2020-2-4 16:21 |

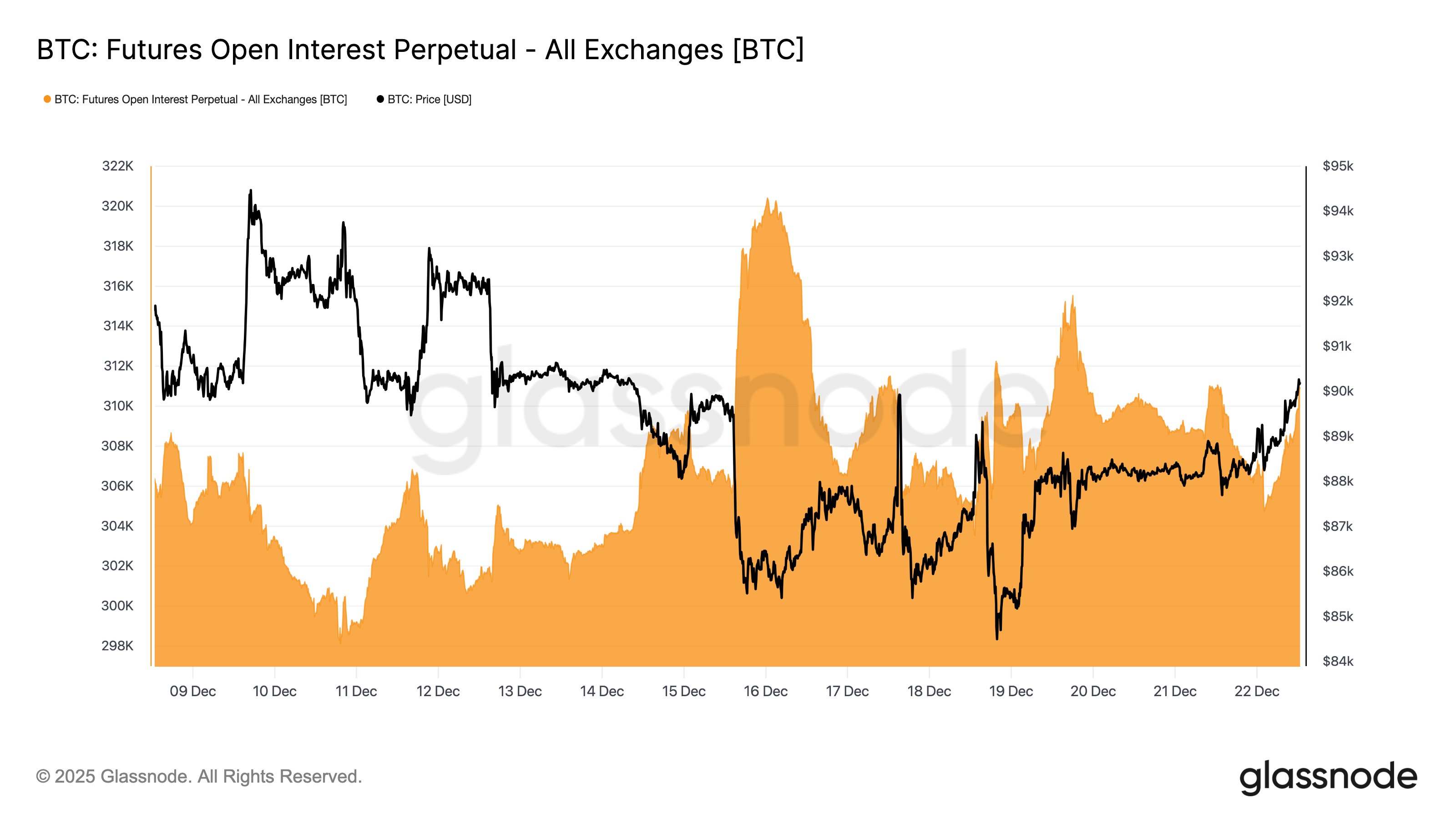

Global Bitcoin futures have seen booming activity in 2020 thus far. Aggregated open interest is up 60% since the start of the year.

As we approach the next Bitcoin halving, it’s unsurprising that futures markets for BTC are booming. The total value of all outstanding Bitcoin futures contracts traded on major exchanges now tops $4 billion. As BeInCrypto previously reported, this number stood at just $3B in mid-January.

