2021-1-9 14:31 |

Bitcoin looked to end its first official week on a strong note as its price claimed another record high this Friday.

The benchmark cryptocurrency soared above $41,000 for the first time since its inception, hitting an all-time peak of $41,499 before correcting lower. Its gains appeared shortly after the European equities reported profits in early dealings, hinting that traders took their cues from a bullish risk-on sentiment.

Since November, the continent’s benchmark Stoxx 600 opened 0.3 percent higher as it stayed on track to finish its best week. Meanwhile, the MSCI index, which tracks developed market equities, jumped 0.3 percent, also on track to record its best week but since 2018.

EUR/USD declined 0.30 percent. Around the same time, Bitcoin’s market capitalization reached an unprecedented $749 billion level—almost near Tesla’s valuation.

Bitcoin FundamentalsGains across riskier assets appeared after Democrats won key seats in Senate run-off elections this week in Georgia. The victories gave the blue political party control of both Congress houses. For investors, that means an increase in fiscal stimulus measures to aid Americans through the coronavirus pandemic’s economic aftermath.

“This is probably the best news for the economy since vaccines were approved,” Adam Kurpiel, head of rates strategy at Société Générale, said in a note.

Meanwhile, investors also assessed lesser political uncertainty after President Donald Trump agreed to transfer powers “orderly” to his successor Joe Biden. Mr. Biden will take oath as the 46th US president on January 20.

Bitcoin analysts have predicted that Mr. Biden’s administration’s larger stimulus measure might usher in inflation alongside economic growth. They have projected the cryptocurrency as an anti-inflation set that would rise higher as the US dollar loses its purchasing power over time.

“Now that Trump has conceded, we can expect Covid Lockdowns to get far worse in the U.S. just like they have in Europe in recent days,” said independent market analyst Elixium. “The Biden [administration] will make very srs attempts to get places like Texas & Florida in Full Lockdown. Bullish for Bitcoin, Bearish for USD.”

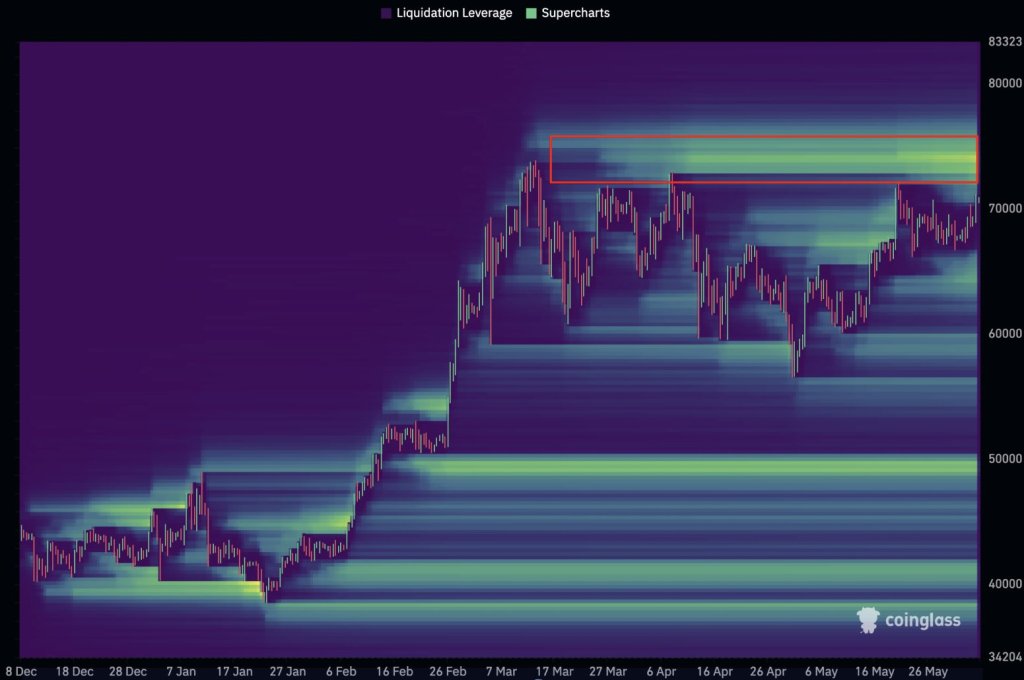

Correction CallBut as retail traders raised their bids for Bitcoin against supportive fundamentals, the technicals seem to suggest a massive correction ahead. The cryptocurrency has reached its most overbought levels on all its longer-timeframe charts, amounting to an unavoidable neutralization led by bear-induced sell-offs.

Bitcoin enters overheated territories, risking sell-off attempts by bears. Source: BTCUSD on TradingView.comShould a correction occurs, BTC/USD would test $40,000 as its interim support while keeping an eye on $36,000 as its primary downside target.

Similar to Notcoin - Blum - Airdrops In 2024

RECORD (RCD) на Currencies.ru

|

|