2023-8-2 19:00 |

Data shows that Bitcoin funding rates have risen to the greenest levels since February 2023, something that could increase the risk of a long squeeze.

Bitcoin Funding Rates Are At Highest Levels Since FebruaryAs pointed out by an analyst in a CryptoQuant post, longs have accumulated in the market recently. The “funding rates” is an indicator that keeps track of the periodic fee that traders on the futures market are exchanging between each other right now.

Related Reading: Bitcoin Addresses In Loss Soar To One-Month High Amid Mixed Market Indicators

When the value of this metric is positive, it means that the long contract holders are currently paying a premium to the short holders so that they can hold onto their positions. This kind of trend implies that the majority of the market shares a bullish sentiment.

On the other hand, the indicator being below the zero mark suggests the payments are flowing the opposite way: shorts are paying the longs. Naturally, here the bearish mentality is the dominant force.

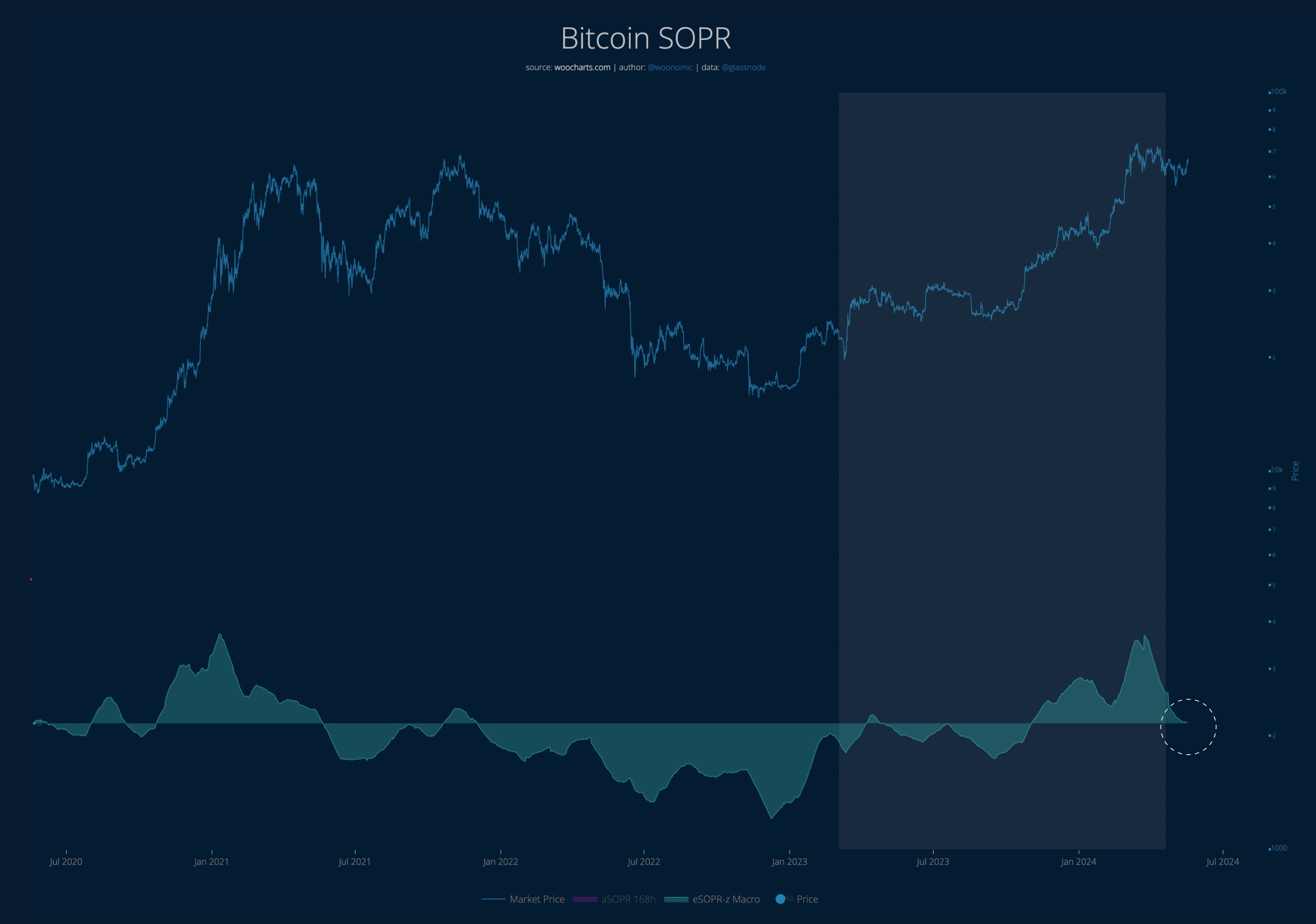

Now, here is a chart that shows the trend in the Bitcoin funding rates since the start of the year:

As displayed in the above graph, the Bitcoin funding rates have surged during the past day as the cryptocurrency’s price has recovered back above the $29,000 level.

The rise implies that new long positions have appeared on the market, and the gap between the shorts and longs has widened. Following this increase, the funding rates have hit highly positive levels not witnessed since back in February of this year.

When the metric hit its high values back then, the cryptocurrency’s price had formed a local top and had started on a steep decline. The reason that the market reversed its trend even though the futures market traders were bullish was perhaps due to a long squeeze.

A “squeeze” is an event where a sharp swing in the price sets off a high volume of liquidations at once. Such liquidations only end up providing further fuel for the price move, thus prolonging it and causing even more liquidations. As such, liquidations can be imagined to cascade during a squeeze.

Whenever the futures market becomes overheated, the chances of this mass liquidation event taking place can go up. Generally, a squeeze is more probable to effect the side that has the larger amount of contracts. Naturally, this side would be reflected in the funding rates.

As the indicator’s value is highly positive right now, a long squeeze could have reasonable chance of happening. If one does take place in the near future, then the Bitcoin market could go down in a similar way as it did back in February.

BTC PriceAt the time of writing, Bitcoin is trading around $29,500, up 1% in the last week.

Similar to Notcoin - TapSwap on Solana Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|