2024-6-14 19:43 |

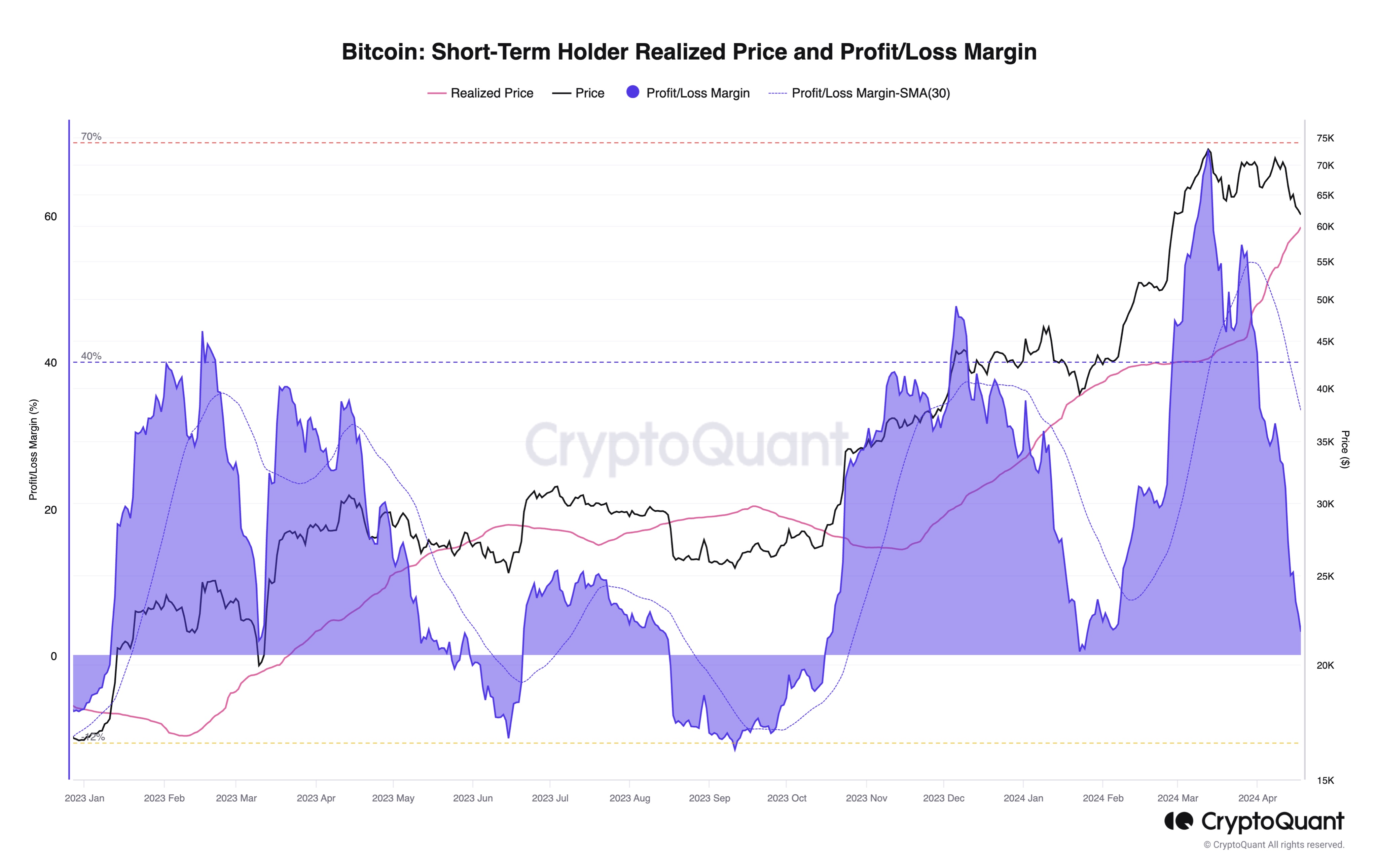

Bitcoin price has declined by nearly 7% in the past week, with bulls failing to hold above the $70k level. BTC has today retreated to around $66,350 amid fresh selling pressure. While prices are down as the market reacts to macroeconomic events, analysts at CryptoQuant say some of the downside comes from sell-off pressure facing miners.

