2020-7-29 16:32 |

The world’s largest cryptocurrency has gone past $10,000 and is trading well into $11,000. During the last bull run, the first time bitcoin hit $10k; it took two weeks to break the ATH of $20,000.

This time, Bitcoin has been holding stable for four months when its physiological barrier of $10,000 was broken.

However, despite this surge in BTC price, there haven’t been any large-scale deposits made into cryptocurrency exchanges. So far, the bitcoin balance on exchanges is remaining stable at around 14.5% of the circulating supply.

Bitcoin investors have taken to HODL instead of taking off profits as BTC surges over 16% in the past five days.

According to Mike McGlone, Commodity Strategist for Bloomberg Intelligence, the extraordinary story of bitcoin is not over yet but will still be heading higher.

It’s A Problem if #Bitcoin Can't Sustain Above $10,000 This Time –

There is little excuse for the benchmark crypto-asset to not transition $10,000 resistance into support toward the end of July, in our view. pic.twitter.com/f7wSUje9Vw

— Mike McGlone (@mikemcglone11) July 27, 2020

The key thing was $10,000 resistance that held quite well for almost a year, and the market blew only last week, said, McGlone. The key was stalling gold, and the OCC giving banks the green light to custody bitcoin for their clients, a hurdle bitcoin finally breached.

The leading digital currency has the tendency to stagnate and drive people crazy only to jump big moves; he said, adding, the next target for bitcoin is $14,000, which was last year’s high. McGlone tweeted,

“Bitcoin is more likely to sustain higher levels than the Nasdaq due to increasing demand vs. declining supply and reduced volatility vs. the Nasdaq. Central-bank liquidity and fiscal stimulus may limit equity downside, but it's fuel for bull markets in the quasi-currencies.”

Besides OCC being the narrative pushing the market higher in the short term, payment networks like Visa and Mastercard, which have been cryptocurrency agnostic, are increasingly turning to the industry, which is also driving this rally, said Mati Greenspan of Quantum Economics.

Moreover, the same factors that are driving the stock market globally, the government pushing too much money into the market, are also behind bitcoin’s price rise.

As for bitcoin being the store of value, the bottom line is its supply is declining by code, less than 2% next year, and going to 1% in the next 100 years, said McGlone. It is unlike gold, which historically started at 2%, but as prices go higher, more supply comes out.

The key thing that matters is demand and adoption. Although it is a new technology, it will see more adoption, more demand with OCC news picking it up, he said.

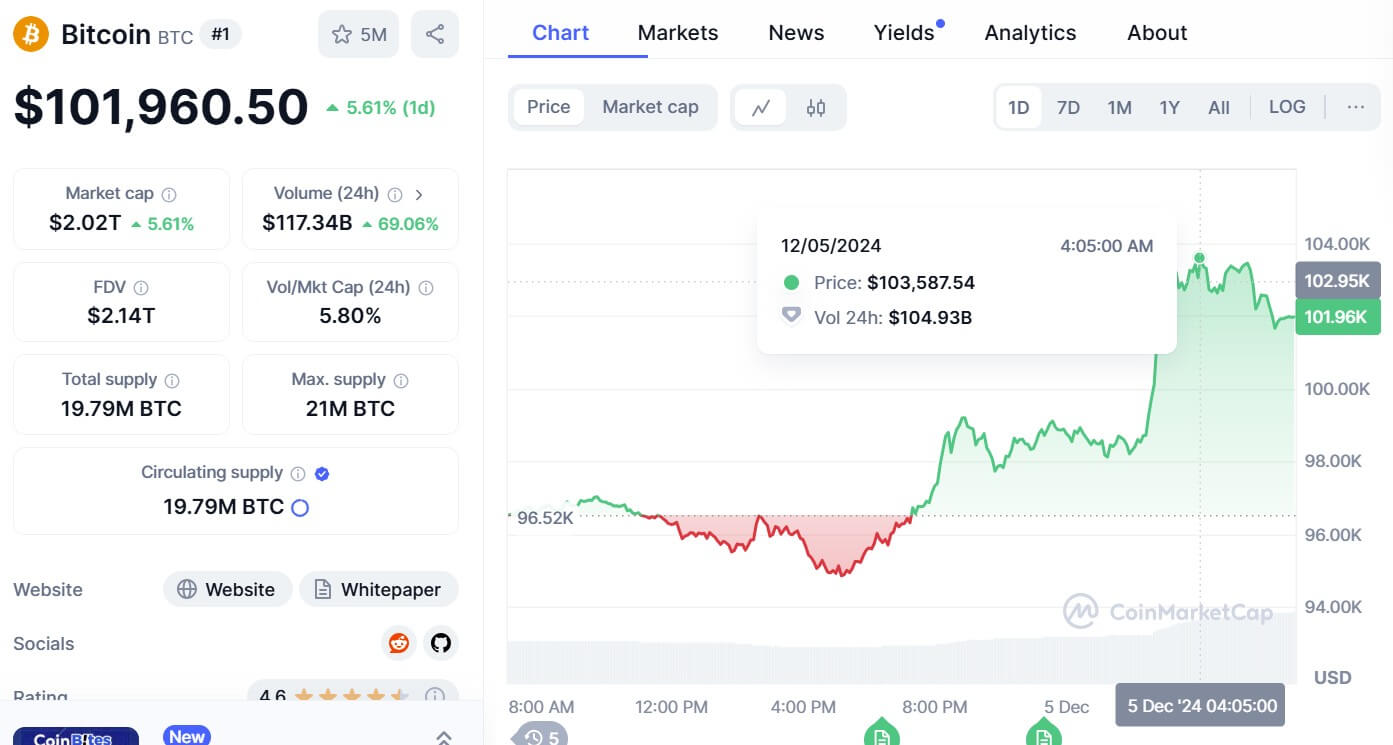

Bitcoin (BTC) Live Price 1 BTC/USD =$11,085.0093 change ~ 1.16%Coin Market Cap

$204.47 Billion24 Hour Volume

$6.99 Billion24 Hour VWAP

$11.02 K24 Hour Change

$128.2080 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Bitcoin (BTC) на Currencies.ru

|

|