2023-10-18 03:00 |

Bitcoin is now above a certain historical on-chain metric, and if the asset can continue to hold here, a bullish trend might follow.

Bitcoin Is Now Above The “Warm Supply” Realized PriceAs explained by an analyst in a post on X, BTC is now trading above the warm supply realized price. The “realized price” refers to the cost basis or buying price of the average investor in the Bitcoin market.

When the cryptocurrency’s spot price is trading above this metric, it means that the holders are in a state of profit right now. On the other hand, the asset being under the indicator suggests the dominance of loss in the market.

In the context of the current discussion, the realized price of only a specific segment of the supply is of interest: the “warm supply.” The on-chain analytics firm Glassnode defines the warm supply as that part of the supply that was last moved on the network between one week and six months ago.

The coins moved within the past week are in the “hot supply.” This section of supply is the most liquid, often involved in transactions.

The coins from this supply that stay still for a bit naturally mature into the warm supply cohort. The warm supply is still fluid but less so than the hot supply, where a large chunk of the coins are repeatedly traded in quick intervals.

The warm supply is where investor behavior starts becoming clearer since the hot supply is essentially churning repeatedly for various reasons, which can hide actual information about normal traders.

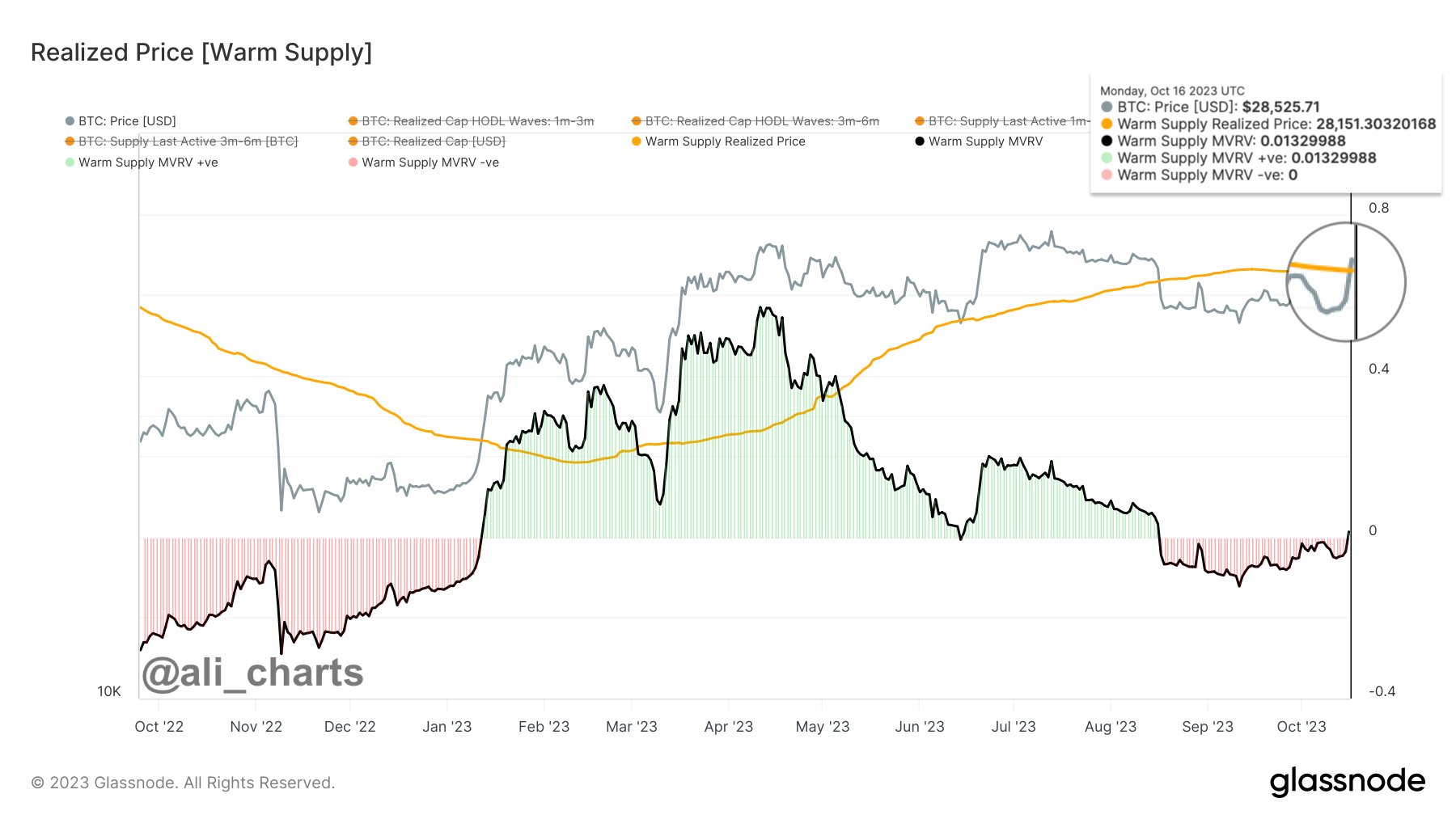

Now, here is a chart that shows the trend in the Bitcoin realized price for the warm supply over the past year:

As displayed in the above graph, the Bitcoin realized price of the warm supply is currently trading around the $28,151 mark. Thus, with the latest surge in the spot price, the cryptocurrency has managed to break past this level.

This can be significant for the asset, as this line has held importance in the past. As mentioned before, the price breaking above the level essentially signifies that the holders of this supply have returned into a state of profit.

Generally, when investors who were previously at a loss start breaking even because of a surge in the price, they may become tempted to sell in fear that the asset would once again dip below their cost basis shortly. Exiting at the break-even mark at least ensures that they avoid any losses.

This selling that can arise at the cost basis of the group can show up as resistance to Bitcoin. Since the asset has cleared this boundary with the latest rally, it’s certainly a positive sign.

The analyst in the post notes that if Bitcoin can hold above this level, then a new uptrend could begin for the cryptocurrency.

BTC PriceAt the time of writing, Bitcoin is trading at around $28,600, up 4% in the last week.

origin »Bitcoin (BTC) на Currencies.ru

|

|