2020-8-16 17:02 |

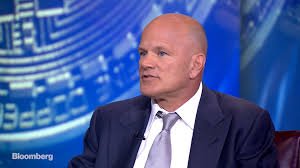

Gold is no longer the best store of value in the world. The OG cryptocurrency takes that title now, according to Mike Novogratz. The billionaire ex-hedge fund manager and founder of crypto merchant bank Galaxy Digital said bitcoin — which has been on a roll in recent weeks — is now a better investment than the yellow metal.

Bitcoin Has Supplanted Gold To Become The Better Store Of Value: NovogratzBitcoin bull Mike Novogratz expressed his optimism about bitcoin while speaking in an interview with Bloomberg. During his interview, Novogratz shared his latest analysis of the stock market and cryptocurrency. For him, the US stock market that has been skyrocketing on the Federal Reserve’s liquidity injections is doomed if Joe Biden is elected as the next president of the United States.

He went ahead to say that the Fed is about to unleash more dovish policies which could drive the price of gold to $2,500 to $3,000 per ounce. However, the Goldman Sach alum believes bitcoin has become a better store of value than the precious alloy.

Regarding his bold claim about bitcoin, Bloomberg quoted him saying:

“He said he thought the cryptocurrency, which has surged in value in recent weeks, had “crossed the Rubicon” on the question of whether it’s a good store of value, and said he considers it a better investment than gold at the moment.”

In fact, Novogratz is so bullish on crypto that he currently has 25% of his money currently invested in digital assets.

Bullish SentimentMeanwhile, Novogratz’s Galaxy Digital is trying to bring crypto to the masses through print media. The crypto investment bank recently published an ad on the Financial Times, urging the public to invest in bitcoin now. “In uncertain times, Bitcoin is a hedge independent of the hegemony,” the ad further stated.

Big ad for bitcoin in the FT today from Galaxy Digital. Love it pic.twitter.com/ro05QdvDFf

— Barry Silbert (@barrysilbert) August 13, 2020The bullish narrative is reinforced further by the fact that bitcoin has outperformed literally every other major asset class in 2020 so far. This has made Real Vision’s Raoul Pal to be “irresponsibly long” on the top crypto:

“In fact, only one asset has offset the growth of the G4 balance sheet. It’s not stocks, not bonds, not commodities, not credit, not precious metals, not miners. Only one asset massively outperformed over almost any time horizon: Yup, Bitcoin. My conviction levels in bitcoin rise every day. I’m already irresponsibly long. I am now thinking it may not be even worth owning any other asset as a long-term asset allocation, but that’s a story for another day (I’m still thinking through this).”

BTC is currently valued at $11,800.42. Charles Edwards of Capriole Investments has predicted that the asset could surge to $13,000 in the course of this week.

Similar to Notcoin - Blum - Airdrops In 2024

Golos Gold (GBG) на Currencies.ru

|

|