2023-11-21 19:00 |

As Bitcoin (BTC) continues its upward trajectory toward $38,000, the long-awaited arrival of a US spot Bitcoin exchange-traded fund (ETF) could open the floodgates of digital currency investing for institutional and retail investors.

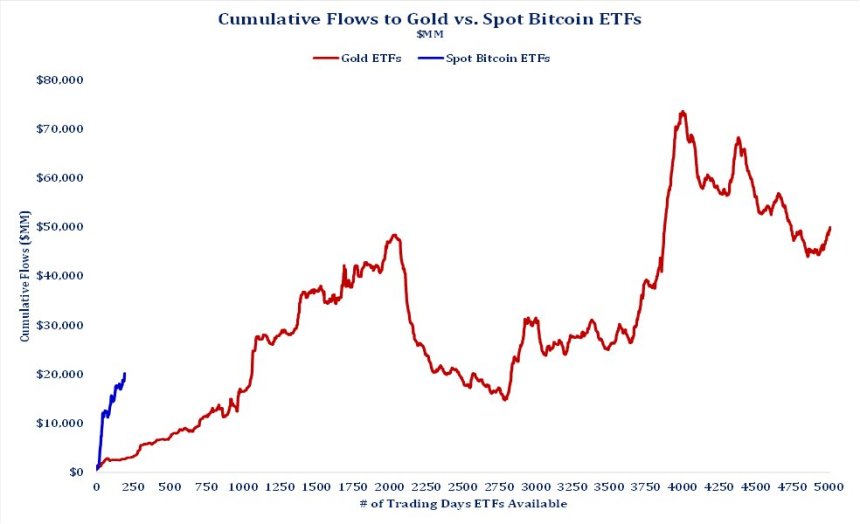

Notably, Bloomberg Intelligence estimates that the potential spot Bitcoin ETF market could reach a staggering $100 billion, signaling a breakthrough for cryptocurrencies on Wall Street.

Inquiries Surge As Spot Bitcoin ETF LoomsThe anticipation surrounding Bitcoin ETFs stems from the expected regulatory approval by the US Securities and Exchange Commission (SEC). After a decade of rejecting various applications, the SEC is on track to green-light ETFs that will enable the buying and selling Bitcoin within a tax-efficient and cost-effective framework.

This pivotal regulatory shift has sparked optimism among digital asset proponents, who see this as a redemption opportunity following the industry’s recent challenges.

Respected heavyweights such as BlackRock, Fidelity, and Invesco are expected to participate in the spot Bitcoin ETF market. Collaborations like the one between Galaxy Digital Holdings and Invesco further emphasize the growing interest from reputable financial institutions.

On this matter, Galaxy Digital recently hosted a conference call attended by approximately 300 investment professionals, discussing strategies for allocating investments to Bitcoin in anticipation of the ETF debut.

According to Bloomberg, wealth managers and financial advisers are increasingly intrigued by the potential of Bitcoin ETFs. Professionals like Jeff Janson at Summit Wealth have received inquiries from investors of all ages, indicating a growing appetite for digital assets in portfolios.

Coinbase suggests that ETFs will attract immediate inflows and reshape the market through fresh lending and derivatives trades. However, it is important to note that this transformation will take time to unfold fully.

The imminent launch of Bitcoin ETFs represents a significant milestone for the cryptocurrency industry, potentially catapulting it into the mainstream financial landscape.

As estimated by Bloomberg Intelligence, the projected $100 billion market for spot Bitcoin ETF underscores the growing confidence and widespread interest among investors.

BTC’s Dominance UnshakenAccording to a recent report by CoinShares, Bitcoin has maintained its dominance in the cryptocurrency market, experiencing a notable inflow of $155 million.

This surge in investment comes as the last eight weeks of inflows alone account for approximately 3.4% of the total assets under management.

Interestingly, while Bitcoin saw substantial inflows, there were outflows of approximately $8.5 million from short-Bitcoin positions the previous week. This suggests that investors are increasingly optimistic about BTC’s future and its potential for further growth.

In line with the above, the report suggests that this positive BTC sentiment is closely linked to the expected approval of a spot Bitcoin ETF in the United States.

At the time of writing, BTC is trading at $37,100, up 1.7% in the past 24 hours, with expectations that the largest cryptocurrency on the market can once again break through the $38,000 mark and consolidate above it to target the $40,000 mark.

However, it remains to be seen whether the SEC’s approval of spot Bitcoin ETFs will be the main catalyst for further gains in the coming months or whether a rejection could cause BTC to test investor confidence and lower support levels.

Featured image from Shutterstock, chart from TradingView.com

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|