2024-10-15 14:00 |

The cryptocurrency market witnessed a significant influx of investments last week, as notable factors played a key role in shifting investor sentiment.

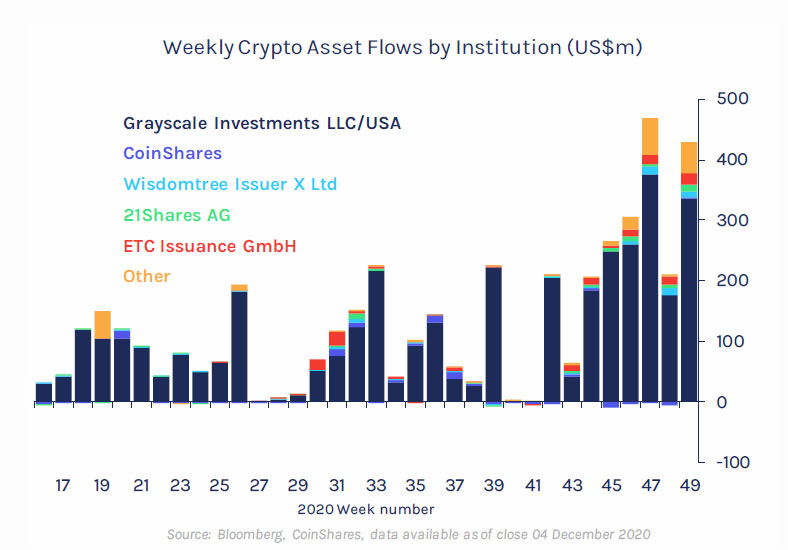

According to the latest report from CoinShares, digital asset investment products saw $407 million in net inflows globally, marking a sharp recovery after a previous week of outflows. This surge in inflows has been primarily attributed to an interesting trend In the United States.

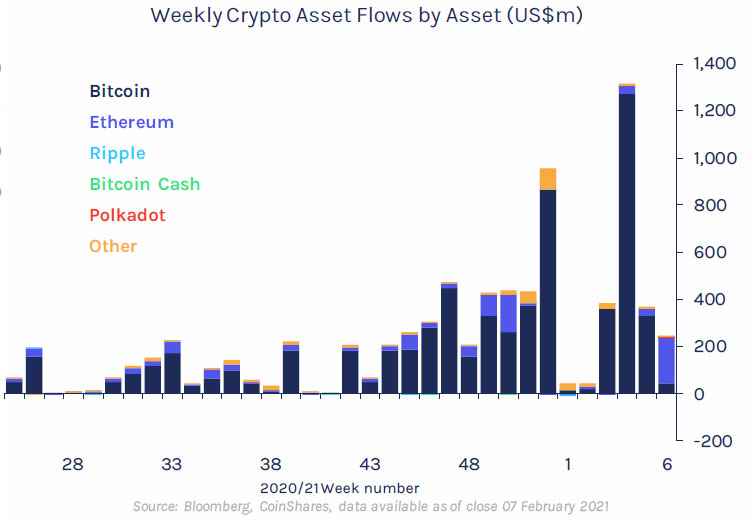

Bitcoin Leads In Fund Inflows As Ethereum Sees Continued OutflowsBitcoin investment products were the main leader in last week’s fund flow, attracting $419 million in net inflows, according to data from CoinShares.

Interestingly, short-Bitcoin investment products, designed to profit from Bitcoin’s price declines, saw $6.3 million in outflows, reflecting a growing bullish sentiment around the cryptocurrency.

The US spot Bitcoin exchange-traded funds (ETFs) also accounted for $348.5 million in net inflows last week despite witnessing brief outflows from Tuesday to Thursday.

The week closed strongly with over $200 million in positive flows on Monday and Friday, signaling renewed investor confidence in the digital asset market.

While Bitcoin-related products enjoyed substantial inflows, Ethereum-based funds continued to face challenges. CoinShares’ report revealed that Ethereum investment products experienced net outflows of $9.8 million globally, despite a small $1.9 million inflow into US spot Ethereum ETFs.

This marks a continuation of the negative trend that Ethereum has struggled with in recent weeks, indicating lingering concerns among investors about the asset’s near-term outlook.

Other multi-asset investment products, which include exposure to various cryptocurrencies, maintained a positive trajectory. These products recorded their 17th consecutive week of inflows, adding a modest $1.5 million to their total.

Additionally, blockchain equity ETFs saw a notable surge, bringing in $34 million in inflows, making it one of the largest weekly increases of the year. Butterfill attributed this rise to the recent gains in Bitcoin’s price, further solidifying the connection between Bitcoin’s performance and the overall health of the crypto market.

What Drove The $407 Million Inflow Surge?CoinShares Head of Research, James Butterfill, highlighted the impact of US political developments on the inflow trend.

“Investor decisions have likely been more influenced by the upcoming US elections than by monetary policy outlooks,” Butterfill explained, pointing to the growing support for digital assets from the Republican Party as a driving factor.

The CoinShared Head of Research further pointed out that this shift was evident following the recent US vice-presidential debate and polling data that showed increased Republican support, which led to an “immediate boost” in inflows and cryptocurrency prices.

In terms of regional fund flows, unsurprisingly, US-based funds dominated the inflows, contributing $406 million to the total $407 million inflows recorded last week.

Aside from the US, the only other significant contributor to the positive inflows came from Canadian crypto funds, which saw net inflows of $4.8 million. In contrast, funds based in other regions recorded minor outflows.

Featured image created with DALL-E, Chart from TradfingView

Similar to Notcoin - Blum - Airdrops In 2024

Intelligent Investment Chain (IIC) на Currencies.ru

|

|