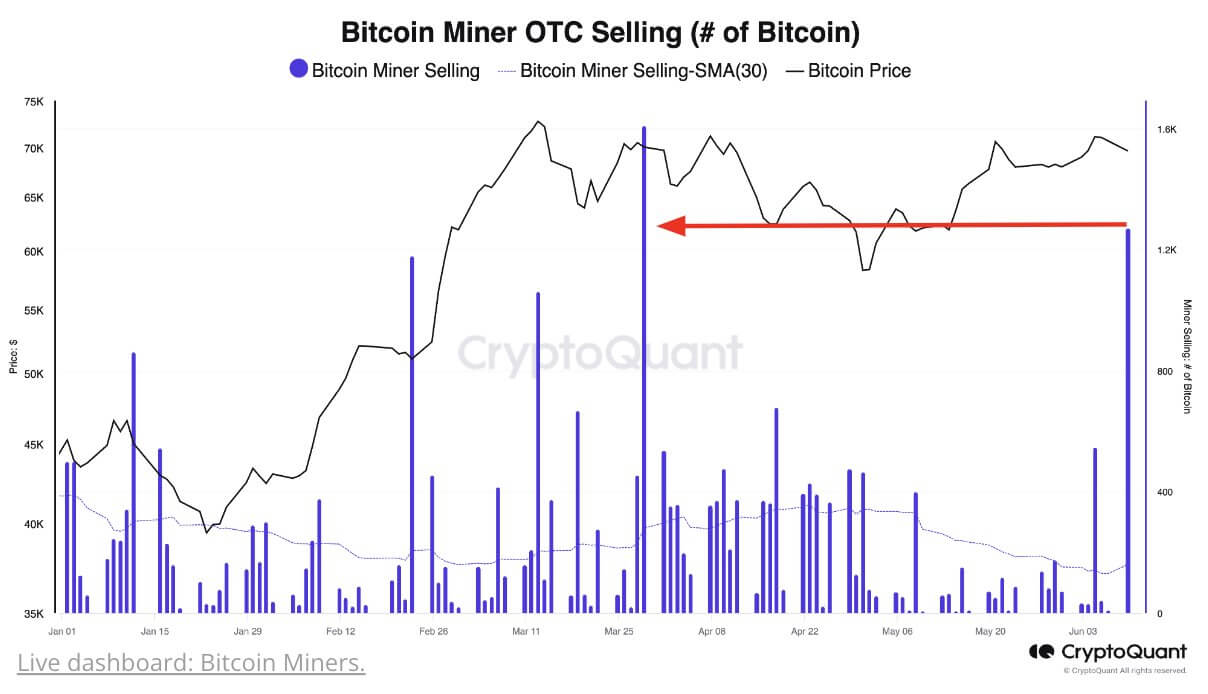

According to a CryptoQuant update on Thursday, there’s been an uptick in mining pool transfers and OTC desk sales for BTC. Some major publicly-traded Bitcoin mining companies have also recently reduced their holdings.

“BTC miners have ramped up selling as prices fluctuated between $69k and $71k. On June 9th, transfers from mining pools to Binance surged, hitting a 2-month peak of over 3,000 BTC. This shift aligns with a price correction, that dropped Bitcoin to $66k,”the CryptoQuant team noted in a post on X

Data also shows increased OTC sales, with the latest being a 1,200 BTC OTC desk sale on June 10.

Meanwhile, major US Bitcoin mining firms have sold off coins – for instance, Marathon Digital (MARA) offloaded 1,400 BTC in June. The company only sold 390 in May.

Miner revenue plummeted 55%Miner sell-off pressure has intensified as mining revenue fell.

For example, post-halving, daily miner revenues have reached $35 million. In March, that peaked at over $78 million, indicating a sharp decline of 55%.

“Amidst low miner revenues post-halving, daily Bitcoin transaction fees have dropped to around 65 Bitcoin from 117 prior to April 18th. Despite record-high transactions, median transaction fees in USD remain low, underscoring the pressure on miners’ income,” the CryptoQuant team noted.

The analysts also say that the Bitcoin network has also seen a dip in hashrate post-halving, but that’s only by 4%.

It means miners face stiff competition amid a reduced block reward and a combination of low miner revenues and high hashrate “often point to potential market lows.”

“Since May, miners have faced significant underpayment, suggesting we might be near a price bottom,”

The post Bitcoin miners are under pressure and they’re selling: CryptoQuant appeared first on CoinJournal.

origin »Bitcoin (BTC) на Currencies.ru

|

|