2020-1-22 22:00 |

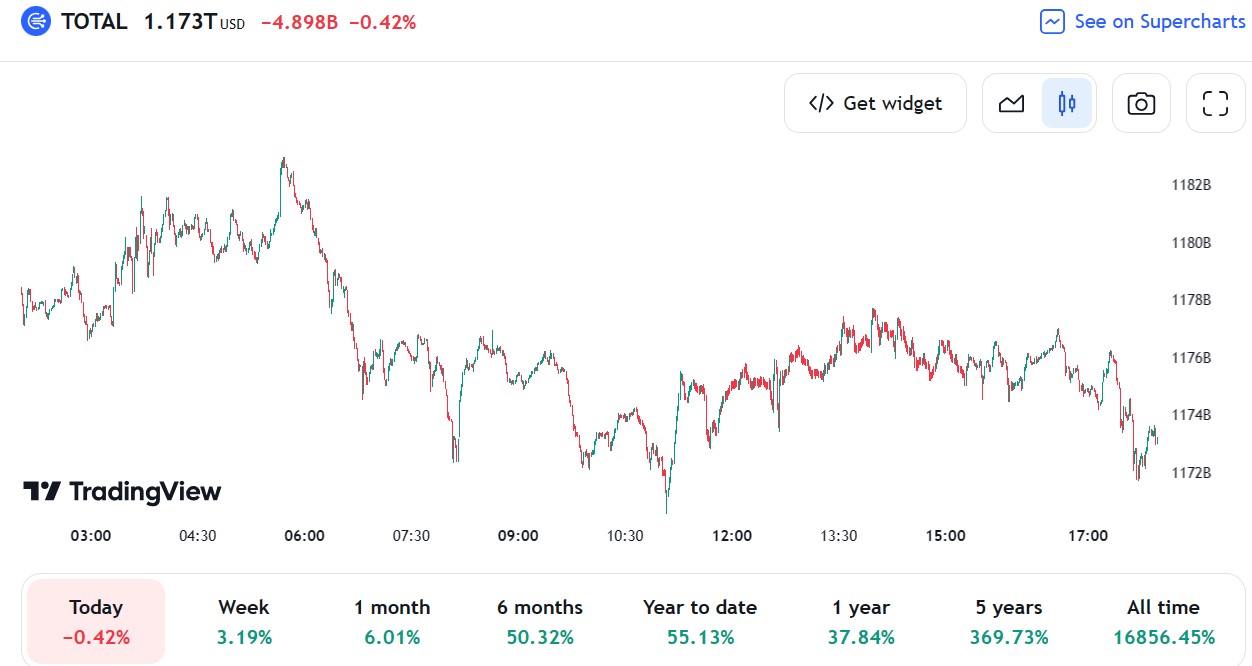

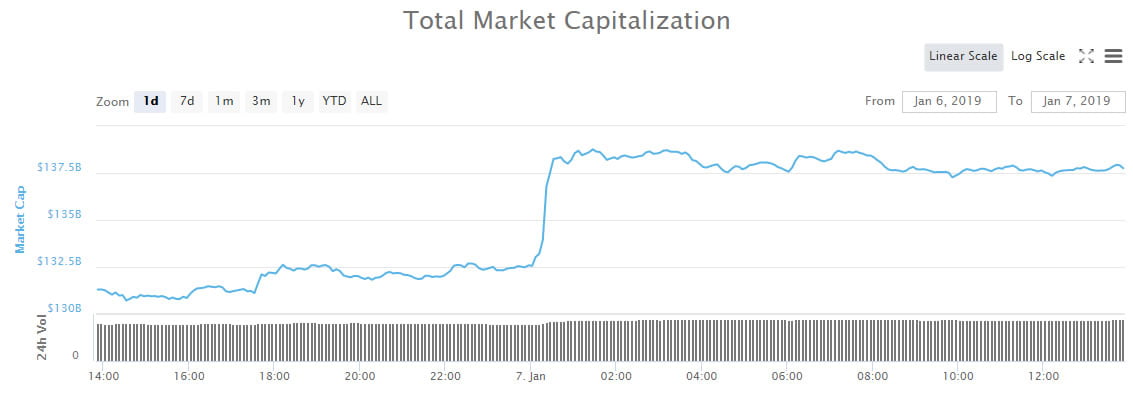

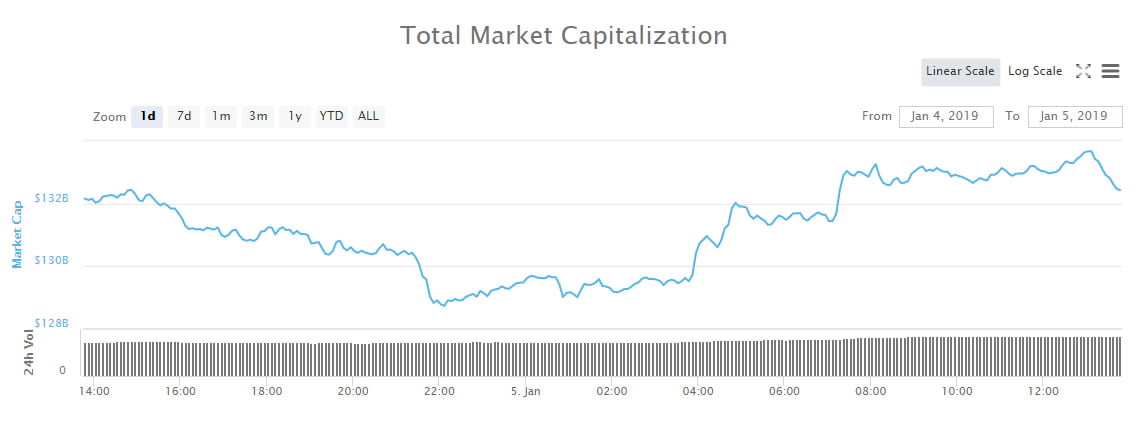

Last week’s explosion in growth across Bitcoin and the altcoin market caused the total cryptocurrency market cap to all break above the 200-day moving average – an important level that smart money often trades based on. However, Bitcoin has failed to hold above the same moving average and may have dragged the total crypto market back below the critical indicator. Total Crypto Market Fails To Hold Above 200-Day Moving Average Last week, various altcoins across the cryptocurrency market broke through downtrend resistance, causing them to go on massive rallies alongside Bitcoin with gains of 40% or more over the last 30 days. Related Reading | Ready for Liftoff: Altcoin Market Cap Breaks Out of Downtrend The total aggregate of capital the buying frenzy caused added over $25 billion to the overall altcoin market cap and caused the price to burst through the 200-day moving average. The 200-day moving average is a line calculated using the price of an asset over the last 40-week’s worth of trading sessions, providing traders with a look at the long-term health of the asset. When price is trending above the moving average, it’s seen as bullish, and the reverse is true if price is trading below it. The recent break of the altcoin market above the 200-day moving average is significant to smart money and institutional investors who may see the signal as a time to start buying crypto