2018-8-15 17:30 |

Cryptocurrency investors are not getting any respite from the bearish mood of the market as, once again, Bitcoin dipped below $6,000 to reach a near 2018 low on Tuesday. The market has been hit by uncertainty over the upcoming cryptocurrency regulations from various jurisdictions across the world, and in the middle of all of this, arrives the rumours of Bitmain’s plans of cashing out of Bitcoin.

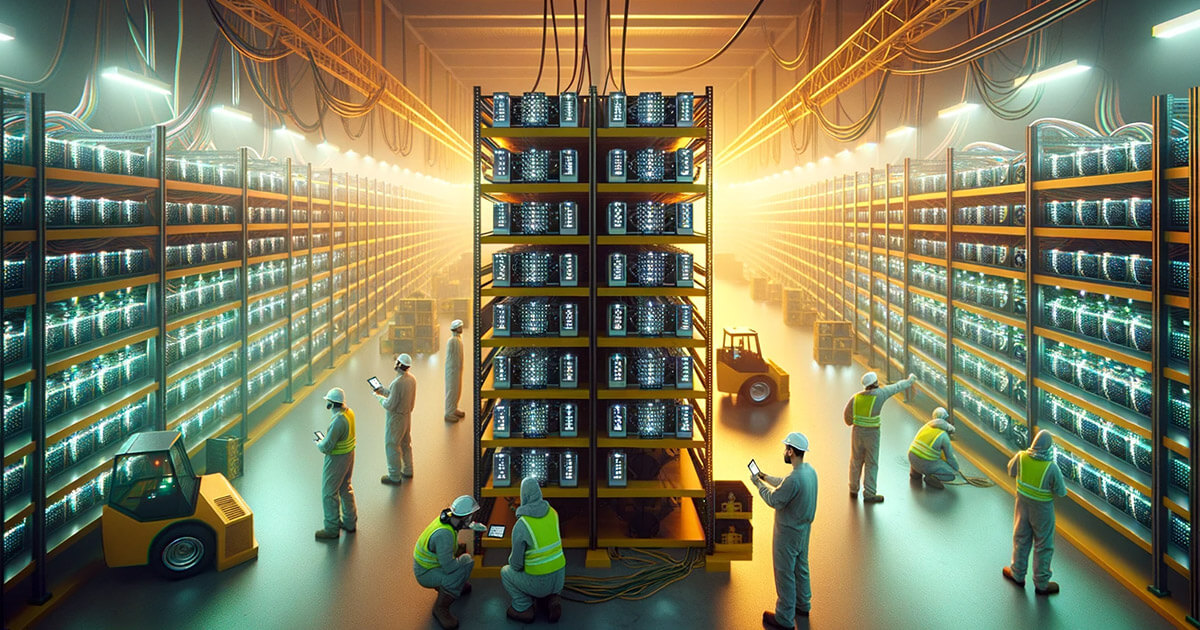

Bitmain IPO Could Create a New Tech GiantBitmain is a seller of ASIC chips and among the biggest cryptocurrency mining pools in the world. It reported a revenue of $2 billion in Q1 2018, and projects to achieve $10 billion in annual revenue, provided the cryptocurrency market does not tumble further. The company is now planning on an IPO for venturing into artificial intelligence, and it expects that it will generate 40% of its revenue in the next 5 years. The company has already closed a $100 million pre-IPO round.

The move is being looked at as the company’s cashing out of the Bitcoin craze and venturing into other promising technologies. 2018 has witnessed declining demand for cryptocurrency mining hardware. While 2017 saw exponential growth of mining hashrates, this year has not been so favourable for cryptocurrency mining. Increasing prices of mining hardware, along with the substantial increase in mining difficulty has interrupted mining growth and led to a sharp dip in mining profits.

Some, on the other hand, feel that this might be the company’s attempt at managing their investment in Bitcoin Cash (BCH), which is not very liquid at the moment. Blockstream’s CSO tweeted on August 11 that “massive losses are just around the corner as they have no idea how to maintain BCH, but are all-in.”

Bitmain, however, has been taking initiatives to convince the audience of its emphasis on increasing transparency and fostering greater dialogues between the company and cryptocurrency communities. In July, it released a blog on the various measures it was going to implement to promote transparency in its operations. The company wrote that it was going to publish data every 30 days to let community members know about which algorithms the company was currently mining for itself and the total hashrate of Bitmain-owned hardware on each of these algorithms.

Other than that, Bitmain also declared its stand against “secret mining”, and mining “empty blocks”. The company is planning on publishing the shipping and volume information for the first model of all new miners, tweeting about the quantity and payment timestamps via their official Antminer Twitter account.

Aside from Bitmain, Canaan and Ebang are also seeking to go public. Ebang has filed an application for its IPO with the Hong Kong Stock Exchange (HKEX).

Image from Shutterstock

The post Bitcoin Mining Monopoly Bitmain May Branch Out From Crypto appeared first on NewsBTC.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|