2026-1-20 13:40 |

Crypto market analysts admit that Bitcoin BTC $91 167 24h volatility: 2.0% Market cap: $1.82 T Vol. 24h: $39.64 B has been having a good run, especially among institutional investors. According to blockchain analytics platform CryptoQuant, institutional demand for the flagship cryptocurrency is still at a peak point. It made this inference after identifying a couple of wallets accumulating Bitcoin.

The 33% Pump in Bitcoin Institutional DemandCryptoQuant founder Ki Young Ju revealed that large custody wallets accumulated $53 billion in Bitcoin over 12 months.

This suggests that institutional demand for Bitcoin is very much active. BTC accumulation by wallets that hold between 100 and 1,000 BTC is usually a sign of continued interest in the digital asset from institutional investors in the United States.

Young Ju claimed that 577,000 Bitcoin was added to this wallet cohort, including Exchange Traded Funds (ETFs) over the past year, adding that “it’s still flowing in.”

Notably, the increase identified by CryptoQuant is about 33% over the last year. This coincides with the time when the first spot Bitcoin ETFs were pushed into the market for trading.

Institutional demand for Bitcoin remains strong.

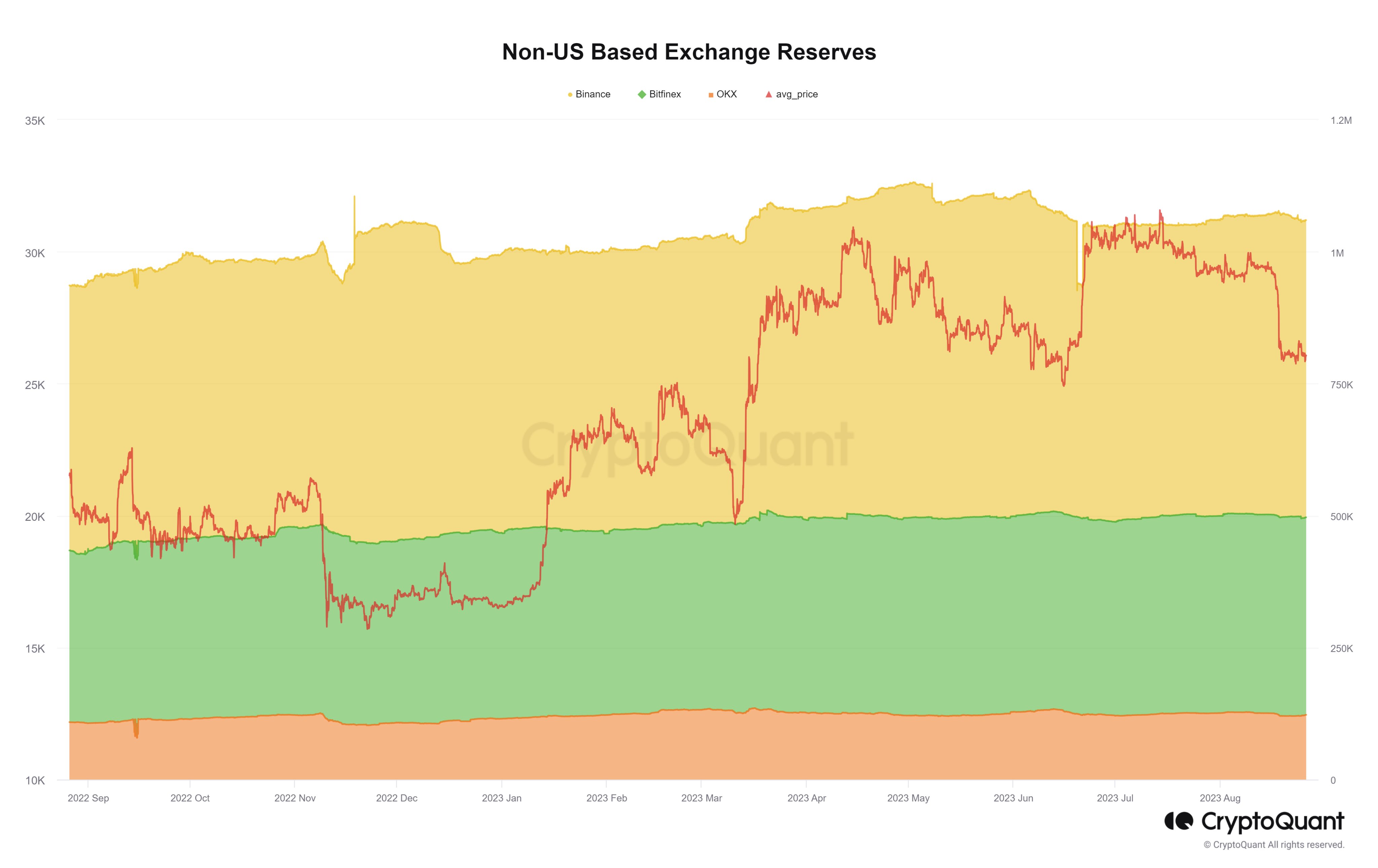

US custody wallets typically hold 100-1,000 BTC each. Excluding exchanges and miners, this gives a rough read on institutional demand. ETF holdings included.

577K BTC ($53B) added over the past year, and still flowing in. pic.twitter.com/kG1c8dTvlq

— Ki Young Ju (@ki_young_ju) January 19, 2026

Based on this information, BTC ETFs have clearly contributed to the uptick in institutional demand for crypto investments.

Also, these funds have grown significantly over time, raking in millions of dollars in net inflows. On Jan. 5, Coinspeaker reported that Bitcoin ETFs logged $697 million in net inflows, marking the strongest daily intake since October 2025.

According to CoinMarketCap data, Bitcoin is trading at $90,921.69, down 2.26% in the past 24 hours.

Strategy and Metaplanet Stays Dogged on Bitcoin AccumulationBeyond ETFs, top companies like Metaplanet and Strategy Inc have made it their lifelong commitment to accumulate Bitcoin. Most times, their acquisitions are without consideration of the price or performance of the firstborn crypto asset at the time.

In Q4 2025, Metaplanet added more than 4,279 BTC to its stash. This purchase was worth $451 million, at an average price of approximately $105,412. The Japanese firm now holds about 35,102 BTC, inching closer to its goal of accumulating 210,000 Bitcoin by 2027.

Strategy, on one hand, holds 687,410 BTC on its balance sheet, further securing the position of the largest corporate Bitcoin treasury globally. It paid an average price of $91,519 per Bitcoin for the latest purchase of 13,627 Bitcoin.

Many other institutions are following in the footsteps of these two top BTC treasury firms to kickstart their journey.

nextThe post Bitcoin Institutional Demand Very Strong Despite Price Crash: CryptoQuant appeared first on Coinspeaker.

origin »ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|