2025-12-24 07:55 |

Bitcoin eased in early Asian trading and held around the mid-$87,000 area as market volatility continued to compress.

Bitcoin investor and entrepreneur Anthony Pompliano said the absence of a year-end surge may reduce the risk of a major first-quarter selloff.

Other analysts see deeper downside potential into 2026, while broader markets are buoyed by a record S&P 500 on stronger US growth and gold’s move above $4,500 an ounce.

Volatility compresses, risk skew shiftsPompliano argued that subdued volatility could limit extreme downside.

“Given where the volatility is right now, it would be very surprising that Bitcoin’s volatility has drastically compressed and yet still could get a 70% or 80% drawdown,” he said in a CNBC interview on Tuesday.

He noted that investors have overlooked Bitcoin’s long-term performance over the disappointment of the asset not hitting $250,000 this year.

He pointed to longer-term gains, saying Bitcoin is “up 100% in two years” and “almost 300% in three years,” calling it “a monster in financial markets.”

Expectations of a rally to $250,000 from advocates like Tom Lee and Arthur Hayes did not materialize this year.

Pompliano also said that while Bitcoin didn’t see the “blowoff top” performance expected in Q3 or Q4, it didn’t suffer the usual 80% drawdown that is normally expected as well.

Others remain cautious.

Veteran trader Peter Brandt recently said Bitcoin could fall as low as $60,000 by the third quarter of 2026, while Fidelity’s director of global macroeconomic research Jurrien Timmer suggested 2026 could be a “year off,” with prices potentially dipping to $65,000.

Bitfinex analysts said Bitcoin bounced decisively from the low $80,000 support area.

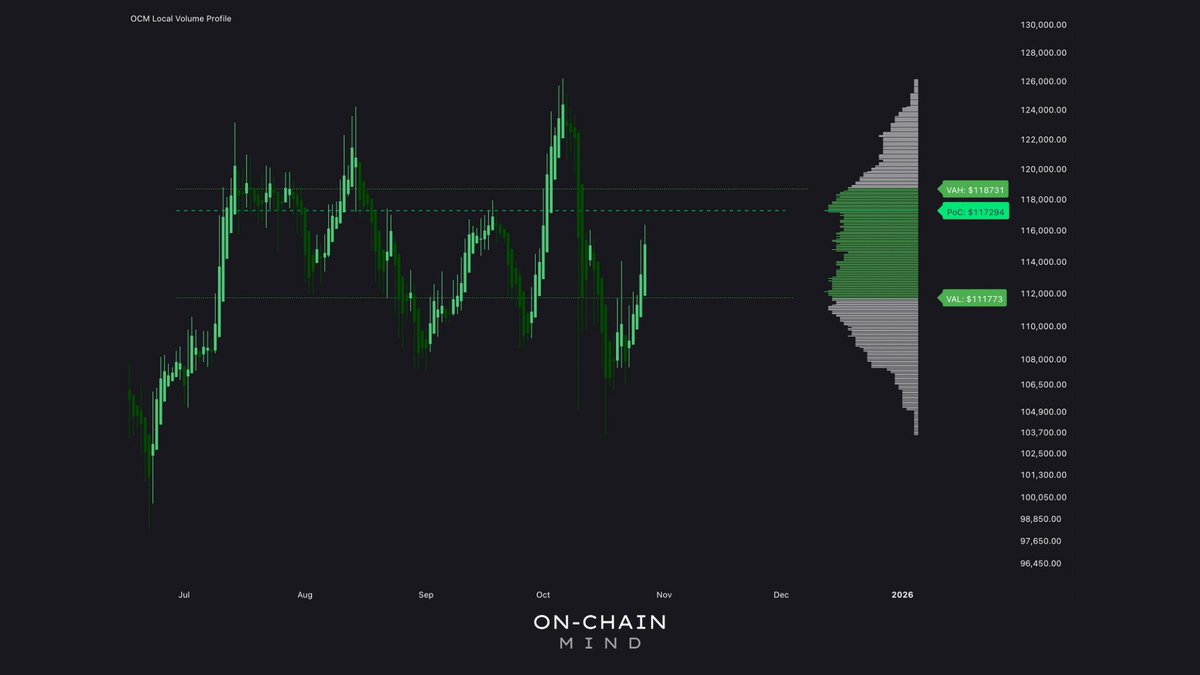

They warned, however, that “a dense overhead supply cluster” accumulated by top buyers between $94,000 and $120,000 now presents a “substantial headwind.”

They described a “top-heavy” setup where rebound attempts face persistent selling pressure, a pattern they said resembled early 2022 during the initial stage of a bearish phase.

Bitcoin was trading at $87,260 at the time of publication, down 1% in the last 24 hours and down 6.5% since Jan. 1.

Ethereum fell 1.6% in the last 24 hours to $2938, while XRP slipped 1.8% to $1.85.

The total crypto market capitalization was down 1.03% to $2.03 trillion.

Macro backdrop, stocks climb, and gold hits a recordStocks strengthened after an upward revision to US third-quarter GDP showed annualized growth of 4.3%.

The S&P 500 closed at a record on Tuesday, with higher bond yields and continued demand for growth stocks.

In Asia, MSCI’s regional gauge advanced for a fourth session, up about 0.2% at the time of writing.

Japan’s Nikkei 225 fell 0.02%, while South Korea’s Kospi was up 0.02%, and Australia’s ASX edged lower in a shortened session.

Gold surged past $4,500 an ounce for the first time as safe-haven demand built on geopolitical tension and expectations for lower US rates next year.

Washington’s pressure on Venezuelan oil flows, with President Donald Trump’s blockade, kept shipowners on alert.

Policy signals and trade developmentsMarkets also tracked policy uncertainty as Trump kept investors guessing about the next Federal Reserve chair, repeating he wants a chair who is willing to cut rates and is nearing an announcement.

In India, the Reserve Bank moved to ease tight conditions with liquidity measures, including bond purchases and a dollar rupee swap.

On trade, the Trump administration delayed new tariffs on Chinese semiconductor imports until mid-2027.

The post Bitcoin holds near $87k as volatility compresses; analysts split on 2026 outlook appeared first on Invezz

origin »Bitcoin (BTC) на Currencies.ru

|

|