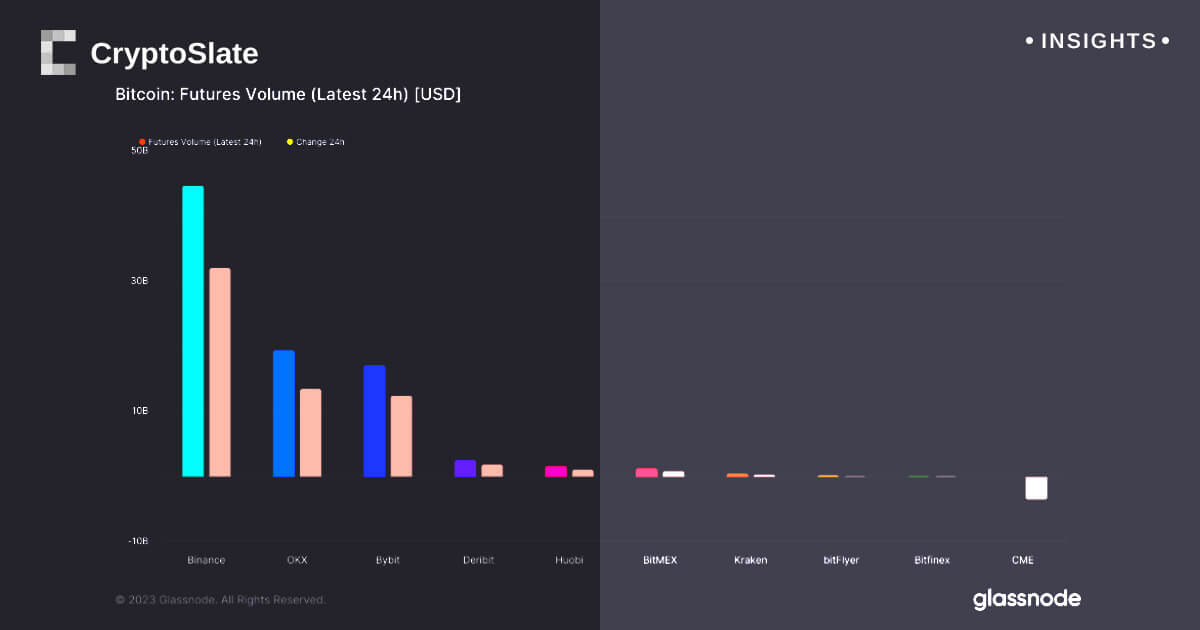

Bitcoin Futures Trading Volume Breaks ExpectationsThe fact that open interest has seen an increase of 33% since just mid-January has shocked many traders. A few trading platforms have been meeting the increase in demand head-on. BitMEX and FTX have both seen the largest upticks in open interest in the past month.

As skew (@skewdotcom) noted, exchanges are reporting a serious bullish shift in futures trading volume across the board.

Global bitcoin futures open interest > $4bln

+60% since the start of the year pic.twitter.com/QowaV4AiO6

— skew (@skewdotcom) February 3, 2020

Open interest on futures markets refers to the value of open contracts that are currently live. It can be used as an indicator that fresh money is entering the market. However, it should be noted that an increase in open interest does not always indicate bullish momentum. These open contracts could just as easily be betting on Bitcoin’s price dropping in the future.

Still, the sudden surge in open interest is all-around a positive sign because it indicates an increase in overall investments and new money entering the market. Coupled with the fact that Bitcoin’s hash rate recently hit a new all-time high, the fundamentals for the leading cryptocurrency are looking strong.

Futures Markets Remain ControversialIt’s still an open question whether or not futures markets are actually beneficial to Bitcoin’s long-term price growth. If you’ve been around since 2017, you may recall that the bearish winter of 2018 seemed to coincide with the introduction of futures markets for Bitcoin.

Exchanges like the CME and others have found their expansion into Bitcoin futures to be among their most successful ventures. It’s been such a success that CME expanded to Bitcoin options trading last month. Other futures markets, like Bakkt, have been met with mixed reactions. Repeatedly, commentators have said Bakkt is a net detriment to the market and represents ‘Wall Street’s attack on Bitcoin.’

So, the uptick in Bitcoin futures trading may be exciting, but it shouldn’t be considered a definite sign for traders to expect further bullishness. At the very least, it means that interest in Bitcoin is growing — and that tends to be good for the cryptocurrency market overall.

The post Bitcoin Futures Open Interest Up 60% Since the Start of the Year appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|