again. The rise of altcoins also helped carry Bitcoin to a new local high and pushed the overall total crypto market cap over the 200-day moving average as well. However, after five daily closes above the 200-day moving average on the total crypto market chart, price has now fallen back below it for two consecutive daily closes. Is Bitcoin Responsible for Dragging Altcoins Down? When comparing the location of the 200-day moving average of altcoins versus Bitcoin, it’s clear to see that Bitcoin could be the cause of the overall crypto market falling back below the important indicator. As can be seen on Bitcoin’s price chart above, the largest cryptocurrency by market cap couldn’t close not even one full day above the 200-day moving average, leaving behind a nasty looking wick into it. Bitcoin’s inability to break through the 200-day moving average as altcoins have could be a sign that the bear market isn’t actually over. Another theory is that bearish sentiment surrounding Bitcoin could be keeping altcoins at bay, much like bearish sentiment in the altcoin market caused Bitcoin’s 2019 rally to top. Related Reading | Altcoin Market Bottoms With Highest Buy Volume in Crypto History Until the total crypto market breaks over the 200-day moving average and holds, with Bitcoin leading the charge, altcoins and the rest of crypto may have more crypto winter to suffer through before a bull market finally returns. The post appeared first on NewsBTC.

Similar to Notcoin - Blum - Airdrops In 2024

Market.space (MASP) на Currencies.ru

|

|