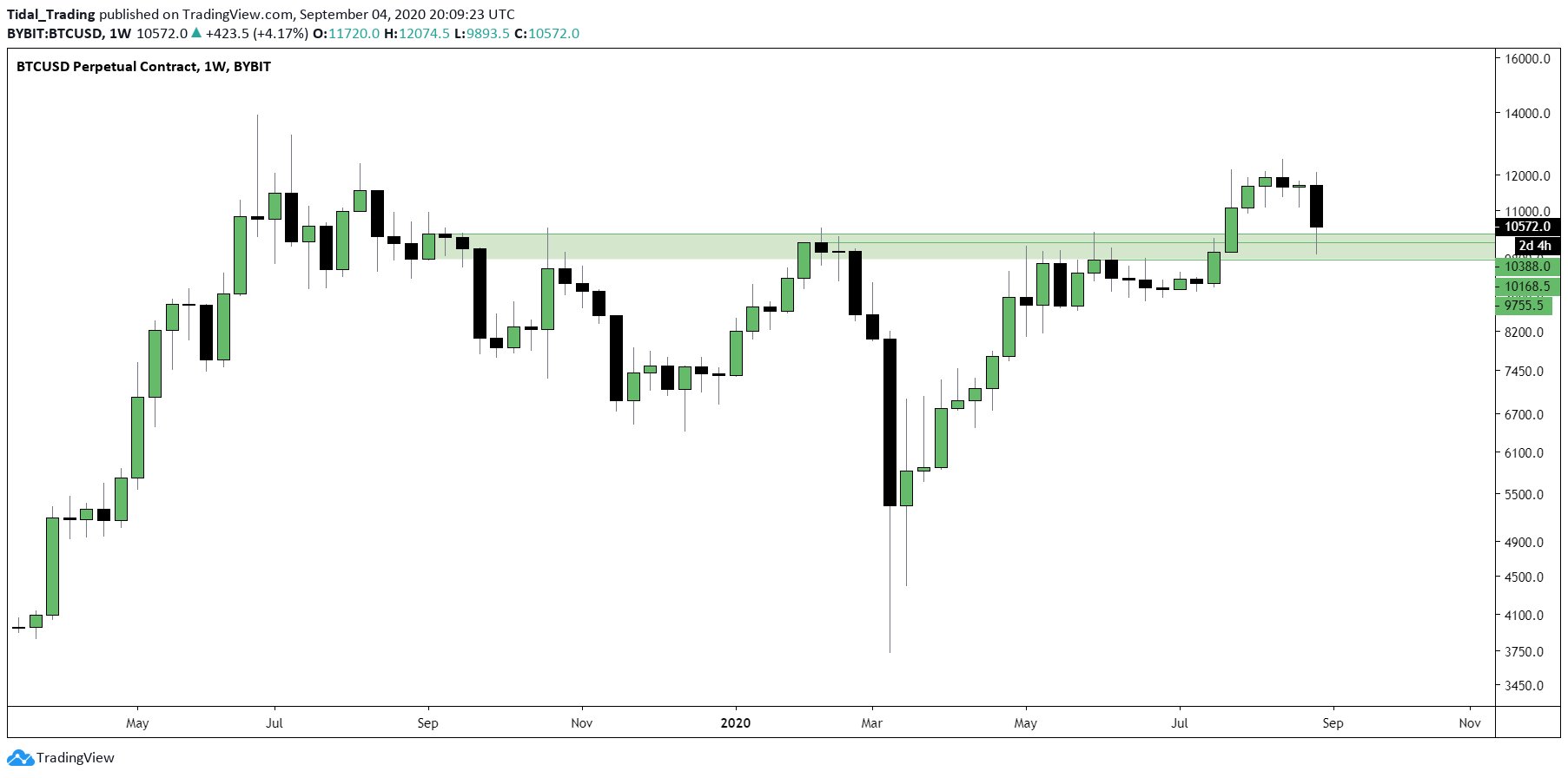

Although other large-cap coins – notably Ether (ETH) – are also increasing, this is a Bitcoin-led rally. Bitcoin dominance – BTC’s share of the total market cap – has increased to 57.7%, its highest level since before the ICO boom.

Source: CoinMarketCap

That should come as no surprise, believes Mati Greenspan, eToro’s senior market analyst. Unlike 2017, which was largely an altcoin-driven phenomenon, Bitcoin has remained the focal point for this rally.

Institutions will have far greater access when Fidelity and Bakkt open their doors. Until then, the regulated futures market remains one of the few places professional traders can gain exposure. Open interest on CME’s Bitcoin contracts has surged upwards this week to an all-time high at 5,311 BTC – approximately $270M.

Source: CME Group

Judging by these statistics, retail investors – who can simply buy the digital asset – are piling in now, Greenspan thinks, fully-anticipating that institutional investors will drive prices higher. “Institutional players still do not have easy access to crypto,” he said. “[What] we’re seeing now are speculators trying to front-run the bigger players.”

But David Thomas, Director and co-founder of GlobalBlock, believes that although retail involvement is picking up, the rally is still dominated by whales. “[R]etail is coming back in and getting excited again, but not necessarily to the levels that we would all believe,” he said. “Fundamentally, these price moves are still bossed by the big holders.”

While some have speculated that altcoins will suffer during the BTC rally, Joseph Denne, CEO and founder of DADI, expects altcoins they will benefit as companies begin to deploy their products. Crypto winter, he said, “has had the effect of shaking out a lot of the more dubious projects in the space…What is left is a more mature set of platforms, with technologies that can be activated and used today.”

The Contrarian Facebook View: (Is A Libra Lover In Crypto A Librarian?)Adam Badrawi, Senior Analyst at Wachsman suggested that “The oft-repeated mantra that ‘institutions are coming’ seems to be coming true, with powerhouses like Facebook, Fidelity, Baakt, and more outlining increasingly definable product entry points into the crypto markets.”

Badrawi echoed a sentiment that many in the industry have embraced, claiming that Facebook’s play means that “As many traders and investors see it, even if Facebook’s Libra project does not provide a clear path to onboard new money into bitcoin via direct trading pairs, the fact that millions (perhaps billions) of people will suddenly be exposed to cryptocurrency wallets could result in a spillover effect into the bitcoin markets.”

Joshua Frank, CEO of crypto analytics firm The TIE, went one step further and demonstrated in an analysis following the Libra news that “Sentiment on Bitcoin surpassed its highest level since May 11th when the coin was at $7,200. Tweet volume picked up substantially with 24 hour tweet volume rising from under 30,000 tweets to over 40,000 tweets within hours. Over the last three days we have witnessed increasing conversations on Bitcoin mentioning Libra Coin and those conversations have been significantly more positive than negative.”

(via TheTIE.io)

Interestingly, and despite crypto maximalist sentiment appearing to be decidedly negative regarding the Libra announcement, Frank maintained that “Taking a closer look at the most frequently used words in Bitcoin tweets on June 18th and June 19th we can see that the largest percentage of tweets mentioned Libra and Facebook. Those tweets were significantly more positive than negative,” and noted that “A large percentage of the accounts tweeting about Libra Coin are not crypto traders. “

As reported by Crypto Briefing last week, a number of other factors are aligning that also drive value, including hash rate and next year’s highly-anticipated reward halving event.

Immediately following the breakthrough, Bitcoin spiked even higher, touching almost $10,150 within minutes.

The post Bitcoin Obliterates $10,000 Hurdle As Cryptocurrency Markets Boom appeared first on Crypto Briefing.

Similar to Notcoin - Blum - Airdrops In 2024

Global Cryptocurrency (GCC) на Currencies.ru

|

|