2024-5-8 09:50 |

Susquehanna International Group, a behemoth in asset management with a trading volume handling numerous financial products globally, has made a substantial investment in Bitcoin through various exchange-traded funds (ETFs). A disclosure to the Securities and Exchange Commission (SEC) on May 7 revealed that Susquehanna held approximately $1.2 billion in spot ETFs during the first quarter of 2024.

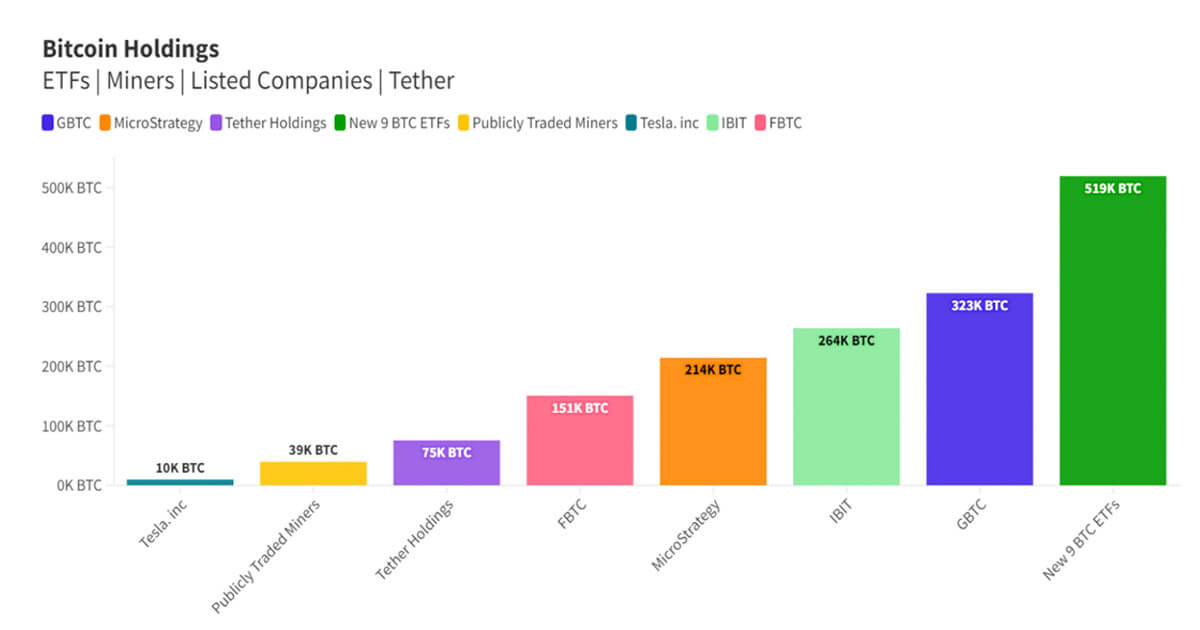

The Bitcoin ‘Monster Whales’ Are HereThe details of the investment are particularly notable for their scale and diversity. Susquehanna now holds 17,271,326 shares in the Grayscale Bitcoin Trust (GBTC), which alone is worth approximately $1.09 billion as of March 31, 2024. This single investment represents a significant portion of the entire BTC investment, indicating Susquehanna’s preference for Grayscale due to its high liquidity.

Further diversification in Susquehanna’s holdings includes 1,349,414 shares of Fidelity‘s spot Bitcoin ETF (FBTC), valued at roughly $83.74 million. In addition, the firm has significantly increased its stake in the ProShares Bitcoin Strategy ETF (BITO), which offers exposure to BTC futures contracts. Susquehanna owned 7,907,827 shares of BITO as of the same date, valued at approximately $255.42 million — this represents a 57.59% increase from a February filing that listed 5,021,149 shares.

Additionally, Susquehanna’s Bitcoin ETF portfolio includes stakes in other high-profile funds such as the BlackRock ETF, ARK21 ETF, Bitwise ETF, Valkyrie ETF, Invesco Galaxy ETF, VanEck ETF Trust, and WisdomTree ETF. The firm’s strategic selection of funds illustrates its comprehensive approach to capitalizing on different aspects of Bitcoin’s investment potential.

Susquehanna International Group, LLP holds over $1 Billion in Bitcoin ETFs in Recent Portfolio Update pic.twitter.com/0UPzLUVRsK

— Phoenix » PhoenixNews.io (@PhoenixTrades_) May 7, 2024

Julian Fahrer, CEO and co-founder of Apollo, commented on the magnitude of this development, stating, “HUGE: Susquehanna International Group is the biggest Bitcoin ETF whale yet! $1.2 Billion held across 10 ETFs! The monsters are here.” This enthusiastic endorsement reflects the growing optimism and institutional interest in cryptocurrency investments.

Despite these considerable stakes, Susquehanna’s allocation to BTC remains a relatively minor fraction of its total portfolio. With total investments surpassing $575.8 billion, the $1.2 billion in Bitcoin ETFs constitutes approximately 0.22% of the firm’s holdings, signaling a cautious yet significant entry into the digital asset space.

This move by Susquehanna has far-reaching implications for the market. Bitcoin ETFs got off to a roaring trading start and have seen interest wane in recent weeks. The rise in institutional investment, as evidenced by Susquehanna’s activities, is expected to enhance Bitcoin’s credibility and stability as a financial asset.

Moreover, Susquehanna’s diverse investment is not just limited to direct Bitcoin exposure. The company also reported indirect exposure through its holdings in MicroStrategy stock, which possesses a substantial Bitcoin reserve on its balance sheet. However, in a recent rebalancing, Susquehanna reduced its stake in MicroStrategy by nearly 15%, adjusting its exposure in line with its strategic portfolio adjustments.

At press time, BTC traded at $62,352.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Monster Byte (MBI) на Currencies.ru

|

|